TRAVIS DURKEE AND NEO WU, FISHER INTERNATIONAL

By the time you’re reading this, it will have been almost a year since the spread of the coronavirus started in China. And though the pandemic crippled Chinese markets early on, at press time (in October) the country’s pulp and paper industry has avoided major impacts due to COVID-19.

Since mid-March, the consumer goods price (which includes rice, eggs, vegetables, etc.) is overall in a declining pattern and back to a “normal” status. Not only consumer goods, but also restaurants and even high-end luxury goods, are growing again. By the end of March, Volkswagen CEO Herbert Diess had commented that, besides China, VW had almost no revenue from the rest of the world. And giant Chinese hot-pot food service company, Haidilao, remains 65 times P/E after the COVID-19 spread. All of this signals a stable, “back-to-norm” Chinese economy.

The “State of the Country” report presented at the China Congress Conference on May 22 didn’t set a clear GDP growth target; instead, the focus has been switched to consumer factors. China’s target unemployment rate is 6 percent, which actually implies that its GDP rate will be no lower than 3 percent. Given the facts of the global recession in almost all countries worldwide, a target of 3 percent GDP is still ambitious.

As for the paper industry in China, it didn’t report much damage from the coronavirus outbreak. Total exports of paper in April increased because of fulfillment of previous overseas orders from before the pandemic.

While China’s domestic demand is stable and growing slightly, the export business was greatly hurt. According to Fisher China’s resources, Chinese tech giant Huawei may see declining orders of electronic consumer products for overseas markets, and that could have a significant impact on packaging materials for such goods (some of the decline, of course, reflects the trade tension between China and the United States).

Packaging, for example, has relative weaker demand in south China provinces such as Guangdong, Fujian, and Zhejiang, which focus more on light industry for exporting. North China states, however, aren’t as heavily impacted since their industries are well-prepared to service local demands.

Online shopping saw a massive boost during the stay-at-home period and seems to be a new norm in people’s daily lives, which creates some demands for eCommerce packaging. Hygiene products are at the front of people’s minds, so the tissue and non-woven industries may experience some growth and drive the growth of virgin pulp demands. Medical-related specialty grades are experiencing potential growth as well.

But with local pandemic conditions greatly recovering, the focus of the Chinese paper industry is back to two key areas of reform that could create opportunities for overseas finished paper products and the wood/pulp supply chain: the OCC/RCP ban effective in 2021; and the ban of single-use plastics by 2022.

RIPPLE EFFECTS OF THE BANS

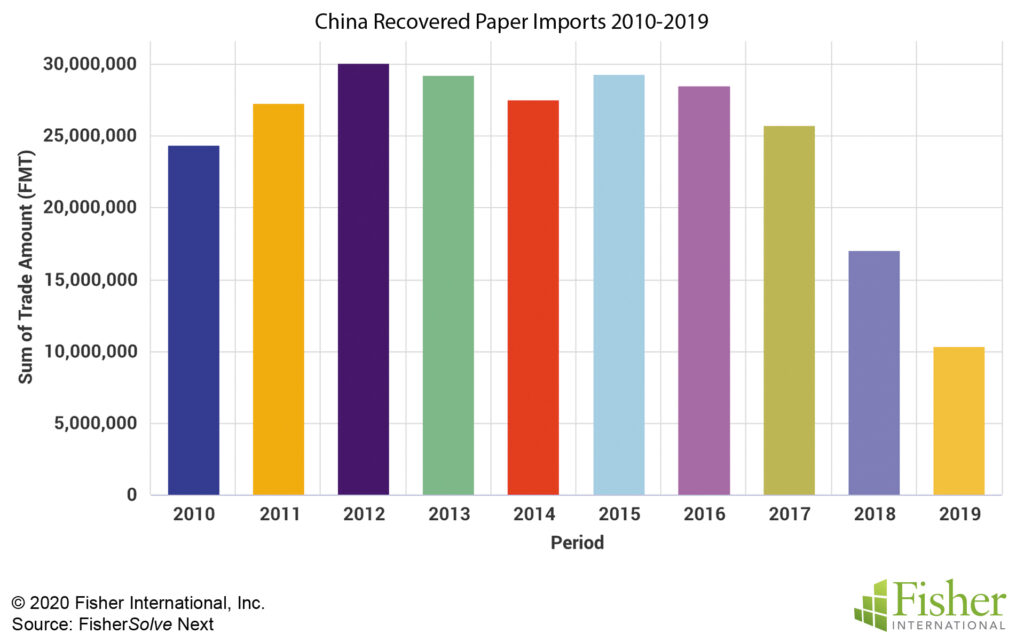

According to FisherSolveTM Next, China has significantly reduced its importation of recovered paper (RCP) since the country announced a ban on certain items (including OCC) in mid-2017 (Fig. 1). Still, with an all-out ban beginning in 2021, China must find a way to fill a 10-million-ton gap in RCP.

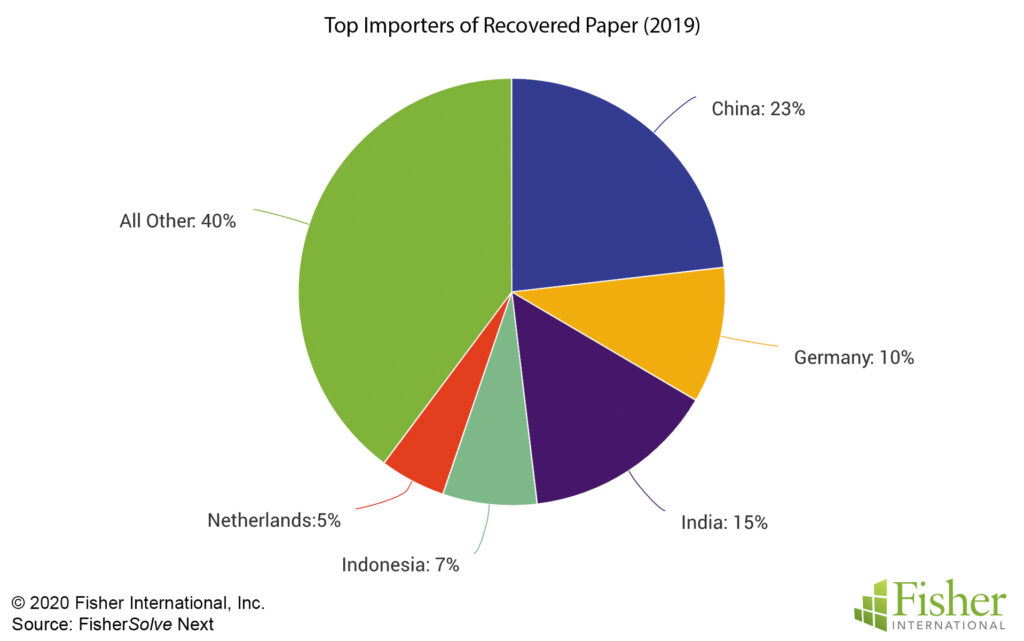

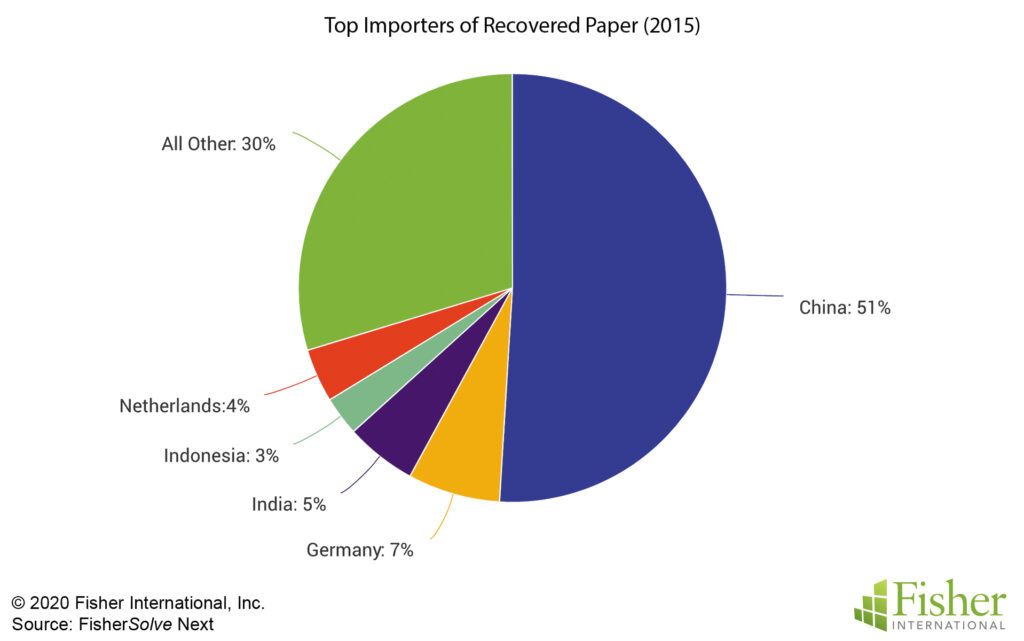

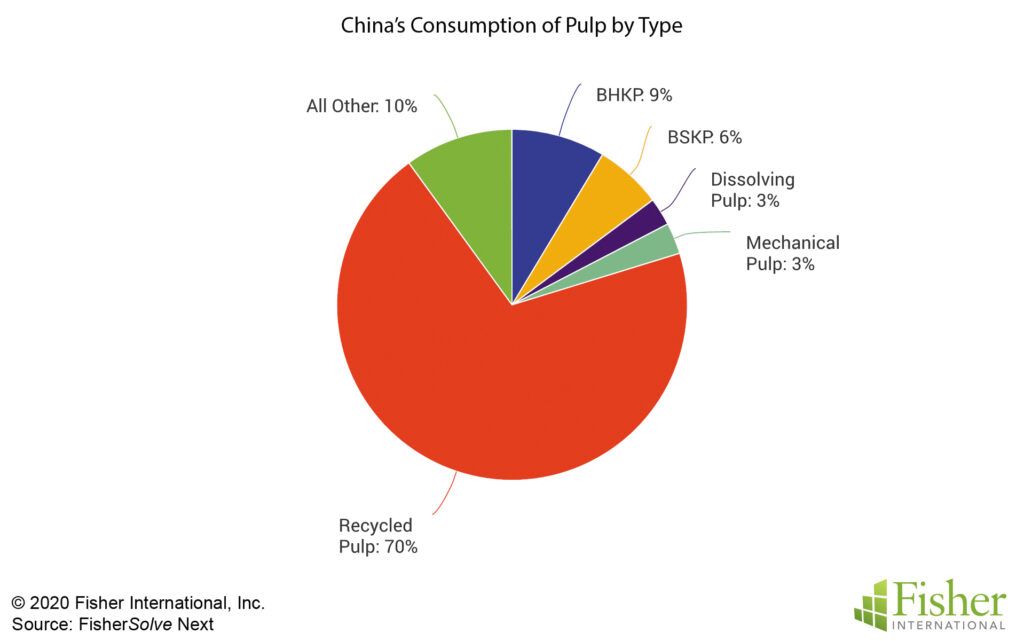

Although China was still the world’s largest importer of RCP in 2019, at 23 percent of total imports (Fig. 2), it was a far cry from just a few years ago (2015) when it accounted for a massive 51 percent of RCP imports (Fig. 3). The OCC ban will be good for China’s landfills, but will certainly present a challenge for a country that relies so heavily on recycled pulp (Fig. 4).

To help ease the RCP burden, it was announced in June that a US$125 million recycled paper pulp mill in Fairless Hills, PA, will source more than 500,000 tons per year of mixed paper and OCC and ship its product to China. Empire Recycled Fiber has a Chinese paper producer as an equity partner; that company signed a 20-year offtake agreement for the pulp. The project team has not publicly named the partner company, which holds a majority ownership in the Pennsylvania facility.

Feedstock will be 70 percent OCC and 30 percent mixed paper. The mill’s output will be 440,000 tons per year of recycled paper pulp, which paper manufacturers will use as a raw material. The mill will use state-of-the-art processing technology to produce and dry the pulp to 10 percent moisture content. Then, the material will be wrapped, baled, and exported to China.

According to Fisher data, RCP resources in the United States are mainly distributed in California, Tennessee, Florida, New York, and Pennsylvania. Before the change to China’s RCP policy, the US West Coast was the main export area of American RCP to China, accounting for more than 50 percent of the US export volume. After China’s total ban on import RCP at the end of 2020, these RCP resource regions in the US may bring certain strategic opportunities for Chinese investors and inspire more Sino-US cooperation projects.

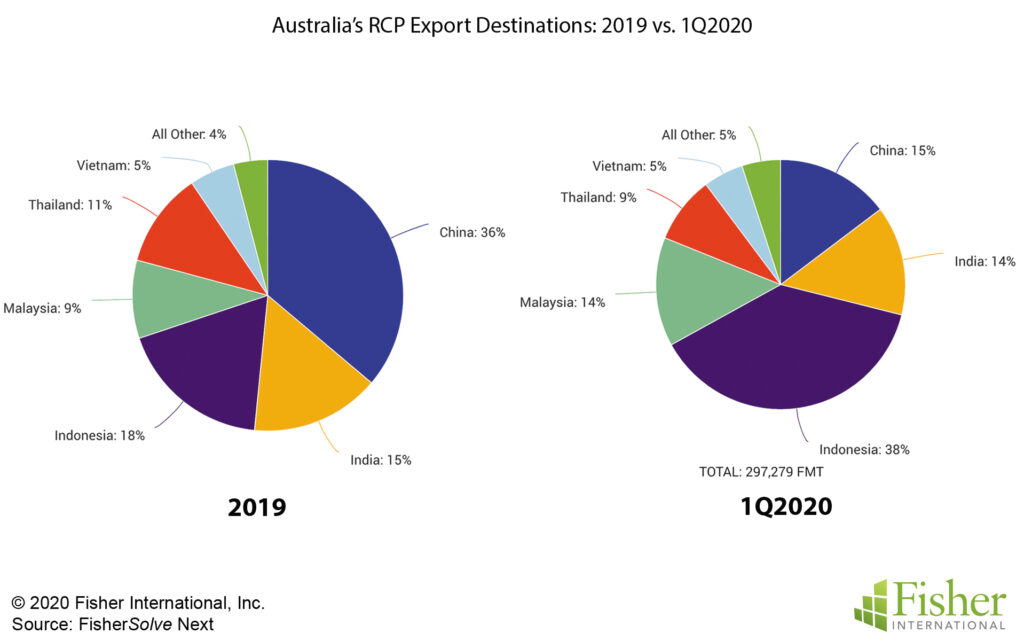

For US suppliers and others that rely on shipping RCP to China, they’ll need to find another option when the calendar flips to 2021. Australian suppliers, for example, have already shifted a large portion of their RCP exports from China to Indonesia in the first quarter of 2020 (Fig. 5).

However, Indonesia is getting ahead on the RCP run. The country has raised its impurity content requirement of RCP to not exceed 2 percent to reduce the import volume of RCP and avoid facing the same rubbish crisis that inspired China’s policies.

As for China’s ban on single-use plastics, there will be massive opportunity for those in the industry to develop sustainable products for a country with a population charging toward 1.5 billion people. That’s quite a lot of grocery bags, drink bottles, food containers, straws, and more.

For more data and insight into the present and future state of the pulp and paper industry, make sure to contact Fisher International or find us online at fisheri.com.

Paper 360

Paper 360