JAN BOTTIGLIERI

Of the many lessons consumers around the world learned during the coronavirus crisis, perhaps the most hard-hitting was this: the global supply chain for large-scale commodity goods is almost impossibly complex, and disruptions in one region can have ripple effects around the world. This includes pulp, paper, packaging board, and the myriad end-products these products become.

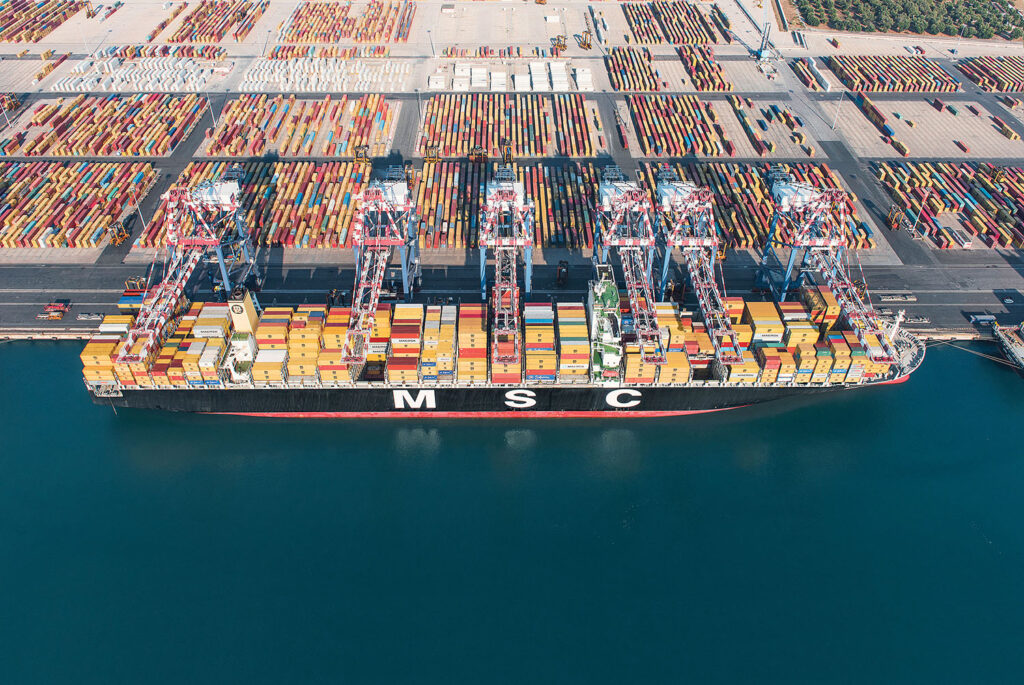

Of course, manufacturers already know this—and the lasting effects of pandemic-related disruptions are only one factor impacting this dynamic sector of our industry. To learn more, Paper360° Editorial Director Jan Bottiglieri spoke with Mediterranean Shipping Company (MSC), a global transport leader with decades of experience in shipping pulp, paper, and forest products. The company provides end-to-end transport solutions and connects mills and suppliers in locations around the world. MSC offers intermodal capabilities including road, rail, and barge; and is one of the world’s largest carriers of recyclable wastepaper.

P360: MSC serves several different industries. How are the transport needs of the pulp, paper, and forestry industry different than other industries? What are some of the biggest challenges with shipping for this industry?

MSC: Forestry sector commodities vary from wooden logs to prime paper, and these different commodities also have their own requirements. High-volume commodities, such as forestry commodities, require a very strong logistics set-up, with equipment and flexible capacity, vessels and feeder networks, and connections to remote areas in Scandinavia and the Baltic region. For example, our company operates in Northern Finland and Sweden, including serving small ports, to be closer to cargo supply.

The overall volume of pulp, paper, and forestry products is currently growing rapidly. The extent of growth in this market is a challenge for logistics globally, affecting the availability of assets (e.g., trucks, containers, chassis, and space on vessels).

Capacity and equipment constraints have heavily impacted the shipping and logistics sector during the pandemic. The availability of labor at ports and across inland logistics providers such as trucking companies has also heavily influenced the state of the market during the pandemic. Online shopping has thrived, which has triggered an increased demand for packaging material. In particular, the flow of packaging materials from Europe to China has risen significantly.

Additionally, the volume of sawn timber and building materials has increased because people are spending their income on renovation projects and home improvements rather than travel. Pulp trade from Europe to China is also growing; however, the volume of paper is decreasing somewhat due to people’s tendency to consume news online.

P360: Around the globe, infrastructure challenges have been in the news—from the Ever Given situation in the Suez Canal, to concerns about cyber attacks on critical functions and capabilities. What are some steps manufacturers can take to make sure their transport logistics remain functional and safe?

MSC: These are quite separate issues. With respect to the Ever Given blockage of the Suez Canal, the timing was very unfortunate, as supply chains were already under great stress as a result of the impact of the coronavirus pandemic. While MSC did arrange to send some ships around the Cape of Good Hope in Africa instead of via the Suez Canal, this was not feasible for every ship due to the higher costs involved. For many ship operators it was a question of waiting until the canal could re-open.

Manufacturers that ship goods in containers should consider staying in close contact with their service providers during times of market stress in order to understand the whereabouts of shipments. However, there is clearly no simple quick fix to a one-week blockage of such an important waterway as the Suez Canal.

With respect to cyber attacks, companies should have a variety of their own policies and protocols in place. At MSC we take cyber security very seriously and we regularly make training available to our people to raise awareness and knowledge of this important topic. It’s a deep and complex topic on which we are actively focused.

P360: What was the biggest “game changer” that the global coronavirus pandemic imposed on the global transport industry? Looking ahead, what are some lasting effects that you anticipate?

MSC: The primary concern of COVID-19 for MSC has been the impact on the health of our people, both ashore and at sea. MSC campaigns for better recognition of the role of seafarers in keeping global trade moving and has made various appeals to governments to make crew changes easier during the pandemic after hundreds of thousands of sailors got stuck at sea. We continue to advocate for these key workers to be prioritized for travel and for COVID-19 vaccinations.

In terms of the market impact, we saw a sudden drop in demand in Q1 2020 as China shut down, followed by an incredible resurgence in demand in the third quarter and after. The wild swings in demand overwhelmed supply chains in some areas and had an unprecedented impact on the systems in which we and our customers operate. Port congestion, equipment shortages, and other factors led to a systemic overload of demands on cargo transportation and logistics, and even in mid-2021 we are still dealing with this despite the carrier industry having injected capacity and modified service networks. We hope for a return to a more normalized market soon, but we can see these effects continuing a while longer until a greater number of governments have COVID-19 more under control.

P360: Can you tell us more about the “eBL” concept? What were the customer “pain points” that prompted MSC to develop this capability?

MSC: The eBL is the electronic version of the traditional paper Bill of Lading—the document issued by a carrier to a shipper upon receipt of cargo. It replicates the exact same functions and retains the same legal value of a paper Bill of Lading. The eBL enables shippers and other companies or organizations involved in supply chains to receive and transmit documentation electronically, without any change or disruption to day-to-day business operations.

MSC’s current eBL solution uses an independent platform called Wave BL to manage the transfer of the eBL. This platform is secured and encrypted by blockchain technology. This means there is no risk of document loss, forgery, or fraud.

For the successful adoption of the eBL we need a variety of supply chain actors, including our customers, to be open to changing their ways of operating and to move their systems online. This is in everyone’s interests, since it should make container shipping better, faster, more cost-effective, more secure, and more environmentally-friendly.

P360: Global transport and logistics is always changing. What is the most exciting trend or development you see ahead in this arena—particularly for the pulp, paper, and forest products industry?

MSC: Indeed, global logistics is a very dynamic area—during these challenging times more than ever. We need to be even closer to customers, though it’s not physically always possible, to understand their changing logistics needs.

At MSC we take a holistic view of the customer’s logistics requirements. This means developing our intermodal and depots network to smartly manage the growing need for equipment and providing quick and efficient transport solutions between the loading areas and global ports network. The market environment in mid-2021 is extremely challenging, but we have a long-term view and a long-term commitment to continuously introducing new services and solutions to match customer demand across ocean and inland transportation and in terms of logistics capabilities. The newest development for forestry customers in Central Europe is a fumigation service that we offer at the port of Antwerp. With a fumigation zone at quay, cargo can be delivered by rail directly to our terminal without stopping on the way to port. This makes it possible to use trains instead of trucks and adds some flexibility to our customers’ supply chains.

Paper 360

Paper 360