It’s been an eventful few years for the Kotkamills family in southern Finland. It made headlines (Paper360°, May/June 2018, p. 29) and won awards for its development of recyclable and compostable cupstock. The coronavirus pandemic hit the away-from-home(AfH) market hard, forcing the mill to rethink its strategy for BM2, which produces the cupstock. BM2 also makes folding boxboard (FBB), a market that held up well during the pandemic.

Finally, the mill was purchased in 2021 by Austrian-based Mayr Melnhof (MM) from MB Funds, which had taken over in 2015 from Open Gate, which had bought the mill from Stora Enso in 2010. Despite the ownership changes, strong investment in the facility has continued through the years.

The mill has a history dating back to the 1870s, when the Gutzeit family opened a sawmill that still operates. Some of the original buildings still stand and are protected as a heritage site. The company built a sulphate pulp mill in 1907. Two paper machines were added in the 1950s to produce sack paper. Over time, the facility produced other grades, including newsprint and coated paper. In 1973, PM1 was dedicated to the production of Absorbex saturating kraft paper.

Kotkamills has been part of large corporate structures as well as small, locally-based firms. Yet managing director Päivi Suutari says the recent change has been mostly seamless. “The decision-making process of the MM Group management is excellent. They are agile, flexible, and fast,” she says.

MODERNIZATION THROUGHOUT

After a rebuild of PM2 to produce board in 2016, the focus these days is on PM1, which produces about 170,000 metric tpy of saturating kraft paper. This is used by MM Kotkamills Absorbex to make a base of decorative and technical high-pressure laminates. Other end uses for Absorbex papers are electro-technical papers, cooling pad papers, surfacing films, and other specialty papers.

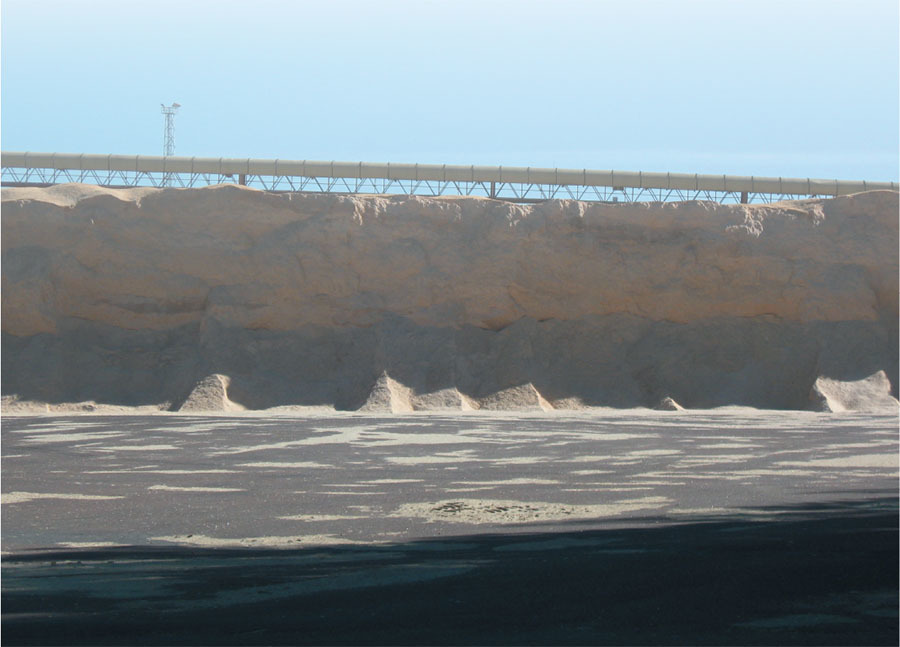

As its furnish, PM1 uses pulp made from sawdust produced at the sawmill as well as recycled pulp made at an onsite OCC plant that was built in 2011. Over the past two years, the sawdust pulp mill has seen an extensive modernization. Two DD washers were installed in 2020 and, in 2021, the cooking line was upgraded with the installation of three M&D digesters.

Technical director Jan Lousa says everything from the conveyors to the flow tanks has been improved. Andritz supplied the equipment. This increased pulp capacity to 180,000 metric tpy.

Next up is a new Bellmer TurboPress shoe press for PM1; this was scheduled for installation during a 21-day shutdown in August and September this year. Bellmer will also rebuild the dryer section and supply three undermachine pulpers, which will help reduce steam and condensate consumption while increasing PM1’s capacity by 15,000 metric tpy. Bellmer Finland will manage the project, including training, commissioning, and start-up services. Project cost is approximately EUR20 million (a bit over US$20 million.)

MM Kotkamills has also invested EUR8 million in a new Raumaster packaging line to accommodate the increase in paper production off PM1, but it can be used for BM2 as well.

In 2018, during Paper 360°’s last visit, a pre-feasibility study was planned for a possible new paper machine to produce low basis weight saturating kraft papers. However, after the MM takeover, management decided to see first how all of MM’s paper machines would fit with each other. Therefore, a new machine has been put on hold—but as Suutari says, “Never say never.”

When MM purchased Kotkamills, it also purchased an International Paper mill in Poland that makes similar grades.

One concern Suutari has now is the availability of sawdust within a “reasonable” distance from the mill. The war in Ukraine has put a stop to Russian supplies. Besides domestic suppliers, MM Kotkamills is now sourcing from the Baltic countries and Sweden.

Suutari says that about 70 percent of sawdust produced in Finland is burned either as pellets or directly. Only about 30 percent is used in a sustainable way, a figure she would very much like to see increase. She adds that saturating kraft paper has a long life; therefore, it can store carbon from sawdust for decades.

On the folding boxboard side, after BM2 was rebuilt, it was thought the development of the sustainable cupstock (ISLA brand) would take up at least half of its capacity. However, as noted, the pandemic hit the AfH market hard. Therefore, the majority (approximately 85 percent) of BM2’s production will remain FBB. “We can make a high-quality boxboard and demand has been so high,” Suutari says. The mill will retain its existing cupstock clients, but will not actively seek new markets.

MM Kotkamills makes FBB (AEGLE brand) with a basis weight range of 180-480 g/m2. It is a three-ply boxboard with mill-produced CTMP in the middle layer and purchased kraft pulp on the outside layers. It features a water-based dispersion coating. It is ideally suited for clamshell containers as well as grease-resistant products.

In 2022, BM2 production should reach 320,000 metric tpy on its way to design capacity of 400,000 metric tpy. Sustainability is a key issue for the mill. Its AEGLE and ISLA boards can replace plastics and some fiber-based packaging that is not easily recyclable. Suutari adds that sustainability is an increasingly important issue for customers as well.

The next major project for the board side will be the installation of two cross cutters along with automated reel storage, palletizing and packaging, and core and waste handling. This will cost EUR30 million (US$30.8 million). The first cross cutter should start up in early 2024. Millwide, although both PMs are digitalized, MM Kotkamills plans further investments in Industry 4.0 and digitalization.

GROWTH AND SUSTAINABILITY

In 2021, mill revenues were EUR444 million (about US$ 454 million). This is expected to rise to EUR500 million in 2022 (US$511 million). By product, board accounted for 55 percent of sales; Absorbex, 30 percent; and timber, 15 percent.

The mill’s product mix and the rebuilt BM2 attracted MM. On the saturating kraft paper side, MM Kotkamills Absorbex is now among the top three producers in the world, together with IP and WestRock.

MM is a leading producer of cartonboard and folding cartons with an attractive offer in kraft papers and uncoated fine papers. The group promotes sustainable development through innovative, recyclable packaging and paper products made from renewable, fiber-based raw materials. Therefore, all activities related to sustainability, the environment, and safety have special priority.

MM generates sales of EUR4 billion (approximately US$4.1 billion) and employs around 13,000 people. Suutari says the company aims to keep growing, either organically or through more acquisitions.

Paper 360

Paper 360