For the first time in four years, delegates were able to meet face-to-face at the PulPaper exhibition and conference. Held in Helsinki in early June in conjunction with ChemBio Finland and the Helsinki Chemicals Forum, more than 6,000 people attended the events.

PulPaper alone attracted more than 200 exhibitors and those involved seemed very satisfied with the event. In addition to the show, several technical sessions were scheduled.

In conjunction with PulPaper, a press tour was organized by the Finnish Trade Show Fund. Besides touring the exhibition, the editors also met with producers and suppliers and attended several technical sessions. We also travelled to eastern Finland to visit Kotkamills (as featured in Paper360°’s September/October 2022 issue).

Kuura fibers from the Metsä Group’s innovation company, Metsä Spring.

FROM CARDBOARD TO CLOTHES

One highlight was a visit with the Finnish Textile and Fashion group. Managing Director Marja-Liisa Niinikoski said her association represents 230 companies involved with the textile and apparel industry: “We want to develop the Finnish fashion industry to be sustainable and successful globally.”

The use of wood cellulose figures prominently in the sustainability discussion. She noted that traditional textile manufacturers are cautious, but “The clothing brands will push them into more sustainable fibers.” She cited seven start-up companies that use cellulose fiber in their materials:

- Infinna™: Developed by Infinited Fiber Company to turn textile waste into a textile fiber, the process can also use other cellulose-rich waste streams such as paper and board. After mechanical treatment, the recovered fiber reacts with urea to form a cellulose carbamate powder that is converted into a liquid and then spun into the Infinna fibers. They are said to have a cotton-like feel and can be used on their own or blended with conventional fibers to make textiles or clothes.

- Ioncell®: Developed by Aalto University in collaboration with the University of Helsinki, this technology uses a novel solvent in the liquid ionic category. The process turns cellulose from virgin wood pulp, recycled paper, and board into high-quality, high-strength textile fiber. Tests have shown that its tensile strength can be two to three times higher than virgin cotton. The fibers feel soft and are strong even when wet.

- Kuura™: This concept from the Metsä Group’s innovation company Metsä Spring uses undried paper grade pulp rather than dissolving pulp to produce a textile fiber. The process is based on Norratex, Nordic Bioproducts Group’s new technology, which allows the large-scale production of man-made cellulosic fiber from kraft pulp without using toxic chemicals. Norratex fibers are smooth and very flexible with a feeling between cotton and viscose. Andritz is a key supplier in the production process.

- Bio2™: The raw material for Fortum’s textile is cellulose made from fractionated straw. The pulp is spun into textile fibers. The process uses Chempolis’ fractionation technology.

- Biocelsol: This technology, which won the Marcus Wallenberg Prize, uses dissolving pulp and can also use paper pulp and cotton textile waste. The technology was developed by VTT Technical Research Centre of Finland and the Tampere University of Technology. The pulp is modified using enzymes, then dissolved and spun using a wet spinning technique. The chemicals used are water-based, non-toxic, and low-cost.

- The final company is Spinnova, which was featured on the 2022 Paper360° Power List. Jarkko Havas, Spinnova’s head of concept, spoke to the group. Its fiber feels natural, like cotton, according to Havas. The pulp used is ground into micro-fibrils. Although still in trial stages, the fiber has been through multiple recycles and so far, quality has not been affected. A commercial-scale plant is under construction in Jylväskylä, Finland. It is a 50:50 joint venture with Suzano; Valmet will supply most of the equipment. Though the first unit will produce 1,000 metric tpy, the long-term goal is to reach a capacity of 1 million metric tpy in the next 10 to 12 years.

- Although not part of this visit, CH Biofore is another company involved with the production of textile fiber from cellulose. CEO Petri Tolonen says its method, a pressurized hot water extraction process, can extract hemicellulose in polymeric form. Once the lignin is removed, what remains is a high alpha content dissolving pulp, which can be converted into microfibrillated cellulose that can be used for textile fibers. Wood and straw can be used as raw material, but the company is focusing on straw first. “We can extract hemicellulose, cellulose, and lignin in process with material efficiency of up to 90 percent,” Tolonen says.

The PulPaper exhibit floor.

The PulPaper exhibit floor.METSÄ SEEKS TO GROW WITH PARTNERS

Metsä Fibre’s CEO Ismo Nousiainen met with the group to discuss the company’s growing interest in sidestream businesses. He stressed that the company still needs to concentrate on its core business—making pulp—so partners are needed. A 2024 startup of an ethanol plant close to its Äänekoski mill in partnership with Veolia is, he said, a good example of how “We can create industrial ecosystems.”

Other possibilities being explored are lignin and bark: “We can now gasify bark and burn it in the lime kiln, but are there other opportunities?,” he asked. Odorous gases from pulp processes are traditionally burned, but the sulfur can be removed to produce sulfuric acid.

Nousiainen said the Kemi kraft pulp mill project is going well. A 3Q 2023 start-up for the 1.5 million metric tpy mill is still looking on-target. The pandemic did affect construction, as did inflation, forcing steel prices higher. Cost for the project is now estimated at EUR1.85 billion (US$1.79 billion).

The mill is expected to be more than self-sufficient in energy, so Metsä should do well selling power back to the grid, he said. Because the old mill is being demolished, there will be room for new facilities that could produce the sidestream products Nousiainen spoke about.

MEGATRENDS TO WATCH

The keynote session to open PulPaper featured three high-profile speakers. From a producer perspective, Hannu Kasurinen, executive vice president, packaging materials, Stora Enso, discussed the megatrends the industry must face, including climate change, biodiversity loss, circularity, consumption, and inequality. So, it is not all business or technically related; social issues must also be answered.

By 2050 (Kasurinen called it a “marathon”), Stora plans to have 100 percent regenerative solutions—that is, negative CO2 emissions and 100 percent recyclability. Its sustainability goals to 2030 should see Scope 1, 2 and 3 emissions cut by 50 percent. How? Carbon capture, decreased CO2 emissions, and electrification.

Paper production has become a lesser part of Stora Enso’s business. Four of its graphic paper mills are up for sale and it plans to convert its Langerbrugge (Belgium) paper mill to board production.

Riikka Joukio, K (Kesko) Group, spoke for the retail sector. The K Group is the major grocery retailer in Finland and has some 1,800 outlets in seven countries around the Baltic with headquarters in Helsinki. Sales are EUR15 billion (about US$14.55 billion). It has three divisions: grocery, building and technical trade, and auto imports.

She said sustainability is at the core of the company’s growth strategy. Sustainability is a must because customers value brands that “do the right thing.” Thus, what’s in the product or how the product is packaged could be used to help define sustainable. “Companies (such as K) demand partners that help them reach sustainability goals.”

Speaking about employees, Joukio said, “People want meaningful jobs, and sustainability is part of that experience.”

K Group’s own objectives are to be carbon neutral by 2025 and emissions-free by 2030. Joukio said the K Group is challenging suppliers to decrease emissions while it works to help decrease the emissions of sold products.

Next, Roland Lorenz, executive vice president and head of AFRY Management Consulting, discussed the post-pandemic shifts in consumer behavior. These were affected by long-term megatrends such as urbanization, climate crisis, and digitalization, as well as what Lorenz termed “shocker” events: the coronavirus and the Ukraine war. How do these things affect consumers and what is the effect on demand and purchase patterns?

Affordability has become a key. Therefore, private labels will continue to grow compared with national brands, he said. Online shopping will also continue to grow as studies show people prefer it.

As COVID dramatically increased the home workforce, this led to an increase in dining at home. Fiber-based packaging has become a “winner” in the evolution of recent trends, said Lorenz. Why? Take-away food from the market and e-commerce continue to grow as well as regulations limiting the use of single-use plastics.

SUPPLIERS HAVE THEIR SAY

Several suppliers offered updates on new projects and innovations for members of the press on the tour.

AFRY: Forged by the merger of AF and Poyry, Kai Vikman, COO, Process Industries, said the outlook is still positive for the industry, particularly tissue and board. He also mentioned the textile sector as being a growth opportunity. “But it is still far from its real potential as the amount now is still so small.”

AFRY’s traditional stronghold remains important as it is now working on 11 pulp and paper projects. It is also working with a Spanish pulp mill on the production of textile pulp.

Vikman noted that traditional industries such as pulp and paper, chemicals, and oil are transitioning to bio-based industries.

Valmet: Thanks to its recent purchase of Neles (valves and valve-related services), Valmet focused on flow control. With this purchase, Valmet can now offer a competitive and balanced offering to the process industries. It also provides a solid platform for growth in flow control and process automation systems.

The company has shown consistent sales growth in recent years, even without the acquisition of Neles. Vamet will withdraw from Russia; as of March, it stopped selling there.

With its work with Spinnova, it sees the textile sector as a good opportunity. “We can provide current technology that is adaptable. We’re seeing it in Europe now,” said Anu Salonsaari-Posti, senior vice president communications, adding that she expects more from China, too. However, in North America, there has been no movement thus far.

The discussion included Valmet’s climate program. By 2030, it hopes to reduce CO2 emissions by 20 percent in its supply chain and by 80 percent in its own operations. It is also aiming for 100 percent carbon neutral production.

Runtech Systems: With a number of mergers/acquisitions in the past, Runtech is now part of the Gardner Denver family, which includes former competitor Nash Pumps (Runtech now sells Nash equipment.) Known for its turbo blowers, with almost 1,000 units sold, Runtech expects a record year of sales in 2022. Although 100 percent of its business is still pulp and paper (tissue through board), it is looking at other industries.

Runtech can supply OEMs as well as end users, but 90 percent of sales are direct to the end user. If a mill wants to replace an older system (blower or pump), energy savings can range from 40 to 60 percent. Its turbo blower models are based on electricity; a large, modern paper machine usually has seven to 12 turbo units.

Runtech can also supply more than vacuum packages, “because we look at the entire machine operation when a client asks about a turbo system,” explains Sales and Marketing Director Jussi Lahtinen. “We can help improve doctoring and flow control.”

In North America, Nash Pumps has dominated the market and as electricity prices are low compared with Europe, it has been difficult to crack the market with turbo blowers. However, Runtech has five projects in the US and Lahtinen says that the increasing focus on water consumption can help them in the future as turbos do not use water.

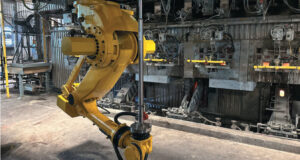

Andritz: Luis Binotto, senior vice president, division manager, maintenance services, said the service is about improving mill availability using intelligent predictive processes. He noted that in South America, the objective for a pulp mill is 99+ percent. “With the Internet of Things (IOT) we get notification of any defect and act on it before it becomes a failure. All notifications are graded automatically through robotic process automation using AI. The long-term objective is an autonomously operating mill.”

Binotto noted that humans will not be replaced by AI; humans will be replaced by other humans who can use AI. He had these recommendations for mills:

- Adapt IOT as soon as possible,

- Integrate all AI into management service, and

- Create an online system to monitor the mill 24/7.

What does “an autonomous mill” mean? He said 100-150 maintenance people plus operators could run a modern, million-tpy pulp mill. There will always be some people needed on site; specialists can work remotely. These principles can work for all sectors, e.g., specialty papers, not just commodities.

Paper 360

Paper 360