Chinese paper companies’ overseas expansion strategy

NEO WU

While papermaking was invented in China, it was western countries that built it into a major industry and made it the ubiquitous commodity it is today. But China is poised to reclaim its central role in the paper industry on a global stage…and then some.

Over the past 30 years, China’s paper capacity grew from less than 3 million tons in 1990 to more than 100 million tons in 2015, making China the largest paper producing country in the world. Figure 1 shows the total paper production by country and, without doubt, China’s lead is significant with a market share that exceeds a quarter of the total worldwide output.

Over the past 30 years, China’s paper capacity grew from less than 3 million tons in 1990 to more than 100 million tons in 2015, making China the largest paper producing country in the world. Figure 1 shows the total paper production by country and, without doubt, China’s lead is significant with a market share that exceeds a quarter of the total worldwide output.

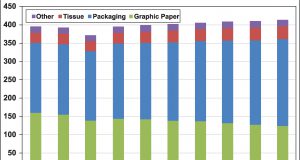

However, as Fig. 2 shows, with the “cooling down” of the Chinese economy, capital investments in new capacities within the Chinese paper industry are becoming less exuberant. Industry leaders like Nine Dragons, Lee & Man, and APP China are investing heavily in efficiency improvement rather than adding new capacity, while service providers such as Valmet, Voith, and Siemens are rolling out key service concepts such as Industry 4.0, Industry Automation, Digital solutions and others, targeting the quest for operating excellence in China.

Looking outward, and in keeping with government initiatives such as “One Belt, One Road,” Chinese funds and trillions in foreign reserves are slated for aggressive foreign investment. With the Chinese government encouraging Chinese companies to expand aggressively overseas, identifying the optimal investment destinations is the key decision to be made in the initial stages. So, how should paper companies think about such potential investments?

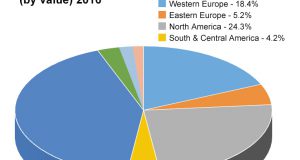

Figure 3 shows paper production and the number of mills in each global region covering Packaging, Printing & Writing, Newsprint, Tissue & Towel, and Specialties (We exclude market pulp from consideration since pulp itself requires sufficient

raw material fiber supply, and pulp producers must stay close to their fiber resources to be competitive.) With fewer than 400 operating mills in North America contributing approximately 90 million tons in paper and paperboard production, it’s easy to conclude that the industry’s scale in North America is more optimal than Asia Pacific and even Europe.

and paperboard production, it’s easy to conclude that the industry’s scale in North America is more optimal than Asia Pacific and even Europe.

In addition to the industry’s maturity in the US, from a macroeconomic perspective, the US dollar is getting stronger against all currencies and expected to get even stronger in the coming years. At the same time, the European refugee crisis and threats of terrorism force risk-averse investors to find more stable investment destinations. North America, due to its geographic location and stable political environment, as well as its desirable social and regulatory systems, already attracts significant Chinese investment, including in its paper industry. In the past three years, we have seen large announcements

concerning Chinese paper industry capital moving into the United States, such as Tranlin Paper’s Virginia project and Sun Paper’s Arkansas project.

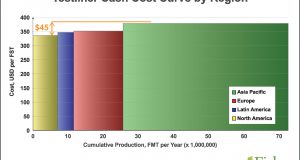

By all appearances, Chinese capital is gravitating to North America, and with good reason. A general overview of North America’s paper industry reveals the thinking behind this activity. Figure 4 provides an overview of the North American paper industry capacity, with its close to 110 million tons of market pulp, paper and paperboard produced by Canada and the United States; while Fig. 5 shows North American assets are relatively older than other regions. Nevertheless, from a general operations perspective, Fig. 6 shows that North America is lower cost than either Asia Pacific or Europe, and the most significant difference comes from the lower fiber costs.

While China’s paper industry has grown to be very large, it is still relatively new compared to those in other regions of the world. Any further investment in China will now be focused on improving efficiency. However, after the past 40 years of “reform and opening” achievements, China has a lot of capital to invest and is looking for good places to land those investments.

The North American paper industry has lower fiber costs and good scale advantage. Although its assets are old and need investments, it is highly reasonable that China would shop in North America for decent investment opportunities. Additionally, the growing value of the US dollar

The North American paper industry has lower fiber costs and good scale advantage. Although its assets are old and need investments, it is highly reasonable that China would shop in North America for decent investment opportunities. Additionally, the growing value of the US dollar against Chinese currency exerts further pressure on Chinese capital investors more willing to allocate USD assets.

against Chinese currency exerts further pressure on Chinese capital investors more willing to allocate USD assets.

“Overseas expansion” has become the hot phrase for Chinese paper companies in recent years and we expect to see more and more projects in the near future. This article mentions a few projects in North America, but North America is not necessarily the only destination for Chinese capital. Indeed, we anticipate aggressive movement from Chinese investors on a worldwide scale.

Neo Wu is a senior consultant for Fisher International, a consulting firm that supports the global pulp and paper industry with business intelligence and data-driven strategy expertise. The information and analyses for this article are drawn from FisherSolve™, the industry’s premier market intelligence database and analytics resource. To learn more, visit www.fisheri.com. Neo Wu can be reached at [email protected].

Paper 360

Paper 360