JOANNA WILHELM

The “work-from-home” trend that spawned a ubiquitous acronym (WFH) and came to represent life in 2020 and into 2021 has been both a blessing and a curse. Without a doubt, the seamless technology that has allowed many employees to work effectively in the safety of their own homes during the early stage—and now into the second wave—of COVID-19 lockdowns is invaluable, as it has helped to prevent the entire economy from grinding to a halt.

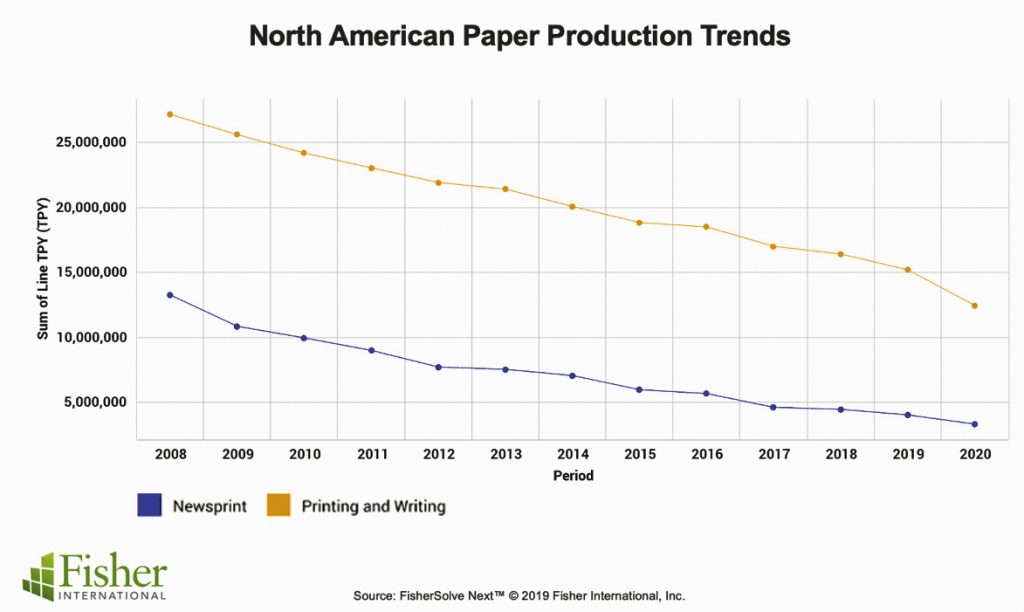

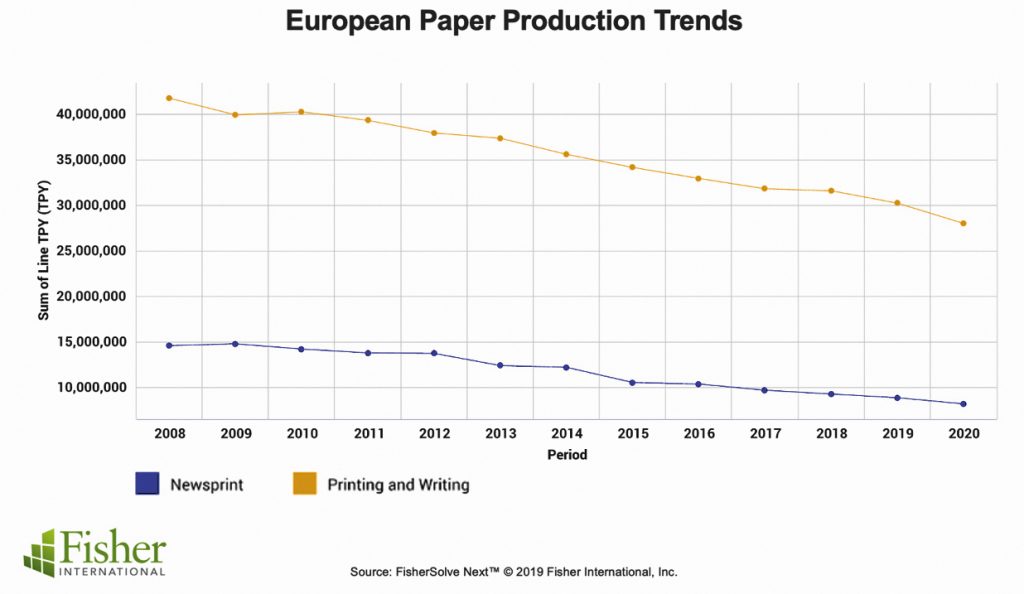

Widespread access to the internet in the mid-1990s ushered in a new digital age—a profound shift in accessibility, information gathering, and knowledge sharing that is still developing at an ever-quickening pace. As a result, demand for printing and writing papers and newsprint continues to decline rapidly as the digital age matures. The pandemic has only quickened demand destruction of these segments as remote work, schooling, and shopping became the norm in 2020. In Q1 2020, McKinsey & Company noted that US e-commerce penetration had experienced 10 years’ worth of growth in just three months.

HOW PERVASIVE IS THE

‘REMOTE’ ECONOMY?

A recent PwC survey showed that less than one in five executives want to return to the office as it was pre-pandemic. However, 87 percent of employees feel that the office is an important aspect of their work environment, as it’s important for collaboration and building relationships with coworkers. With many school and university systems across the country reinstating “distance learning” (at press time), tens of millions of K-12 and college students have been doing their work online.

All of this adds up to a situation where an existing structural market change—tumbling demand for printing and writing papers—has accelerated under the weight of the coronavirus pandemic.

Unsurprisingly, with the arrival of the lockdowns that took effect in late Q2 2020, we began to see announcements from major pulp and paper companies and mills around the world detailing closures, curtailments, and consolidations. The Nordic paper industry, for instance, had to close at least eight machines across the region’s 19 paper mills following a 29 percent drop in second-quarter sales due to the pandemic-induced, rapid decline in demand for printing and writing papers. Curtailments and closures have also occurred in the rest of Europe, although to a lesser extent.

IS THE TREND REVERSING?

Recent data suggests that the worldwide experiment in WFH has had some unforeseen consequences for both employees and employers:

1. Many WFH employees have found themselves unable to unplug from work since they are essentially confined to their home offices 24/7. They are working longer hours—data have shown a 2-hour increase in the average workday—and reaching increased rates of “burnout,” which can lead to long-term health and career regression.

2. Productivity declines among remote US workers (as detailed in a study by Aternity) in mid-summer were concerning: 85 percent were still away from the office and their overall productivity had dropped by 14 percent. With many months of data and observations now available, employers are noticing pitfalls in WFH productivity. Projects take longer, training is more difficult, hiring and onboarding new employees is increasingly challenging, and some employers say their workers appear less connected.

As our understanding of the coronavirus continues to evolve and the economic impacts continue to unfold, there is still a high degree of uncertainty surrounding nationwide “next steps.” There are currently two authorized and recommended vaccines being distributed in the United States—the Pfizer-BioNTech COVID-19 vaccine and Moderna’s COVID-19 vaccine. As of December 28, 2020, three large-scale clinical trials were in progress for three other vaccines.

According to the CDC as of January 20, 2021, a total of 35,990,150 doses of the COVID-19 vaccine were distributed in the United States with 16,525,281 total doses administered to the public. Due to the limited number of vaccinations available, the CDC has recommended that during these first few rollouts, the following groups are to be prioritized:

• 1A: Health care personnel and long-term care facility residents

• 1B: Frontline essential workers and people over the age of 75

• 1C: Anyone with an underlying health condition and other essential workers

An exact timeline of when the next rollouts will be distributed and administered, and which groups it will include, is still uncertain and will be different in every city and state. Any return to “normal” work and school operations will ultimately hinge upon successful inoculations at scale, and we are likely months away from that reality.

The WFH trend isn’t going away anytime soon, but “the evolving thinking among many CEOs reflects a significant shift from the early days of the pandemic,” notes the Wall Street Journal. “’You can tell people are getting fatigued,’” wrote Peter P. Kowalczuk, president of Canon Solutions America, a division of copier and camera giant Canon Inc.

As a response, some organizations are pressing ahead and returning to the office, though this seems to be the exception rather than the rule. In September, 2020, JPMorgan announced that its traders, bankers, brokers, and research analysts were required to return to their offices after six long months of WFH, and Goldman Sachs has followed suit.

WHAT DOES THIS MEAN FOR PRINTING AND WRITING?

The WSJ notes that more companies now envision a hybrid form of working in the future—one that allows more time spent working remotely, yet with occasions to convene teams in-person. “I am concerned that we would somehow believe that we can basically take kids from college, put them in front of Zoom, and think that three years from now, they’ll be every bit as productive as they would have had they had the personal interaction,” said Chief Executive Ronald J. Kruszewski of Stifel Financial Corp.

The recent PwC survey showed that most executives and employees expect a hybrid workplace will begin to take shape in the second quarter of 2021, depending on the timing of mass vaccine rollouts. Many employers have eliminated dedicated offices and moved to a shared space “hotel” model in which employees occupy whatever open office is available for the day. While this qualifies as being on-site, this mode of work also requires reliance on electronic filing and sharing systems, which has aided in diminishing the need for printing and writing papers.

It’s too early to tell if workers operating in such arrangements will return to printing/copying as much as they once did, or if they have become accustomed to sharing 100 percent of their information via the cloud.

Likewise, a hybrid or part-time return to K-12 schooling and universities will likely create some demand in the printing and writing papers segment. At press time, newly-elected President Joe Biden had ambitiously pledged to reopen most K-12 schools within 100 days. One new executive order will direct the Department of Education and the Department of Health and Human Services to provide reopening guidance to schools with a focus on masking, testing, and cleaning. Concerns about students falling behind in school is extremely prevalent among parents, teachers, and students as many push for the reopening of schools in the near term.

While the hybrid approaches may be more sustainable for all organizations moving forward, time will tell where, exactly, the balance between work-from-home vs. at-the-office or school will land. These fundamental shifts will continue to impact the printing and writing segment of the industry as this balance settles.

Predicting the future with certainty is always hard to do, but we certainly can envision different likely scenarios—a “hope for the best, plan for the worst” paradigm—in which we are more prepared and agile for whatever may come.

With more than 20 years of paper industry experience, Joanna Wilhelm brings exceptional project management and operational leadership skills to her position as senior consultant at Fisher International. Learn more at fisheri.com.

Paper 360

Paper 360