Three years have passed since the world was gripped by a global pandemic, wreaking havoc on manufacturing supply chains. Though designated early on as part of a “critical industry,” pulp and paper mills were not spared the trials of long supplier lead times, international shipping delays, driver shortages, and other supply chain upsets. When critical components or raw materials are unavailable, even a government mandate can’t help keep the machines running.

Recovery has been steady but slow … at times, painfully slow. That was the case in 2022 when Ryan Rush, founder of Universal Packaging, began to attract more interest from papermakers. The mill managers Rush spoke with were desperate, facing the possibility of production shutdowns over the lack of a seemingly insignificant but critical element for creating saleable rolls: tape.

“We were in a pretty unique position, where we had some raw material on the floor during a national shortage of repulpable tape, due to supply chain and labor issues. We got calls from several major paper companies, and we were able to pick up a handful of really good accounts,” Rush says.

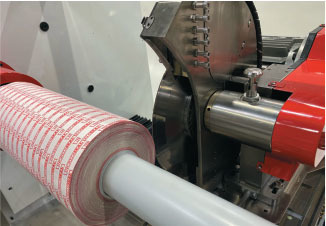

“What’s even better is that the new business has allowed us to expand,” he adds. “We were able to put in a third tape slitter. With three tape slitters, we’re set up to ship all orders out within 24 hours of being placed, Monday through Friday.”

STRAIGHT TO THE SOURCE

Headquartered in Hunt Valley, MD, Universal Packaging (univpack.com) is both a distributor and a converter with its own brand of product called IncrediSeal. The company stocks a range of packing materials, including stretch wrap and packaging tape. Repulpable tapes are stocked in 50″-wide rolls, which Universal can slit on demand to suit a mill’s preference, in custom widths from 1/2″ on up. “We have a lot of competitors in this space,” says Rush, “but we do things differently. We import a lot of our products from overseas; we import now from seven different countries. The ability to then convert in-house, on demand, is the value added.

“The normal supply chain for paper mills is to buy their tape from a large company that acts only as a distributor; they might be selling a Tesa product, or a 3M product. We give mills the opportunity to go direct to the source—that’s the pivot point. The fact that we also convert removes that extra layer of markup for the mills.”

That flexibility was key when it came to working with paper mills facing a national shortage of repulpable tapes. Mills use the tape for end-tabbing, splicing, and core starting. The tape used must be repulpable because it may end up entering the mill’s own pulping system and, without the ability to break down in the pulper, could cause problems or even require a shutdown to clean out the pulper. Avoidable shutdowns are a mill manager’s nightmare and can cost tens of thousands of dollars an hour, says Rush.

“During the height of the shortage, some of the larger US tape suppliers were pushing orders back—a mill would place an order and be promised tape in April, then April came and went, then May came and went. Some of these paper mills might not have tape for up to four months.”

The smaller the paper mill, the bigger the problem, Rush says. “Imagine one of the larger paper companies, with 90 different mills in North America—if one facility runs out of tape, they have plenty of other facilities to call. But for smaller, isolated, or independent mills or plants, it can be tough to find options.”

GROWTH AND FOCUS

Universal’s first warehouse was 2,200 square feet. “We ended up understanding the benefit of having product on the floor: controlling the quality of the product and knowing that if someone orders an 80 gauge stretch wrap, we’re going to send him an 80 gauge stretch wrap,” says Rush.

From there, Universal Packaging moved into a 30,000 sq. ft. warehouse; in 2015, Universal purchased the current facility, which is 70,000 sq. ft. The company also has auxiliary warehousing in California, Ohio, and Tennessee.

Another lesson learned from paper mill customers? When it comes to inventory, keep it simple. “One large tape supplier offers 17 different types of repulpable tape,” says Rush. “That’s because, before the supply chain crisis, many paper mill crews thought ‘if we don’t use this exact, specific tape, we’re courting tragedy.’ As it turns out, that’s not really true.”

Rush recalls speaking to a customer contact at a mill in Maine during the worst of the tape shortage. “He told me that they were buying stuff off eBay—they were getting whatever tape they could find that had the word ‘repulpable’ associated with it. They were shocked that almost everything they bought on eBay actually worked.”

This prompted Universal to simplify its line of repulpable tapes to five basic products that can be custom-slit to a mill’s specification. “We’ve got three double-sided tapes and two single-sided. We estimate that that’s going to meet 98 percent of the requirements for papermakers,” Rush says. To help mill buyers choose which product is the best fit, Universal will send a representative on-site to discuss what tape the mill is currently using, and which of the five Universal products is of similar thickness and adhesive strength.

The company stocks a range of other packaging products including stretch film, steel strapping, pallet covers, and customizable labels; packaging equipment, such as stretch wrappers and carton sealers; and packaging services. This includes a warehouse audit service in which an account representative from Universal Packaging will perform an in-house assessment of a manufacturing facility’s inventory and processes to make sure that the customer is achieving the highest possible cost and labor-efficiencies. “We’ve helped many of our customers save money in tape purchases alone, simply by changing to our own IncrediSeal tapes,” says Rush.

A LOGICAL FIT

Though Universal Packaging is still a rather new name for papermakers, the company’s history serving other industries helped position Universal to have the right capabilities to step in during the industrywide shortage of repulpable tape. Says Rush, “We already had the slitting equipment, and we already had some of the repulpable tape on our floor, at the time of the supply chain crisis 12 months ago. We also sell truckloads of general packaging supplies, banding materials, and lots of pressure-sensitive labels. Two of our largest clients include a popular sports clothing manufacturer, and one of the largest retail pharmacy chains in the US.”

Rush is excited about expanding the company’s presence in the paper industry. In 2023, Universal Packaging took its first booth at TAPPICon to learn more about mills’ needs and make new connections. “We had such a great turnout from our first TAPPICon experience that we signed up for a 2024 booth before the end of the 2023 show,” he says. “So look for us in Cleveland at TAPPICon this spring—we’ll have lots of samples on hand!”

A mill customer recently shared with Rush that one major tape supplier was still reporting 12-week lead times on orders of repulpable tape. “The fact that we’re custom slitting and shipping within 24 hours is mind-boggling to some customers,” Rush says. “One of my favorite customer stories is the time I got a call from a mill on a Sunday afternoon and we shipped out that order—all 42 cases—on Monday. It feels good that, during a tough time, we were able to bail out a handful of large paper mills… and they’re getting used to the service.”

Paper 360

Paper 360