On March 20, 2023, Clayco—a full-service, turnkey real estate, architecture, engineering, design-build, and construction firm—broke ground in Longview, WA, as they took a major step in their collaboration with WestRock. WestRock’s new 410,000-square-foot corrugated box plant will begin production in the fall of 2023 and is situated on 23.5 acres.

“The new packaging plant will enable our team in the region to serve customers even better in the future, with a manufacturing facility that will provide new capabilities and efficiencies,” says David B. Sewell, chief executive officer of WestRock.

In fact, within the last five years, more than a billion dollars have been invested in various projects in the Pacific Northwest (PNW). Some of these recent investments include:

- Roseburg Forest Products announced in April, 2023, that it planned to invest US$700 million over the next four years to upgrade and expand its manufacturing operations in Southern Oregon. The investment includes the creation of two new, state-of-the-art manufacturing plants.

- Drax invested in a 450kt new-build pellet plant in Longview. The new plant will give Drax access to a new fiber basket. It also presents Drax with the opportunity to develop port infrastructure at the Port of Longview.

- North Pacific Paper Company (NORPAC) expanded its Longview facility in 2019 to produce 100 percent recycled packaging paper. In 2022, NORPAC opened its newest drum pulper as part of its ongoing effort to bring jobs to the area and meet a growing market for recycled paper products.

- Nippon Dynawave announced plans to invest in a new pulp dryer in 2018 at its Longview pulp mill in an effort to expand the market for its products.

IS THE PNW A PROFITABLE AREA FOR P&P INVESTMENTS?

After hearing about all the money invested in forest products facilities in the PNW over the last several years, the logical assumption would be this is because it’s a profitable and beneficial location. Actually, the reality is the opposite for many.

The PNW is a unique market with unique drivers of supply and demand. As basic economic theory commands, the equilibrium between supply and demand ultimately drives price. When one of these elements falls out of balance, price will respond accordingly.

In the case of wood chips, the PNW is generally more sensitive to supply side drivers for two primary reasons:

- Consumers of wood fiber have two options: chips and/or pulpwood (small-diameter logs). Most consumers typically use some combination of the two based on price and availability. The PNW is largely a chip market—unlike other regions such as the US South, which has lots of demand (and capacity) for both chips and pulpwood. This lack of pulpwood availability makes the PNW fiber market overly dependent on, and particularly sensitive to, chip supply.

- Timber supplies in the PNW remain stressed due to lack of harvesting on federal lands. Lack of active management on federal forests has contributed to a forest health crisis. Seasonally, wildfires consume federal forests in the western US and threaten neighboring private and state forest lands. With the current legislative environment, there is little opportunity for expansion. The regional market for public timber is severely constrained and the supply of private timber is largely maxed out. Unless more public timber becomes available to the market in the near term, the forest industry—and the forest resources—in the PNW will remain limited. Fiber prices will reflect these supply constraints.

The tighter timber supply in Washington and Oregon, as well as increased competition for available logs from domestic sawmills, have increased sawlog and woodchip costs in the region. The cost of woodchips and sawlogs in the PNW is about double those costs in the South.

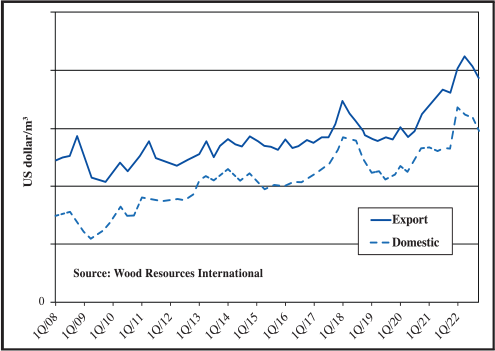

The increase resulted in all-time high prices for Douglas fir and hemlock logs in early 2022, when domestic lumber markets were strong. However, US wood markets have cooled off since then, and log prices have fallen by 22 percent for Douglas fir and 9 percent for hemlock from 1Q2022-1Q2023, according to WoodMarket Prices from ResourceWise (see Fig. 1.)

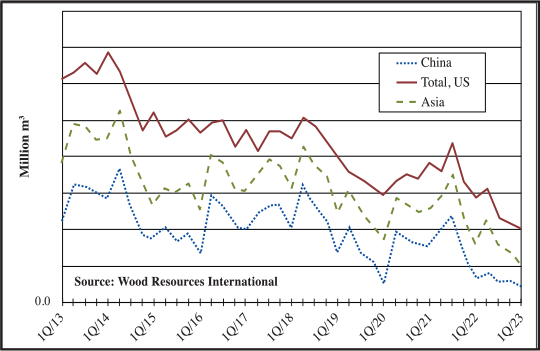

Log exports in the region have also decreased significantly. The US PNW has a long history of exporting logs overseas, predominantly to China and Japan. For many years, the region was the second largest log exporter in the world behind Russia. However, US overseas shipments have declined in the past few years from 7.5 million m3 in 2018 to less than 4 million in 2022.

Export log prices in the US PNW have consistently tracked domestic prices at a premium. The record high prices in recent years have moved Chinese log buyers away from North America and increased their purchasing of logs from other continents.

As a result, the US share of imported logs to China has fallen from 13 percent in 2018 to less than 4 percent in 2022 (see Fig. 2). During the same period, the country’s shares of imports from New Zealand, Europe, and Latin America have increased.

As a result of all these combined factors, we’re seeing a tightening of supply for logs and fibers. Consequently, there have been multiple pulp mill closures in the area due to the increase in prices the PNW is experiencing.

WHY ARE P&P COMPANIES STILL INVESTING IN THE PNW?

The PNW isn’t all doom and gloom. Two major factors that appeal to companies such as those mentioned here still motivate them to continue making investments in the rural areas of the PNW.

The first of these factors is the region’s access to fiber. Lumber production in the PNW has been consistent over the last 10 years, rarely wavering too much despite major disruptive occurrences such as the Covid-19 pandemic. In 2022, western production made up roughly 37 percent of North America’s total lumber production. The consistency in which lumber is produced helps make the PNW a reliable provider of fiber for pulp mills.

In addition to consistent lumber production, the PNW also has an established conglomeration of pulp mills, paper mills, sawmills, and other forest product manufacturing facilities. This contributes to easier accessibility to fiber and other resources. In fact, Weyerhaeuser operates one of the largest sawmills in the world at Longview. Its softwood mill produces about 720,000 m3/year.

With proximity to needed resources, producers are finding investments and startups in this area advantageous. Transportation and import costs are of little concern in this area. Between the numerous manufacturing facilities located in such a tight radius and the consistent lumber production, the PNW can provide easy fiber accessibility for pulp and paper producers.

The second factor that plays a role in why companies are still investing in the PNW is the area’s access to infrastructure. The PNW provides incredible access to transportation infrastructure. From its railway to its roads to its ports, the opportunity to import and export locally and easily is a major incentive to invest in the area.

Oregon and Washington’s easily accessible infrastructure was further enhanced when a bill passed in November 2022 called for multiple improvements. This included repairs and upgrades to roads and bridges, new sustainable transportation options, improved airports, and much more.

Accessible, advanced infrastructure goes hand-in-hand with a growing economy, increased revenue generation for businesses, and more jobs. The fact that the PNW already has secure (and improving) infrastructure makes this area incredibly desirable. This holds true not only for pulp and paper producers, but other major players in various industries as well.

GOOD INTEL LEADS TO BETTER DECISION-MAKING

Companies such as Roseburg Forest Products, WestRock, and NORPAC are already so deeply established in the PNW that their decisions to stay there and expand allow them to remain competitive due to roots they’ve put down long ago. The investments we’ve seen these companies make over the last five years demonstrate their commitment to the region despite the downward turn the forestry products market is facing there.

Rapidly changing market dynamics like those currently developing in the PNW are challenging, but not without precedent. The converging events noted are likely to impact the regional pulp and paper manufacturing segment. However, there is no universal business strategy or answer that can be applied to all companies when deciding whether to invest in the PNW region. Each company will have a different answer depending on their unique situation.

Maintaining profitability in periods of extreme stress requires that manufacturers stay focused on both today’s challenges and planning for the future. This is the time when preparation and forecasting pay dividends. ResourceWise provides stakeholders across the global forest products value chain with raw material and end-product pricing, pulp and paper mill and sawmill intelligence, and strategic consulting so you can make tactical investments.

Paper 360

Paper 360