Photo courtesy of Solenis

When we talk about winning teams, powerful partnerships, or great performances, conversation often turns to that almost unexplainable agent of success we call “good chemistry.” It’s a figure of speech that Paper360° readers can relate to through experience: pulp and paper mills rely on complex chemistries at every stage of production, and without good chemistry the mills and those who run them are in trouble.

A recent market report from Global Industry Analysts predicts that the pulp and paper chemicals market will reach more than US$15 billion by the year 2025. Chemicals affect our products and processes in thousands of ways, and the market for game-changing chemistries continues to grow—so how can papermakers keep up with what’s new?

Paper360° asked professionals from some major chemistry suppliers (see sidebar) to tell us about their most exciting innovations for the pulp, paper, and packaging industries. We also asked them how mills and suppliers can work together to create “good chemistry” of their own.

Of course, each responding company has its own products and perspective. Yet the responses confirm that the chemistry sector is committed to developing new ways to help pulp and paper manufacturers refine their products and improve their ROI. In short, what’s the one thing that every P&P maker demands from its chemistry providers? Continual innovation.

SOMETHING NEW FOR EVERYONE

With that in mind, it’s not surprising that mills are demanding new and improved products and solutions for every part of the process—and suppliers are stepping up. Our respondents cited innovations in the following areas:

PULPING

“There are always pressures and oppor-tunities to reach better efficiencies in pulp operations,” says Kemira’s Scott Rosencrance. He recommends that mills work with suppliers in every mill area—from incoming water through pulping, bleaching, and deinking, to outgoing effluent—to find economic gains they may be missing. “Cost benefits and production increases can result from actions as simple as changing the chemical injection point, to something as ambitious as building an on-site chemical production plant—i.e., the so-called ‘chemical island’,” he says.

One of the biggest challenges pulp mills face is foam. “Excess foam can create a variety of challenges: increased maintenance costs, lost capacity, reduced efficiency, and longer processing time,” according to Dow’s Arturo Cuellar. The company offers an extensive range of silicone antifoams for use in sulfite and Kraft pulp stock washing.

“Formulators translate mill needs to Dow demanding more efficient and robust solutions that can help them address a variety of situations without drawbacks. As an example of how Dow responds to the industry challenges, our latest technology (DOWSIL ACP 3073 Antifoam Compound for brownstock pulp washing) has gathered all key properties needed by mills operators into one single active,” says Cuellar.

“In pulping operations, silicone defoamers are the workhorse of the brownstock washers,” adds Richard G. Brooks of Solenis. However, his company feels there is a gap between customer expectations and available industry technologies, created by rising costs and an increasing need for reduced silicone carryover. In response, Solenis has created a new series of high efficiency/low silicone content brownstock defoamers designed to meet changing mill needs regarding knockdown, drainage, and low carryover requirements.

For best results, it’s important to coordinate the entire system. “Pulp mills are fragmented structures, which can lead to separate cost-driven decisions to reduce defoamer dosage at the washer level that do not take into account the overall cost impact on water consumption and energy use at the evaporator level,” adds Christophe Deglas of Dow. “Optimizing energy and water uses can drastically improve the overall cost structures and sustainability profiles of mills—but it requires a coordinated approach between the various installations of the mills.”

PACKAGING AND BOARD

For board makers, the ability to reduce basis weights—while maintaining strength, stiffness, and performance—depends on the right chemistry. “The marketplace is driving the packaging industry to become more sustainable by increasing the recycled fiber content while providing more strength and striving to create new products to replace plastics,” say Maurice Rizcallah and Rosy Covarrubias of Buckman. “This is forcing higher recycle rates, which is decreasing the fiber quality. The key concerns are higher levels of contamination (filler, starch, biological, etc.) and lower quality fiber. This is magnified by the drive to reduce fresh water usage, creating higher levels of VFAs and odor across the mill and in the final product and increasing the likelihood of calcium deposits.”

Buckman offers its Reinforce methodology to control the key drivers that contribute to these issues. “Reinforce is a holistic approach of managing the biological activity to protect fiber integrity and reduce the production of unwanted byproducts. Coupled with polymeric and enzymatic strength additives and effluent treatment boosters, Reinforce will provide customers with more stable operations, allowing them to meet or exceed market demands for strength,” says the Buckman team.

“The right chemicals can also improve your machine runnability and reduce sheet breaks and downtime,” says Darren Swales, Kemira. “Mills can improve overall profitability through fiber savings, lower energy consumption in the drying phase, less tonnage to transport, and reduced volume of the finished products.”

Chemistry also plays a key role in increasing sustainability and reducing food waste by enabling safe and functional fiber-based packaging, Swales adds. “Fiber-based food packaging materials are more sustainable than plastic, but they set high demands for qualities such as sizing. Liquid resistance is one of the most important packaging board characteristics that is needed for all take-away food packages such as noodle cups, coffee mugs, or hamburger boxes. Thanks to liquid resistance, consumers are able to keep their fingers clean and liquids and grease inside the food packages.”

The ban on imports of OCC to China has had a global impact on the quality and variability of furnish for recycled linerboard mills, says Brooks. “In addition, increasing demand for lightweighting for E-commerce has put a premium on maximizing the strength of container board.” He says that Solenis’ on-site GPAM strength technology provides a direct, linear, and efficient strength response at low cost compared with other synthetic dry strength chemistry.

TISSUE

Strength, softness, and absorbency are the required properties for many tissue products, says Harold Goldsberry of Kemira. “Working together, we can analyze a mill’s process to introduce the desired functionality into the sheet with the help of chemistry. We can also improve the costs for raw materials and energy, and help with the hygiene and cleanliness of the tissue operation.”

According to Brooks, the yankee drying cylinder is the most critical area of the tissue machine; its performance has a huge impact on final product quality and machine productivity. “Using a high quality and reliably stable coating to protect the yankee dryer is vital to any tissue-making operation. However, market trends toward sustainable fiber use and water conservation are adding complexity, as they contribute to inconsistent operating conditions that can compromise yankee coating performance.”

One example of how chemistry can address this is Solenis’s Tapestry Yankee Coatings package, Brooks says. “The package enables tissue makers to overcome this challenge by delivering a high quality yankee coating with excellent doctorability, edge control, and coating uniformity across a wide operating window. In addition, our Hercobond dry strength additives can help reduce not only energy use, but also fines generation.”

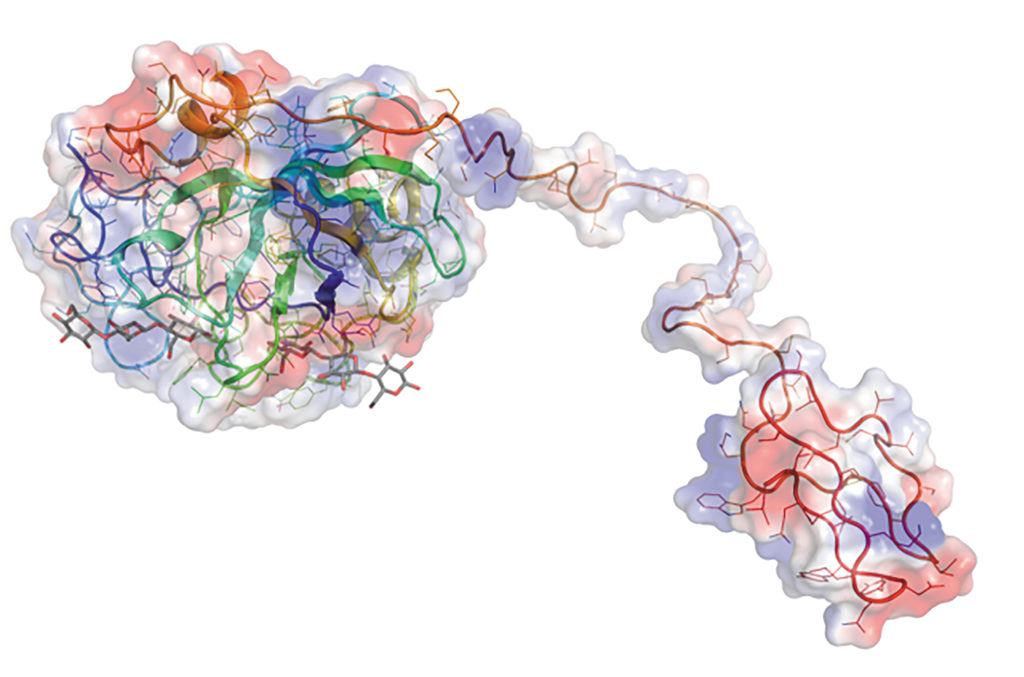

Buckman’s team agrees that customers want to make tissue that is softer and stronger. They offer enzymatic technology to help mills increase strength without losing bulk or softness. “Enzymatic technologies have come a long way in recent history,” says Buckman’s Mark Christopher. “With the advances of DNA sequencing and computer modeling, we can identify and isolate specific substrates to develop new enzymatic activities. In addition to developing new enzymes, we have developed enzymatic products that contain non-enzymatic components to provide synergy, boosting overall performance.”

Papermakers can use these technologies in the areas of stickies and pitch control, fiber modification, brightness improvement, deposit control, and starch modification.

WATER

We’re putting more demands on our water resources all the time. But how can papermakers replenish the water cycle and keep up with the industry’s growing production needs?

“As environmental legislations are becoming stricter, customers are asking for solutions to meet regulations and also improve their carbon and water footprint,” says Kemira’s Pascal Morin. “Deep know-how in research, development, and application of flocculant and coagulant chemistries ensures safe, efficient, and sustainable chemical water treatment.”

Chamee Chao says Dow’s latest offering also offers benefits in this area. “DOWSIL ACP 3073 offers superior drainage properties, enabling reduced dose of active, lower water consumption, and decreased energy use at evaporator level in a way we have never seen before,” she states.

Brooks agrees that the right chemistry can aid water conservation. “The Solenis portfolio includes innovative chemicals, on-site experts and on-call application specialists to help customers responsibly manage fiber, improve energy efficiency, conserve water, and enhance worker safety,” he says. “As a result, our customers are more innovative and able to produce those favorite brands of paper towels, facial tissues, coffee cups, and packaging paper that consumers have come to expect and want.”

DATA ANALYTICS

Brooks reports that, for the mills Solenis works with, digital solutions that enable chemical technologies are currently an area of high interest. “In particular, the pulp and paper industry is exploring how to use artificial intelligence to improve papermaking operations,” he says.

Solenis’s OPTIX Applied Intelligence is a novel adaptive analytics platform that uses robust data science techniques to create a real-time, adaptive soft sensor that analyzes key process variables and provides a minute-by-minute, machine-direction quality profile. In addition, Solenis’s new OnGuard SmartScale technology addresses increasing industry demand for asset protection. “The SmartScale technology can incorporate up to eight process signals into a proprietary algorithm for optimum control of a customer’s digester scale control program,” Brooks says. This can improve a mill’s process efficiency and extend time between shutdowns.

The takeaway is that getting good results is not just about what chemical a mill uses—it’s also about how the mill applies that chemical and assesses the results. Data analysis and predictive tools are becoming more prevalent at mills, says Morin. “Kemira uses cutting edge technology to ensure our application technology, type, and location of addition are optimized for specific applications,” he says. “Our KemConnect digital platform enables 24/7 access to data and its interpretation by our customers and global application experts.”

IMPROVING SUSTAINABILITY

Pulp and paper producers are under pressure to develop robust sustainability programs. Can innovative chemistries help them achieve this goal? According to all of our respondents: absolutely.

Chemistry providers can help customers manage or conserve natural resources more effectively, and enable them to produce products that are more sustainable. That’s the mission for Solenis, says Brooks. “As an example, governments and major brand owners are searching for innovative solutions to replace plastic packaging with more sustainable paper-based packaging,” he explains. “To enable the required functionality, mills need new barrier coatings that provide ease of recyclability, repulpability, and compostability. Solenis has developed a range of sustainable ecological barrier coatings as functional replacements for polyethylene, fluoropolymers, and wax coatings.”

The contributions that chemicals can make to a mill’s sustainability will vary by product line and application, notes Kemira’s Harold Goldsberry, “so we have a very broad portfolio of products. For example, our dry strength product line has demonstrated many times the abilities to enhance machine efficiency and productivity; to save on fiber costs with substitution of higher levels of lower cost, weaker fiber sources; to reduce fiber costs via basis weight reduction; and to save energy via reduced refining and easier sheet drying.”

Drainage chemistries are also vital to sustainability, adds Kemira’s Mike Wallace. “Improved drainage in the forming section enables lower pressing and drying (steam) demands. Improved former drainage also allows for better press section sheet consolidation and improved compression strengths on packaging grades,” he says.

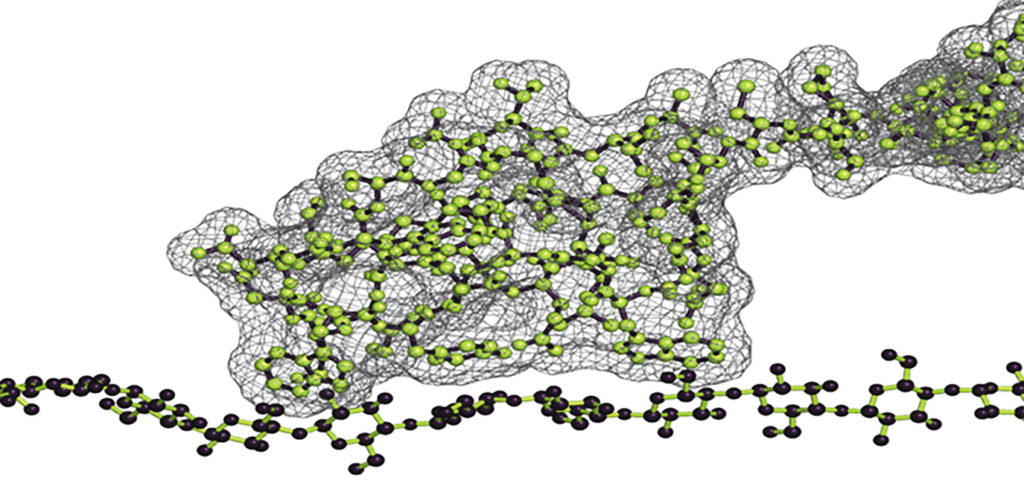

Another significant innovation is the use of silica microparticle on kraft packaging grades. “The improved colloidal retention is dramatically reducing foaming and therefore reducing sewer fiber losses and keeping basements cleaner and safer,” says Wallace.

Paper chemicals can offer a host of contributions to sustainability, say Buckman’s Rizcallah and Covarrubias: “The most important contributions are the ability to reduce basis weight in packaging, reduce use of hydrocarbon-based products and high volume low active products (such as GPAm, PVAm), improve safety, lower hazardous bleaching chemistry usage, and reduce or eliminate use of solvent-based cleaners.”

“On the tissue side, enzymes allow manufacturers to use higher contents of the more sustainable fiber sources, including eucalyptus and bamboo, while improving quality and reducing energy usage,” adds Christopher.

Buckman’s Tom Holm adds perspective from the pulping side. “In Europe, the move to drive AOX emissions lower is forcing companies to look at ways to reduce the use of chlorine dioxide or go ‘all in’ on TCF bleaching. Buckman’s Vybrant technology has been shown to help them along that path.”

Sustainability is also important to the Dow team. “Our latest technology assists in this effort. For instance, for every ton of carbon dioxide emitted for its production, the use of silicone defoamers such as DOWSIL™ ACP 3073 allows a typical saving of 27 tons of CO2 eq in the pulp industry, compared to the use of traditional organic defoamer,” says Frauke Baltruschat.

Packaging producers are also being challenged by increasing regulatory demands and a market drive for more sustainable operations. “Many mill managers proactively seek products that meet future regulatory demands,” say Covarrubias and Rizcallah. “Increasing this engagement from mill managers will allow chemical suppliers to be at the forefront of product development to meet future regulatory and market demands.”

GOOD CHEMISTRY =

WORKING TOGETHER

As we’ve seen, the pulp and paper industry’s chemical suppliers specialize in different types of innovation to help meet the needs of their customers. But what can customers do to help suppliers deliver the right chemistries for their mill’s unique needs?

“Just as papermaking is complex, the challenges faced by these operations are also multifaceted,” says Brooks. “The impact of an aging workforce; increased and varied regulatory demands; and the hesitation to leverage new technologies such as artificial intelligence are often at the forefront. But effective knowledge transfer and regulatory compliance are possible through a combination of chemical and digital solutions while embracing new technologies such as AI and advanced analytics.”

In the pulping arena, says Holm, he sees mills that are very reluctant to try new technologies. “The focus has been on mechanical reliability to do more of the same. For the industry to advance, we need mills that are pioneers, willing to risk short-term loss for large, long-term gains by adjusting their processes and trying new technologies. These pioneers do exist, but they are a precious few. And when a pioneer does identify a new technology as successful, it can still take years for the rest of the industry to adopt it.”

For the Kemira team, it’s about balance: “Mills and chemical suppliers need to develop a balance between product performance, the value proposition that suppliers deliver, and the service expected by customers.” Suppliers then need to balance these factors with the investment required to develop new products against the profitability their shareholders and senior management expect.

Open and transparent lines of communication will always play a key role in successful mill/supplier partnerships, concludes Brooks. “A willingness to consider and support change must always be ‘on the table’—this opens discussion points for new methods and new products. Both parties must be aligned and committed to the same set of goals; the mill manager is critical to this process.”

Paper 360

Paper 360