GRAEME RODDEN

Specialization has long been a sought-after ambition for business: the ability to create a niche, to develop products so that there is a clear differentiation from competitors, and perhaps to command a premium for them.

As the world’s fifth largest producer of northern bleached softwood kraft (NBSK) pulp, producing more than a million metric tons annually as well as about 150,000 metric tons of unbleached kraft, some may feel Canfor is providing a commodity. But it begs to differ.

Take a look at Canfor’s evolution over the past few years. In 2007, 52 percent of its pulp went to publication grades, 12 percent to tissue, and 30 percent to specialty applications. In 2018, the publication paper share dropped drastically to 17 percent while tissue (mostly premium grades) rose to 33 percent and specialty applications jumped to 50 percent. By 2025, Bill Adams, senior director, strategy and innovation, says that will rise to 65 percent. In 2018, pulp sales reached CDN$1.2 billion (US$911 million).

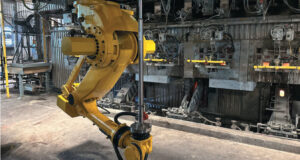

The Intercontinental (foreground) and Prince George mills share the same site.

STRONG AND CLEAN

What are specialty pulp applications? It is a wide sector and includes such diverse products as teabags, filter paper, masking tape, wallpaper, wet laid non-wovens, metalized papers, fiber cements, décor, label and release paper, cigarette papers, flushable wipes, abrasive papers, and electrical grades.

The key parameters for specialty pulp are strength and cleanliness. The strength properties start with the fiber available to Canfor: lodgepole pine and white spruce are the dominant species. The Canfor pulp mills use residual chips from regional sawmills to produce the highest strength fibers in the market.

The company harvests from the montane forest (west of the boreal forest) in a 400-km (250 mi) radius around Prince George, British Columbia, where it has three pulp mills. “It is a uniform area with mature wood that has excellent, consistent fiber,” notes Adams.

Adams explains that the whole plateau where Canfor harvests has the same climate and precipitation level. “We only have about 130 frost-free days per year, so the fiber grows very quickly in the long daylight season.” The fiber is distinguished by its long length and thin walls, which impart tensile strength.

“We source about 2.5 million metric tpy of chips in Prince George and almost all are identical,” Adams adds.

This fiber requires low energy for refining. The fibers are thin and collapsible, which creates a much better fiber network. There is high fiber uniformity with low fines content. It has very high zero-span tensile strength. Adams adds that three parameters determine pulp strength: low coarseness, intrinsic strength, and fiber length.

Canfor focuses the production of unbleached kraft on high-end specialty markets made at its Prince George Pulp & Paper mill. “The unbleached kraft market is about 2.5 million metric tons,” Adams explains. But, he adds, “There are not many producers that can make unbleached kraft for the high value-added, specific markets such as fiber cement, electrical, and liquid packaging.”

Of the total unbleached pulp market, just over half is for commodity paper and packaging, 15 percent for electrical, and about 30 percent for fiber cement. Other specialty applications (abrasive, tape base papers, filtration grades, etc.) make up the rest of the unbleached market pulp demand.

“No one else can make a premium re-inforced pulp (PRP) in the unbleached pulp market like us. We have the only PRP with a dedicated unbleached kraft pulp production line suitable for both high cleanliness and high strength applications.”

Canfor claims its PRP allows paper makers to reduce refining energy, gives improved dimensional stability, and has higher tensile strength (see graph). Along with its other properties, PRP also has excellent folding endurance.

Adams adds that Canfor’s strategy to focus on specialty pulps has been successful. “The end use segments we have chosen—high tensile, high cleanliness, exceptional consistency—are also growing themselves. Some of these market segments are growing at 5 to 6 percent annual levels.”

This is why Canfor’s goal is to increase the amount of pulp it produces for specialty grades. There is a big opportunity and the pulp does command a premium.

Specific electrical paper products that use unbleached kraft include capacitor tissue, electrical insulation, and transformer cores. The multi-layer paper that is at the core of a transformer must be ultra-clean to maximize the lifetime of the transformer. Low conductivity, low ash, and exceptionally high purity are essential parameters for this pulp.

Fiber cement also uses unbleached kraft pulp. High tensile and chemical cleanliness are the key pulp qualities for this fast-growing segment.

Applications that can use either bleached or unbleached kraft include tape base paper, liquid packaging, and abrasives. Adams explains that there are two types of abrasives: consumer products, such as sandpaper; and industrial abrasive paper that relies on Canfor pulp’s excellent tensile properties. For example, they may be used in delicate applications such as polishing telescope lenses.

THE BEST TECH

To maintain and strengthen its position in the specialty market, Canfor has invested heavily in its pulp mills. Between 2010 and 2018, it spent CDN$600 million (US$455 million). It plans to invest another CDN$70-80 million (US$53-60 million) annually though 2021 to improve mill performance.

It has invested in the best available technology such as PulpEye, which has been installed on all five of the company’s fiber lines as well as its paper machine: one each for Northwood Pulp’s A and B lines; one at Intercontinental Pulp; one on the unbleached line at Prince George and one on the paper machine; and one at the Taylor, BC, BCTMP mill. PulpEye (from Sweden) measures fiber wall thickness as well as fiber length, curl, coarseness, freeness, kappa, and pulp brightness.

Canfor also installed Valmet’s Process Quality Vision systems on its three bleached kraft pulp lines. The high-speed, high-resolution cameras measure dirt count. There are 36 cameras across the web that measure 100 percent of production. Canfor produces 12,000 pulp sheets every 10 minutes and each is measured.

“From the count, we can determine where the pulp should go,” Adams says. Since the installation of these systems, he adds that dirt complaints have been almost eliminated.

Energy investments include CDN$80 million (US$60 million) for two 30-MW turbine generators, one each for Northwood (2019) and Intercontinental (2018). The company now has 180 MW of renewable energy generating capacity in Prince George.

The new incoming water treatment system at the Prince George and Intercontinental mills (which share the same site) is scheduled for startup in early 2020. The CDN$30 million (US$22.7 million) system will provide cleaner water to improve pulp quality and lower bleaching costs. The cleaner water will also improve electrical grades by lowering the metals content.

Looking ahead, Adams says Canfor always envisions having a position in the ultra-premium tissue market as well as P&W papers. But, “We see 65 percent as the sweet spot for specialty pulp. It will balance the market and the ability of the mill to make the necessary quality.

“We want to grow with our customers in segments that are growing. One of the things we are looking at is to make better pulp: cleaner, purer, stronger. This is an R&D focus. This focused effort will keep the market advantage we have.”

There is a lot of direct contact with customers, either at their paper mills or Canfor’s pulp mills. “We really need to understand our customers’ requirements and do joint product development to help them optimize their use of our fiber.”

Canfor is also studying potential markets that do not use cellulose at present, such as wet wipes. “There are a lot of applications that are currently using plastic or synthetic fibers that perhaps could transition to cellulose and we have work going on there,” Adams explains. “As people look to displace plastics, unbleached kraft has some advantages. Also, lightweight packaging needs a strong fiber, so that may be another possibility.”

Research Still an Important Part of Canfor’s Strategy

LR40 Voith Lab Refiner at the Canfor Pulp Innovation Center.

Canfor is the only Canadian northern bleached kraft pulp producer with a dedicated research facility. The Canfor Pulp Innovation Center has four key focus areas: PRP strength and quality; identifying specific end use segments for its PRP; cost reduction for Canfor and its customers; and new bioproducts (an upcoming Paper360° feature will look at the company’s joint venture to produce transportation fuel).

Canfor will sponsor the new industrial research chair in bioproducts at the University of British Columbia to accelerate its efforts in creating value from sustainable forests.

The research center located in Vancouver installed a Voith LR40 pilot plant refiner in 2017. Adams says this is “the standard” for laboratory refiners as the results are very consistent with paper mill refining results. In conjunction with a lab refiner user group, it is trying to develop a globally accepted standard for lab refining.

Paper 360

Paper 360