Recognizing his strong leadership and strategic planning ability, Fastmarkets RISI has named Susumu Yajima, chairman of Oji Holdings Corporation, its Asian CEO of the Year. The award will be presented at the 20th Annual RISI Asian Conference, held at the Four Seasons Hotel in Shanghai on May 22-24, 2019. With headquarters in Tokyo, Japan, Oji is one of the world’s leading pulp and paper manufacturers.

The Fastmarkets RISI Asian CEO of the Year Award is appraised and nominated by many investment analysts, industry consultants, and commentators from the Asian and global pulp and paper industry. This year, Yajima earned the nod for leadership, decision-making, and strategic planning that has helped Oji achieve globalization, diversification, and centralization of its domestic undertakings.

Fastmarkets RISI: For your first three fiscal quarters of 2018 (April 1—Dec. 31), the consolidated sales of Oji Holdings were 1170.6 billion yen (US$10.49 billion), an increase of 6.1 percent; and profits of 38.8 billion yen ($US347.7 million), an increase of 30.6 percent, over the same period of last year. What were the main factors in achieving this performance growth for Oji Holdings? In what areas did Oji perform better than its competitors?

Yajima: We have built up various initiatives for business structure improvements and portfolio shift over the years, which led to these results. In particular, one of the major contributors is the overseas business. While the demand for printing paper has continued to decline rapidly in Japan, we have reduced our reliance on the printing and communications paper business as well as the domestic business in Japan. Instead, we have been expanding our businesses of household and industrial materials, functional materials, and forest resources and environment marketing, including pulp and electric power, and expanding our businesses in overseas regions centered on Asia-Pacific. We believe we have been a step ahead with the accuracy and speed of our investment strategies while our domestic competitors have also been promoting similar measures.

Oji has been expanding overseas businesses; the overseas sales ratio of the Oji Group rose to 32.1 percent. Could you please share the overseas layout and planning strategy and the challenges that Oji Holdings faced in expanding its overseas businesses?

We are actively investing in regions and fields of growing businesses. To be more specific, we continue to enhance our packaging, disposable diapers, thermal products, adhesive products, and pulp businesses, mainly in the Asia-Pacific region. We have acquired highly talented personnel and developed our human resources by acquiring companies through M&A.

Going forward, we will further expand the scale of our business based on these companies and human resources. In addition to merely expanding the business, we aim to create further synergies and enhance our earnings foundation by strengthening collaboration between the materials and the converting businesses as well as strengthening collaboration between different fields. There is a saying, “a little leak will sink a great ship.” When business begins to turn bad, it falls into a negative spiral, and it takes considerable cost to get out of it. We are conducting business with the utmost care every day to not miss even a little leak.

How does Oji Holdings perceive the fact that SE Asia’s intake of RCP has jumped since China tightened its control of RCP imports? How has it affected Oji Holding’s existing business and strategic plan in Southeast Asia? Can you please share a little of Oji Holdings’ investment plan in Southeast Asia?

The sharp increase in wastepaper exports from neighboring countries to China is expected to be temporary. Last year, wastepaper exports to China also increased sharply in Japan due to demand for replacing US products, but are now calming down. The Chinese government has set a goal to eliminate the import of solid waste, including wastepaper, by the end of 2020. If the import of wastepaper is completely banned, we expect that it will be difficult for Chinese domestic manufacturers to maintain their current levels of operations. Therefore, it is conceivable that wastepaper of quality above a certain level will continue to be imported as a resource rather than as waste, and the recovery rate of wastepaper in China will improve. In addition, wastepaper pulp and paperboard will be imported to make up for the shortfall that may still exist.

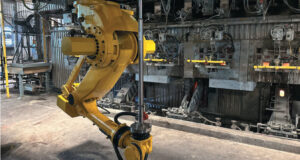

Operators move a paper roll at Oji’s Jiangsu mill.

In view of this, it is expected that the supply-demand balance of wastepaper will be eased and exports of wastepaper pulp and paperboard to China will be increased in neighboring countries. Oji Group is currently promoting the construction of a new paperboard machine at GSPP in Malaysia, mainly for in-house consumption. While stabilizing local wastepaper procurement, it may increase our exports of paperboard to China.

Since Oji Holdings entered China in 1995, the pulp and paper market has undergone tremendous changes. Can you comment on the progress of China’s pulp and paper industry? How have China’s consumer market and demand changed?

Production and consumption of paper and paperboard in China increased more than four times compared to 1995, and has now become the world’s top. Also, the market is increasingly demanding higher quality paper as the economy develops. The sophistication of the Chinese paper industry is expected to further progress as a result of a shakeout of enterprises caused by market selection and the supply-side reforms being implemented by the Chinese government. The current environment surrounding the paper industry is undergoing a major turning point, such as the implementation of severe environmental measures and restrictions on import of wastepaper. We look forward to embarking on a new era of a truly recyclable and sustainable Chinese paper industry after achieving the “quantity-to-quality” transformation.

China eliminated a large number of backward production capacity during the twelfth Five-Year Plan period. Local governments are paying more attention to environmental protection. What opportunities and challenges do you think Oji Holdings faces in this “environment first” trend?

The Chinese government places increasing emphasis on environmental protection and has begun implementing strict environmental measures for the paper industry. Under these circumstances, in the paper industry, backward enterprises are being eliminated and consolidated into companies with advanced facilities and technologies. As for Oji Group, it has developed a variety of technologies and expertise over many years in Japan, where resources are scarce and strict environmental regulations are implemented. We have refined our recycling technologies for raw materials, energy, water, etc., and have built a high-level recycling-oriented business model. In addition, Oji Group places the highest priority on “safety, the environment, and compliance” in its management.

The business in China has also adopted similar technologies and management policies. We believe that the time has come for these initiatives to be evaluated from the market. Going forward, we aim to be a company that is even more environmentally conscious and continues to provide innovative value that precisely meets the market needs.

China’s paper industry is in a period of transformation and upgrade. The integration of forestry, pulp, and paper is also an important issue in China’s paper industry. Could you please share some successful experiences of Oji Holdings in the integration of forestry, pulp, and paper in Asia and the Pan-Pacific region? What are your views on the implementation of integration in China’s paper industry?

In recent years, many companies in the paper industry have expanded their industrial chains upstream and downstream, rather than just making paper. Despite a significant investment associated, the integration of forestry, pulp, and paper has many advantages such as securing of raw materials, effective use of energy, and reduction of logistic costs, which eventually realize an industrial model that is energy-saving and resource-recycling.

Oji Group practices sustainable forest management, with forest plantations around the world.

Oji Group conducts sustainable forest management, with forest plantation areas in Japan, Southeast Asia, South America, and Oceania. Our forest plantation sites have been certified by third-party forest certification organizations such as FSC certification and SGEC certification, and have been highly evaluated by users and investors amid growing environmental awareness worldwide. Resources produced from forest plantations are used for various applications depending on the quality of wood, such as woodchip for paper manufacturing and lumber processing. Jiangsu Oji Paper is an integrated pulp and paper mill that produces both pulp and paper using woodchip for paper manufacturing.

While profits of the paper industry in China as a whole in 2018 decreased from the previous year, the business performance of Jiangsu Oji Paper improved. I believe it was due to the cost competitiveness enabled by the integrated manufacturing of pulp and paper. Furthermore, Oji Group is also striving to create a new business by leveraging its experience in each of the upstream, mid-stream, and downstream fields, and is working on businesses such as of cellulose nano-fiber, medicinal plants, renewable energy, and the water environment.

Strategic alliances are an effective way to enhance competitiveness. Can you describe the work of Oji Holdings on M&A and strategic alliance?

We are actively promoting strategic alliances in Japan and abroad. As the most recent example in Japan, we conducted a capital alliance with Mitsubishi Paper Mills in March. We had previously been promoting joint investment and joint business development in areas such as thermal paper, household paper, and energy with the company. Going forward, we hope to further develop the partnership and to realize the synergy effects in all business fields.

As the most recent example abroad, we have decided to start our first corrugated container business in Indonesia in 2020 as a joint venture with the Sinar Mas Group. We will continue to actively pursue strategic alliances, particularly those with a purpose of entering into new regions and new fields, as they are often far more advantageous in terms of speed of entry into new markets and risk hedging, compared to working alone.

What is your medium-term management plan? What is your outlook for FY2019?

In FY2016-2018, Oji Group implemented various initiatives in line with the fundamental policies of its three-part medium-term management plan: expansion of overseas business, concentration/advancement of domestic business, and enhancement of our financial foundation. As a result, our operating profit will very likely reach the management target of more than 100 billion yen (US$895 million) at last in FY2018. We have implemented various initiatives to develop a structure that can maintain high profit levels in any economic situation. We aim for further improvement in FY2019, when we can expect to see the effects of the measures launched in FY2018.

Thanks to Nick Chang, Shawn Wang, and Rita Yao for their support in this interview. Fastmarkets RISI is the world’s most trusted price reporting and market analysis provider for the forest products sector. Businesses working in the pulp and paper, packaging, wood products, lumber, timber, biomass, tissue, and nonwovens markets use Fastmarkets RISI data and insights to benchmark prices, settle contracts, and inform their strategies worldwide.

Paper 360

Paper 360