GRAEME RODDEN

Innovation in the Finnish pulp and paper technology sector is alive and well.

This was amply demonstrated during an editors’ tour organized by the Finland Pulp and Paper Technology (PPT) group. This tour usually takes place every two or three years, and the 2018 edition was as full as its predecessors, with 15 visits to producers, suppliers, and even the new Helsinki port—all in five days.

The first stop, as per usual, was Konecranes, just north of Helsinki. In a typical mill, there are more than 100 pieces of Kone equipment (cranes, hoists, etc). One of the company’s latest innovations is a customized, totally automated crane designed for Metsä Fibre’s new bioproducts mill at Äänekoski, Finland. The crane can load 32 metric tons per lift into a rail. It takes two lifts to fill a car.

The attachments were designed by Stevenel, whose managing director, Heikki Hyysalo, also presented during the visit to Konecranes.

Petri Asikainen, director, product development, Konecranes, spoke about the Industrial Internet as it relates to cranes. The “intelligent, connected” crane is not just about connectivity and data. With key performance indicator capability, he called it “connected R&D.” Yet even now, the limits of connectivity have not been reached.

Data security has become an increasingly important issue. Lots of measures have been taken to protect data, and the importance of security will grow as more equipment is connected.

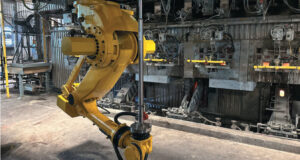

A typical pulp and paper mill contains more than 100 pieces of Konecranes equipment. Pictured is the Metsä Board mill in Finland. Photo courtesy Konecranes.

Besides supplying connectors for the Äänekoski mill, Stevenel also designed and supplied semi-automated spreaders for the five Panamax vessels that Fibria chartered to carry its pulp. One lift can handle 24 to 40 metric tons with a production rate of 1,800 metric tons/hr. Established in 1998, Stevenel designs and manufactures attachments for port operators, ship owners, industrial terminals, and OEMs. It focuses on mechanizing cargo flows at ports and pulp and paper mills.

Next it was off to Pöyry and a preview of the world’s paper markets up to 2030. Hanna Yliherne, senior consultant, noted that paper demand has stalled since 2010. Global production is now about 400 million metric tons, but in the last six years had grown only two million metric tons. She added that there are several mega-trends shaping the paper industry: demographics, political/regulatory landscape, environment, economy, consumer behavior, and technology.

Tom Lind, Pöyry vice president, technology and new solutions, gave a European market overview of advanced biofuels and biomaterials. There are two demand drivers in the sector: advanced biofuels and advanced bio-based chemicals. Lind pointed to three issues fueling the demand: climate change, sustainable materials, and innovation. Lignin cuts across all three issues. However, Lind said he is still skeptical about lignin products, as the market is not established. Other products such as nanocellulose, wood/plastic composites, bio-based chemicals, and bioplastics address issues such as sustainability and innovation.

Lind also pointed out that the Nordic region has already surpassed the EU target of 10 percent biofuel consumption by 2020. The region is leading advanced biofuel development.

He did note that renewable diesel capacity expansions are putting pressure on sustainable feedstocks such as oily plants. Biofuel policies in the EU will have a dramatic effect on the advanced biofuels business. The bar has been set high—“almost impossibly high,” says Lind.

WORLD’S LARGEST RECOVERY BOILER

Andritz was next to host the group. Among its recent orders/start-ups:

• A complete 1.9-million metric tpy pulp line for Fibria. The mill set a single day world production record in January, 2018, making 6,394 metric tons.

• Much of the equipment for Metsä Fibre’s new bioproducts mill in Äänekoski, Finland, which started up in August, 2017.

• Chenming Shouguang (China), 1.1 million metric tpy hardwood pulp mill.

• SCA Ostrand, which is more than doubling pulp capacity from 430,000 metric tpy to 900,000 metric tpy.

• Much of the equipment for Klabin’s Puma (Brazil) pulp project.

Henrik Wikstedt, vice president, recovery boilers for Andritz, spoke about APP’s OKI mill project. It features the world’s largest recovery boiler at 12,000 metric tpd dry solids. To show the evolution of technology, Wikstedt noted that in 1985, the largest recovery boiler could handle 1,700 tpd dry solids. HERB is Andritz’ registered name for all its high energy recovery boilers.

There is a lot happening elsewhere on the technology front for Andritz. Its A-Yield, advanced pulp yield has the potential to save mills 2-4 percent wood consumption (softwood) and 1-2 percent (hardwood). A screen room after oxygen delignification with reject recirculation allows the increased yield. The cooking chemistry is slightly different; it uses polysulfide cooking. For dissolving pulp, Andritz has a continuous cooking process. The technology allows mills to convert or swing from paper grade to dissolving pulp and back again.

In the field of micro crystalline cellulose (MCC), Andritz has an agreement with Aalto University in Finland. The Andritz AltoCell MCC plant is pilot scale at present. However, Jussi Piira, Andritz sales and business development manager, fiberline, calls the process “cost-effective” and it has attracted interest. Global production of nano- or micro-crystalline cellulose is now about 130,000 metric tons, but growing 5 percent annually, he added.

Andritz also has lignin technology. It started a project in 2010 and commercialization is ongoing. It is a double filter press process with a flash dryer. Lignin markets still need to be established, Piira said. There is the question of high volume end uses compared with high value end uses.

The last stop of the day took the group to Scitech-Service. Established in 1983, it is a small company specializing in the bioeconomy sector. Managing partner Eric Enqvist said that SciTech focuses on biomass conversions using wood and agricultural residues as well as annual plants. End products include biofuels, polymers, biochemical, and/or energy. Basically, SciTech applies scientific knowledge for practical benefit.

“We try to bring the uncertainty risk low enough before a lot of money is spent,” Enqvist explained. It has a pilot plant, or “flexible laboratory” as Enqvist called it, in Rauma, Finland, where its neighbors include pulp and paper mills as well as a chemical plant.

Most of the work SciTech does is by contract. Even when its own stand-alone work shows promise, SciTech offers the work at an early stage to a customer. “We want to be facilitators,” Enqvist said, “to let our customers own the technology.”

Its topics of activity now include: dissolving pulp, cellulose textile fiber, biochemicals from wood-based pulp, and various biorefining concepts, as well as mill improvements. “We will be at the front end of biomass fractionation for some time still,” Enqvist added.

LIMITLESS POTENTIAL

The second day, the editors were welcomed by UPM at its head office. Jyrki Ovaska, executive vice president, explained the evolution of UPM into UPM, The Biofore Company. He said the company will create value by seizing upon the “limitless potential” of the bioeconomy. The visit will be the subject of a feature in an upcoming issue of Paper360°.

A mill visit was also on tap as the group travelled east to tour Kotkamills (see feature in Paper360° May/June 2018).

Staying in eastern Finland, the Runtech Group was the next stop. Founded in 1997, Runtech has enjoyed impressive growth since acquiring companies such as Ecopump and the EV Group. The latter acquisition came in 2017, the same year the company founded Runtech Systems Inc. in the US. Sales manager Lari Lampila noted that EV was strong in the dryer section while Runtech’s strength was in the wire and press sections, “So EV was a good fit.”

Holder of 60 patents, Runtech specializes in vacuum systems/turbo blowers, doctoring and tail threading. In China, Runtech has more than 100 blower systems installed. The EV Group specializes in runnability, energy efficiency (heat recovery), cleanliness and tail threading.

Lampila discussed some case studies featuring Runtech installations:

• At Papelera de la Alqueria, the installation of a turbo blower helped the mill reduce energy consumption by 60 percent.

• A boxboard mill in China converted its old vacuum system to turbo blowers. Maintenance costs were reduced and an energy saving of 1,000 kWh was realized. Water use fell by 70,000 m3/yr.

• At Kotkamills, the vacuum system was rebuilt using a turbo blower and the mill saved one million m3/yr of water.

“In rebuilds, we are the leader because our system is compact and can be fit into existing frames,” Lampila said.

Sulzer is a well-known name in pumps, and although this part of the company accounts for 50 percent of revenue, it has a well-established foothold in rotating equipment services, separation, and mixing technology (through its Chemtech subsidiary) and, based on its 2017 acquisition of Ensivel-Moret, applicator systems.

Sulzer has been active in the pulp and paper sector for a long time and committed strongly to the sector when it acquired Ahlstrom Pumps in 2000. Sulzer has assets in more than 3,800 mills worldwide and has provided pumping and mixing equipment to most major projects in recent years. For example, it supplied more than 400 pumps to the Äänekoski mill. Matti Rikka, head of business development, general industry, said the company can upgrade most existing equipment, even from acquired brands, with more efficient (energy, productivity) technology.

The company has had the foresight to look beyond the traditional mill, seeing a strong future in other wood cellulose-based products. Reijo Vesala, business development manager, pulp and paper industry, explained that Sulzer has taken a strategic step in this sector to create a space for itself. Cooperation is key, whether through consortiums or other types of agreements: “These applications need pumps, but pumps with new features. Suppliers need a deep understanding of the applications: dissolving pulp, lignin, nanotechnology.”

Vesala discussed foam-forming technology designed by VTT to produce lightweight materials. Sulzer is working with Valmet and Wet End Technologies and he said the process is close to commercialization. Benefits include reductions in fiber use, drying energy, and water consumption.

An American company featured in the tour as well. In March, 2017, Trimble Forestry (California) acquired Savcor, which made its name in corrosion prevention. However, the corrosion arm of Savcor has been spun off into an independent company.

The roots of Trimble are in positioning systems. It purchased Savcor because it wanted to expand its offering from the mill gate to mill-wide. Acquiring key geographic positions in South America and Germany were important, as Trimble Forestry had no exposure there before.

Trimble Forestry Solutions manages more than 50 million m3 of log transactions annually and more than 55 million ha of production forest. Clients include Canfor, UPM, Arauco, and Stora Enso. It covers the whole value chain from planning to processing.

Jari Suihkonen, senior vice president, process analysis, spoke about some of the Savcor assets that Trimble acquired. Zenith Forest Management was developed for South American plantations. It is a total planning/analysis system for the entire silvicultural process: planting, climate, yield, and harvesting techniques. All information is fed to a connected forestry portal and data is entered in an ERP system. For example, one analysis showed a company that it could plant 3 percent more seedlings in one hectare, which meant additional revenue of US$20 million when harvested in seven years. Trimble calls it “precision forestry,” Suihkonen said.

Suihkonen also discussed Trimble’s Wedge Process Diagnostics system. An hour of lost production could cost a mill up to US$100,000. It is not unusual for a major process to suffer more than 100 significant upsets annually, he added. About 20 reasons cause 80 percent of these upsets; Suihkonen said that Wedge can locate and eliminate the main causes of upsets and report “why” they occurred. Wedge is built on top of the data historian, and turns a huge amount of data into knowledge. It has been installed in more than 200 production lines; though developed for the pulp and paper industry, almost half of its customers are outside the sector.

After a night at a noted Finnish hotel and spa deep in the woods, the intrepid band set off for Varkaus and a stop at AFT, the world’s largest supplier of screen cylinders. It is also known for its refining technology, approach flow systems (POM), and stock prep. The company adopted the LEAN philosophy in 2013 and Kari Ikäheimonen, human resources manager, said it affects all AFT does. The goal is to increase AFT’s efficiency and profitability with a total focus on the customer. The company’s supply reliability is now above 97 percent.

Research and product development is a key part of AFT. It does a lot of computational fluid dynamics (CFD) to see how liquid acts in a screen. It has also developed its own simulation program: SIM Audit.

On the product side, its MacroFlow2 screen cylinder features precise laser-cut rings. AFT does not specify slot width, but can do any size a customer wants based on the application.

The GHC2 Powerwave Rotor keeps fiber agitated and creates a complex 3D flow near the cylinder surface. This helps reduce energy consumption. That is, a mill can run slower at a given capacity or, if it runs at the same speed, capacity can increase.

ON THE GROWTH PATH

According to CEO Kari Pellinen, Protacon has been in the Internet business since 1996. Leading the way into Industry 4.0, Pellinen said Protacon puts digitalization into practical use.

He said the company is an “industrial integrator” that in the future will focus on turnkey projects. It has grown through acquisition, the latest being in January 2017 when it purchased Descal Engineering. “We now have mill engineering capability,” Pellinen added. “Customers want the whole package: mill engineering and automation.”

Protacon has focused on the finishing end: winders, fully automatic roll control, wrappers, conveyors, warehouse management. However, it is expanding its offerings through the mill. Recent projects include: a winder automation rebuild in China, a wrapping line troubleshooting project with Palm in the UK, plus dryer section and tail threading work at Kotkamills.

In pulp and paper, about 50 percent of its work went through the OEMs, but in the future, Pellinen said the company plans to go directly to the customer more. It is looking at the US market as well, with discussions underway with one large producer. China is also a priority.

Kimmo Kettula, managing director of Descal, said the company offers equipment, structural, process, and plant engineering. It is building up a new E&I department that will mean a 40 percent increase in personnel. Pulp and paper makes up about 60 percent of its business.

The penultimate stop on the tour was at another well-known name in the industry: SKF.

The editors were welcomed by the general manager, lubrication business unit, Tuomo Helminen. He noted that more and more, the business is connected to life cycle analysis. “So, we are focusing on this more, moving from being strictly a components supplier.”

As more processes automate, lubrication has followed suit. Helminen said systems can be retrofitted to older machines. He did add, however, that manual systems are still important and are not going away anytime soon.

Risto Kuukkanen, export manager, said SKF always understood it needed to sell a solution, not a product. Some of SKF’s offerings include: DuoFlex grease/lube system; FlowLine oil circulation systems; and, Safeflow oil flowmeters and oil monitoring. Millwide deliveries are possible that include complete lubrication system and design all the way to maintenance, spare parts service, and training. Kuukkanen said that in the end, he feels this gives a mill lower cost.

Metsä Fibre’s new bioproducts mill at Äänekoski is a popular reference for SKF as well. It installed an automated lubrication system with more than 3,000 lube points. SKF engineered and installed the system and trained the mill staff. It covers the mill from water treatment to the woodyard to effluent treatment. The debarking line alone had one control unit and 10 pumping stations.

The final day saw the tour end at FP Pigments in Raisio, eastern Finland. Three companies presented—FP-Pigments, CH-Polymers and CH Chemrec—all of which have the same ownership, with Chemrec being the “mother” company. Chemrec’s main products are slurry makedown and additives. FP Pigments offers unique, patented opacifying solutions and specialty pigments.

The companies all have their roots with Raisio Chemicals, which was founded in 1971. CIBA then took over Raisio, which in turn was taken over by BASF. The competition authorities in the EU said BASF was too strong in styrene acrylate so it closed down that part of the business, which Chemrec took over to establish CH-Polymers in 2009. FP-Pigments had been founded in 1996.

CH-Polymers produces barrier products such as waterborne binders and additives. These include recyclable barrier products (food applications) that can replace plastic and fluorocarbon barrier coatings and are also compostable. About one-third of its business is in paper and board.

Its BAR 3200 product is a sustainable barrier solution with a solids content of 50 percent. It can be used for food applications such as hamburger wraps, baked goods, wraps, and sandwich boxes. It has been tested for ice cream and frozen food containers. The BAR 2200 product shows excellent resistance to mineral oil migration. It is repulpable and recyclable.

Eskko Aarni, director BU paper and board, FP-Pigments, said the company has a patented process in which it precipitates calcium carbonate on different surfaces. It achieves excellent properties such as opacity, brightness, strength, and stiffness while helping to save fiber.

The company also has a TiO2 replacement concept. Applications include tipping papers, labels, packaging, catalogue and book papers. Work has been done with coated recycled linerboard; surface treatment with a structured pigment improved flexo printability with high brightness. For a coated kraftliner, only 1 g/m2 allowed a totally different starting point in terms of reaching final target board brightness. No whitetop was needed.

FP-Pigments’ work with cationic pigment technology resulted in a group of products that can improve inkjet and flexo print quality. Customers can formulate them on site or use ready-made. It is a cost-efficient quality improvement, Aarni said. Rapid ink drying is another benefit of these pigments.

Paper 360

Paper 360