ROD YOUNG

In the past three years, significant changes have impacted the dissolving pulp market, and more can be expected in the next five years. RISI has just published Outlook for the Global Dissolving Pulp Market 2016, our third detailed study of this relatively small, but fascinating sector of the world pulp market. The study discusses major developments since the last study was published in 2013 and presents a forecast through 2020. The forecast includes a thorough analysis of the factors influencing the various end uses for dissolving pulp, along with a comprehensive look at the supply side of the market and prices for main products. Following are some of the study’s most interesting elements.

Domestic cotton prices in China have collapsed over the last three years. The Chinese government’s ill-fated attempt to subsidize the domestic cotton industry, focused especially on producers in Xinjiang Province, resulted in an enormous inventory build. Government purchases led to inventories reaching nearly two years of demand by the end of 2013, and the subsidy program finally was abandoned. Domestic cotton prices then plunged by nearly US$1,000/metric ton over the course of 2014 and continued down to the lowest level since the first half of 2009 in March of this year. Cotton prices fell below viscose staple fiber (VSF) prices in August of last year and have remained lower for nine of the last 10 months since then. The dramatic drop in cotton prices has helped to undermine the growth pace of VSF in China. The track of cotton and VSF prices over the forecast period will be a significant factor in determining VSF demand growth.

Prices of polyester staple fiber (PSF) have also plummeted over the last two years. PSF prices in China reached a near-term bottom in the early part of this year, returning to the lowest level since mid-2003. The cause of this striking decline can be traced to the plunge in oil prices since the latter part of 2014. Oil lost two-thirds of its value from the third quarter of 2014 to the first quarter of 2016. Chinese PSF prices followed oil downward, although the decline was limited to a mere 40 percent between July 2014 and January 2016. Thus, the already large price differential between PSF and VSF became even wider, adding to the downward pressure on VSF demand. The outlook for oil prices, with their direct influence on PSF prices, will be a major element in the forecast for VSF demand.

Maybe the biggest factor impacting the demand in the hi-alpha sector of dissolving pulp is a sea change in cigarette smoking in China. Cigarette consumption in China jumped by nearly 40 percent from 2000-2010. At the same time, the amount of acetate tow used per billion cigarettes doubled as more filters were used in cigarette production. The combination of rising cigarette consumption and increasing application of filters resulted in Chinese acetate tow usage tripling between 2000 and 2010. Chinese cigarette consumption started to plateau in the first half of this decade and then dropped 3 percent between May 2015 and May 2016 after the government increased the wholesale tax on cigarettes. It appears that Chinese cigarette consumption is now on a downward track and the application of filters is slowing as well. A sensitivity analysis is being conducted on the rate of decline in Chinese cigarette consumption and the impact on global acetate tow usage.

Maybe the biggest factor impacting the demand in the hi-alpha sector of dissolving pulp is a sea change in cigarette smoking in China. Cigarette consumption in China jumped by nearly 40 percent from 2000-2010. At the same time, the amount of acetate tow used per billion cigarettes doubled as more filters were used in cigarette production. The combination of rising cigarette consumption and increasing application of filters resulted in Chinese acetate tow usage tripling between 2000 and 2010. Chinese cigarette consumption started to plateau in the first half of this decade and then dropped 3 percent between May 2015 and May 2016 after the government increased the wholesale tax on cigarettes. It appears that Chinese cigarette consumption is now on a downward track and the application of filters is slowing as well. A sensitivity analysis is being conducted on the rate of decline in Chinese cigarette consumption and the impact on global acetate tow usage.

An important factor affecting the supply side of the dissolving pulp market is cotton linter pricing in China. Domestic dissolving pulp producers using cotton linters as their fiber source still account for 20 percent of total supply to the Chinese market. Cotton linter prices have surged by 75 percent since September of last year due to a big drop in domestic cotton production and, therefore, cotton linter availability. The surge in linter prices is forcing the closure of many cotton linter pulp mills due to being cash negative and helping to prop up viscose pulp prices. A detailed analysis of the Chinese cotton linter market is included in the study; it looks at both demand from cotton linter pulp producers and potential supply from the cotton ginning process. The demand/supply balance derived from this analysis is used to predict a likely path for cotton linter prices in the future.

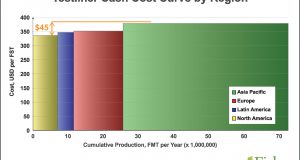

Another supply-side factor that will bear watching is the potential for more hardwood paper grade pulp capacity to be swung into viscose pulp. The market is currently in a hiatus from an investment perspective after the boom sustained in the first part of this decade. The last major expansion was the start of a greenfield swing mill in China by Sun Paper at the end of last year and the swing of the Jari mill in Brazil to viscose pulp at the beginning of this year. A mill is under construction in Belarus that will devote a small part of its output to viscose pulp, but startup has been delayed several times. Arauco announced the conversion of its Valdivia mill in Chile to dissolving pulp; however, the project is apparently delayed by environmental concerns in the court system. No other developments have been announced. However, it looks like the hardwood paper grade pulp market will be oversupplied by the end of this year when the massive OKI mill starts in Indonesia. Existing hardwood pulp mills will be looking to move up the food chain to viscose pulp, especially if there is an opportunity to substitute for high-cost Chinese cotton linter mills.

Forecasting dissolving pulp prices is always an adventure. In fact, just collecting reasonable historical price data in the hi-alpha sector is a challenge. Currently, viscose pulp prices are defying gravity, while hardwood paper grade pulp prices remain at low levels. (Refer to the paragraph on cotton linter pricing for a major reason why viscose pulp prices are relatively high.) Hi-alpha pulp prices, on the other hand, remain under downward pressure due to weak demand, partially as a result of the change in Chinese cigarette consumption, and partly due to continuing efforts by viscose pulp suppliers to penetrate the higher-priced acetate and ethers markets. Our in-depth analysis of the demand and supply sides of the viscose and hi-alpha sectors, along with cost estimates based on the mill-by-mill data generated by the RISI Cost Benchmarking Group, allows the best possible price forecasts for both viscose and hi-alpha pulps.

Rod Young is chief economic advisor, RISI, and the author of the World Dissolving Pulp Monitor. He can be reached at [email protected].

Paper 360

Paper 360