In the pulp and paper industry, there exists a hidden goldmine that many companies are unaware of: the emissions generated from waste wood and black liquor combustion. Beyond being environmentally responsible, these emissions can translate into lucrative opportunities for businesses. In this article, we’ll delve deeper into this topic, exploring not only how to monetize emissions, but also why it’s essential for the industry’s future.

AN OVERVIEW OF WASTE WOOD AND BLACK LIQUOR BURNING

Waste wood is a versatile resource encompassing various wood residues, including wood chips, bark, sawdust, and wood shavings. These materials are often generated during the papermaking process and can also be a byproduct of sawmills and logging operations.

Pulp and paper mills harness the energy potential of waste wood by using it as a biomass fuel source. The steam and electricity produced play pivotal roles in heating, drying, and machinery operations, reducing mills’ reliance on fossil fuels and minimizing their carbon footprint.

Black liquor, a byproduct of the kraft pulping process, is a potent mixture comprising lignin, hemicellulose, and spent cooking chemicals. Characterized by its high alkalinity and energy content, black liquor is a valuable resource. Mills reclaim energy from black liquor by burning it in a recovery boiler. The combustion process then generates high-pressure steam, which is used to drive turbines and produce electricity. The process also recovers cooking chemicals, allowing them to be reused in the pulping process. This helps make the kraft pulping process more efficient and sustainable.

MONETIZING YOUR EMISSIONS: A GREEN OPPORTUNITY

The emissions stemming from waste wood and black liquor combustion are often labeled as “green” emissions due to their environmentally friendly attributes. These emissions hold significant value, particularly for industries seeking to offset their carbon footprints, such as oil companies. As offset programs and emissions trading schemes gain traction worldwide, the demand for these emissions is on the rise. Taking a proactive approach to emissions monetization, pulp and paper companies can generate revenue and strengthen their market position while reducing their carbon footprint.

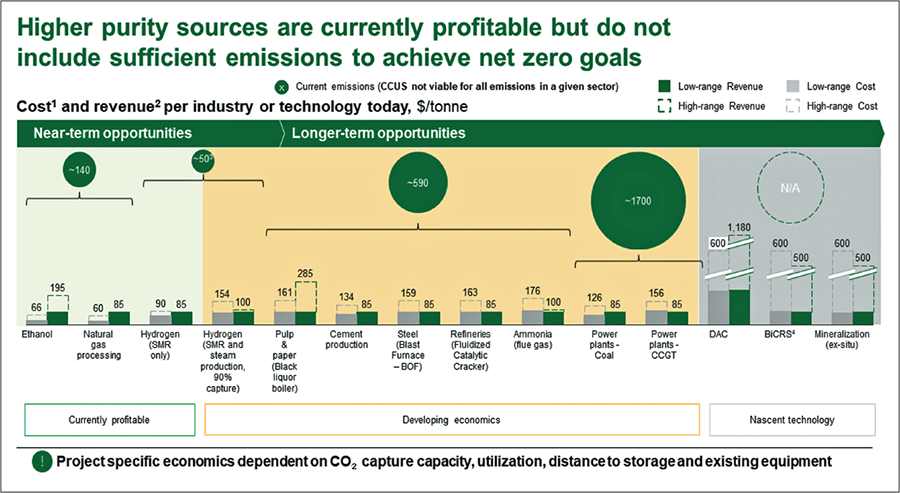

Pathways to Commercial Liftoff (liftoff.energy.gov) is a series of reports created by the US Department of Energy (DOE) to create a common fact base and a tool for ongoing dialogue with the private sector. The Liftoff report on Carbon Management illustrates the untapped financial potential that pulp and paper producers might be leaving on the table. Figure 1 shows the potential revenues and costs of different technologies that capture carbon, including pulp and paper black liquor boilers.

According to the DOE, “For longer-term opportunities (within) industries with lower-purity CO2 streams and distributed process emissions, project economics must improve to make widescale deployment likely in the absence of other drivers.”

We can expect to see a rise in carbon capture utilization and carbon dioxide removal projects through demonstration projects and increased policy support—either via regulation or incentives—or technology premiums for low-carbon products. When combined with continuous government support, these initiatives have the potential to generate consistent revenue streams as deployment experience reduces cost.

ENVIRONMENTAL BENEFITS: BEYOND PROFIT

Monetizing emissions isn’t just about the financial gains; it’s also about making a positive impact on the environment. By reducing greenhouse gas emissions and enhancing air quality, pulp and paper companies can contribute significantly to global sustainability goals. Emphasizing the dual benefits of profitability and environmental responsibility is crucial for the industry’s long-term viability.

Understanding the regulatory landscape related to emissions trading is essential. Regulations can vary by region and evolve over time, impacting the feasibility and profitability of emissions monetization initiatives. Staying informed about these regulations and actively engaging with regulatory bodies can help companies navigate this complex terrain effectively.

While emissions monetization offers immense potential, it’s not without challenges and risks. Market volatility, technological barriers, and regulatory compliance issues can pose obstacles. To mitigate these challenges, companies should adopt a proactive and adaptable approach, continuously monitoring industry developments and adjusting strategies accordingly.

EMERGING TRENDS: PAVING THE WAY FORWARD

The pulp and paper industry is evolving, with emerging trends shaping its future. These trends include the integration of circular economy practices, the exploration of alternative revenue streams (such as selling excess heat), and increased emphasis on sustainability-driven innovations. Understanding and embracing these trends can position companies for long-term success.

Emissions monetization isn’t limited by borders. Companies in different countries approach this opportunity differently, influenced by local regulations and market dynamics. Exploring international perspectives can provide valuable insights and opportunities for collaboration on a global scale.

METRICS AND MEASUREMENT: THE FOUNDATION OF SUCCESS

To succeed in emissions monetization, accurate measurement and reporting are crucial. Implementing robust metrics and measurement systems ensures transparency and credibility. Companies can explore tools and methodologies that enable them to track and manage emissions effectively, enhancing their overall sustainability efforts.

Pulp and paper producers have several opportunities when it comes to monetizing the emissions generated from burning waste wood and black liquor. These opportunities not only create additional revenue streams, but also contribute to the achievement of sustainability objectives. Some options that can be considered include:

- Renewable Energy Credits (RECs): Mills that generate excess electricity from burning waste wood and black liquor can feed it into the grid and become eligible to sell renewable energy credits. RECs can be sold to utilities or companies seeking to meet renewable energy goals or regulatory requirements.

- Investments in Carbon Capture and Storage (CCS): Pulp and paper producers can explore investments in carbon capture and storage technologies to capture CO2 emissions from their operations. These stored emissions can be sold as carbon credits or used for enhanced oil recovery in some cases. Governments and organizations may even provide incentives or subsidies for CCS projects.

HOW TO GET STARTED: A ROADMAP

Ready to embark on your emissions monetization journey? Here’s a roadmap to guide you:

- Assess your emissions: Begin by understanding the quantity and composition of emissions your company generates. A commodity intelligence platform can provide carbon and energy benchmarking data to help you assess your potential compared to other mills in the market.

- Engage stakeholders: Showcase your commitment to sustainability by engaging with stakeholders, including investors, customers, and the community. Transparency and collaboration can bolster your emissions monetization initiatives.

- Stay informed: Continuously monitor industry developments, regulatory changes, and emerging trends. Adapt your strategies to align with evolving opportunities and challenges.

It is essential for professionals in the pulp and paper industry to have a deep understanding of sustainability developments and to stay ahead of the curve. As the industry continues to evolve, new opportunities are constantly emerging, and it is crucial not to be left behind.

Paper 360

Paper 360