Founded in 1966 and headquartered in Porcari Italy, the Sofidel Group operates in 13 countries—Italy, Spain, United Kingdom, Ireland, France, Belgium, Germany, Sweden, Poland, Hungary, Greece, Romania, and the United States—with 6,900 employees, a production capacity of 1,440,000 tons, and group net sales of €2,801 million in 2022. Sofidel is at No. 39 on the latest TAPPI list of the Top 75 pulp and paper companies globally.

The group operates through four business lines: Consumer Brand and B-Brand, Private Label, Away-from-Home (AFH), and Parent Reels. Regina is its best-known brand, with a presence in most markets. Other brands include Sopalin, Le Trèfle, Hakle, Softis, Nalys, Cosynel, KittenSoft, Lycke, Nicky e Papernet.

T360°: Can you give a general update on the Sofidel Group as we have passed through the challenge of Covid-19 and are now getting back to “business as usual”? Any major challenges or opportunities you can talk about from a group perspective?

Lazzareschi: Even in a very complicated global environment, in recent years Sofidel has continued to grow and has been able to further the implementation of its sustainable development strategy. Covid-19, as well as the war in Ukraine, the energy crisis, the challenges of the green and digital transition, and the search for new geopolitical balances are problems of enormous scale. However, these challenges have only increased our taking of responsibility for positive economic, environmental, and social impacts.

During the pandemic, the tissue paper industry was considered essential in almost every country in the world and had to ensure safe working conditions and continuity of production in real time. This situation was made even more complicated by spikes in demand caused by the tendency of consumers to stockpile large quantities for fear of running out of products. Subsequently, the simultaneous recovery of all economic activities led to logistics chain bottlenecks, and the market struggled to regain its equilibrium, especially in the AFH sector, which was the most affected by the consequences of Covid-19. And when it was just starting to do so, the war in Ukraine and the energy crisis brought about highly unstable conditions once again. All these experiences have revealed to our sector at least two major truths: an awareness of the absolute centrality of our products in people’s daily lives; and the interdependence and delicacy of global balances. Today, under relatively more stable conditions, we are called upon to meet a growing demand for hygiene and to make every effort to implement transformative change.

NORTH AMERICA

How is the market in North America for Sofidel post Covid-19; what trends are most notable?

Increased interest in products related to hygiene has led us to work to increase production capacity and raise service levels even more for our customers. In the meantime, the increasing use of online shopping—confirmed even after the pandemic emergency—has led to e-commerce being a very, very important channel for us. Today, we are engaged with major market players and are continuing to invest to further strengthen our position. At the same time, strong inflationary pressure is leading US consumers to implement defensive buying strategies, with an increased focus on Private Label (PL) products. This also represents a marvelous opportunity for us. The PL is our main segment, where we offer high quality products at a competitive price.

In the AFH sector, however, the downturn experienced during the pandemic due to lockdowns and working from home has not yet fully recovered. In this channel, we thus focused primarily on finding new customers, and managed to significantly increase our volumes.

At the end of last year Sofidel had its 10th anniversary of North American operations. Can you comment on the overall success of the company’s entrance into the market there?

It has been 10 years of tremendous work and impressive growth. This beautiful page of our history was written together with excellent fellow travelers. We started in 2012 by acquiring a company active in three states. We then proceeded with other acquisitions and two greenfield investments—in Circleville (OH) and Inola (OK)—to build two large, integrated plants at the forefront of technology globally. Growth in production capacity and geographical coverage has resulted in us having manufacturing operations in six states and a corporate office in Horsham, PA, as well as major customers. This was also thanks to the fact that we could always count on the support of governments and other institutions, a business friendly environment, and skilled people with team spirit with whom we had the opportunity to work to build something important; something destined to grow further.

Can you tell us about any plans and ambitions you have in North America going forward?

In 2022, the US was once again confirmed as Sofidel’s top market by revenue (26.7 percent). And it is the one in which we expect to have the most room for growth. With this in mind and on the basis of increasing demand, we are working, also with the cooperation of state and local public entities, to significantly increase our production capacity at the plant in Circleville, Ohio. It is an operation designed to make it our leading plant in the world. For us, it is a good way to start our second American decade—to look to the future with confidence.

Any particular challenges you are facing in the US?

In addition to growing, we certainly want to make our sustainable approach to making high-performance more widely known, and further strengthen our relationships with local communities.

EUROPE

Can you comment on the market in Europe and any post Covid-19 trends you are noticing?

In Europe, where market growth rates are lower than in the United States, our last few years have been characterized mainly by investments in organic growth. We did this, for example, by doubling our production capacity first in Poland and then in Spain. However, when we believe there are interesting development opportunities, we are ready to seize them. That’s what happened a couple of months ago in Germany where, with the acquisition of the Hakle brand, one of the most beloved toilet paper brands in Germany produced since 1928; Hakle Feucht, moist toilet paper, a category we have not yet featured in our offerings; and Dick&Durstig and Servus in the household paper segment. With these brands we have significantly strengthened our position.

Could you give us an overview on some of the pioneering energy projects you have going on at your mills in Europe?

We are devoting enormous attention to the energy transition. Sofidel was the first company in the world’s tissue sector to join the international WWF Climate Savers program in 2008 to voluntarily reduce greenhouse gas emissions, and today, our 2030 targets are approved by Science Based Targets initiative (SBTi). Between 2018 and 2022, we reduced our direct atmospheric CO2 emissions (carbon intensity) by 15.7 percent, and we are implementing a multi-option strategy to increase the use of electricity from renewable sources.

We have signed 10-year supply agreements—PPAs, Power Purchase Agreements—with RWE Renewables in Italy, with ACCIONA Energía in Spain, and with RWE Renewables Europe & Australia and PPC Renewables in Greece. We are carrying forward the construction of a renewable gas production plant (syngas produced from wood biomass from the local supply chain) with Meva Energy at our Kisa production site in Sweden, which should be ready in the fall. Significant investments in biomass are underway in France. And, like many companies engaged in hard-to-abate sectors, we are following developments related to the use of hydrogen.

FOCUS ON THE ENVIRONMENT

Talk about environmental, social, and corporate governance (ESG) as a whole, and how important the reporting has become to the Sofidel Group as a whole?

For us, sustainability ratings are increasingly crucial. That is not only because the financial world demands them, but because companies that are truly committed to integrating sustainability into their development models need to be able to rely on credible and efficient reporting methods. This reporting enables them to document and share externally, in a timely and transparent manner, their effective capacity to manage ESG risks and produce positive impacts. It is a concrete way to combat greenwashing as well. In recent years, we have achieved positive results with Morningstar Sustainalitycs, EcoVadis, and CDP. It was precisely with CDP that we fell into the leadership bracket of the Supplier Engagement Rating Report 2022. The A rating we achieved gave us access to the leaderboard with the best companies in each sector. We will continue to invest in this area.

Any other environmental or social developments?

Yes. We—who see collaboration with suppliers as a key element in implementing our sustainability strategy and expanding positive environmental and socio-economic impacts—have recently initiated an important project with Suzano, one of the world leaders in the pulp sector. The project is named “Together We Plant the Future—Developing Biodiversity Corridors for a More Sustainable Future.” It is a three-year bioeconomy project that, through the application of regenerative forestry criteria, will help a number of local communities achieve economic self-sufficiency and support the ecological restoration and conservation of an area of the Brazilian Amazon region between the states of Marañhao and Pará. All of this will be accomplished with the support of IABS, the Brazilian Institute for Development and Sustainability, and Amazônia Onlus, an Italian nonprofit association active in defending the forest and the people of the Amazon.

LOOKING TO THE FUTURE

What do you see as the main challenges the tissue industry is facing as we look toward the future?

I’m certainly thinking about the energy transition, and particularly the short amount of time at our disposal. And about how, for an energy-intensive sector like ours, it is not easy to reconcile the short-term vision—the need for large energy supplies—with the indispensable goal of decarbonization. But I also think, as an entrepreneur and as a citizen of the world and a human being, about the need to be able to create more sustainable conditions in all areas of the planet; in the United States and Europe as well as in China and in what is called the global south. Much of our future passes through there. And we should all be aware of that.

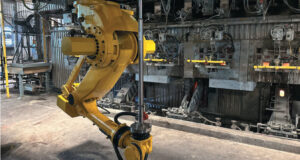

Any comments on the latest technology being offered to tissue producers, including alternative energy, digitalization, IIoT, process improvements?

In addition to the entire sphere of technological innovation related to energy resources, the impacts that the vast computing capacity now available through digital technologies makes available to our sector are significant. I am thinking, for example, about real-time measurement of many product variables, an extremely important strand of development that will enable new steps forward in terms of predictive logic, process diagnostics, and increased environmental standards. An optimization of production that allows an increasing amount of useful information to be tracked and made available to consumers as well. Thus, not only an efficient process, but also a more transparent one; a need increasingly felt by new generations who are not only digital, but also sustainable natives.

Paper 360

Paper 360