Thinking outside the box? There’s no reason: corrugated containers offer economy, performance, printability, sustainability, and a virtually endless array of purpose-built forms and functions. According to the Fiber Box Association, corrugated packaging and displays is a US$35.5 billion per year industry; in 2021, corrugated producers pushed out a record 416 billion square feet of material from more than 1,100 manufacturing facilities in the US alone. Within each of those facilities (and thousands more around the world), a staggering array of custom-built machinery must be purchased, maintained, and operated.

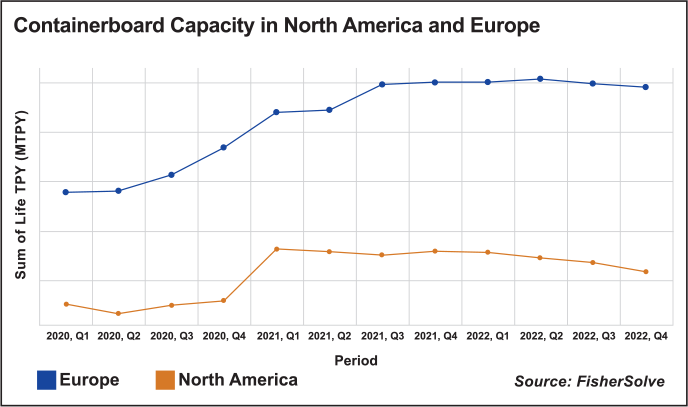

Containerboard is the most dynamic sector in the pulp and paper industry. It far outpaces any other sector in terms of tons produced and experienced a huge surge in demand during the COVID-19 pandemic. A variety of societal factors, including e-commerce and the circular economy, are expected to keep demand strong, despite a slight decline in recent capacity within Europe and North America (Fig. 1). The downtick can be partly attributed to the turbulent global economy and high fuel prices, say market specialists. As Fisher International comments in a recent article: “The economic uncertainty looming over our heads has led to a noticeable decrease in consumer spending, thus decreasing containerboard demand. The main question that comes with this is: how long will this last?”

Fig. 1: Containerboard capacity in North America and Europe. Despite this slight decline, containerboard output globally is still far ahead of any other sector in the pulp and paper industry (see “North American/European Containerboard Capacity Declines,” Paper360° May/Jun 2023 issue, pg. 38.)

With competing factors in play, it’s critical that corrugated manufacturers get the most out of their machinery investments. Maximizing efficiency and reducing bottlenecks are key to maintaining profitability—and will be the best ways for boxmakers to make sure they’re ready if demand surges again.

Paper360° reached out to members of TAPPI’s corrugated community (see sidebar) for their thoughts on how to get the most from existing capital equipment. Following is a “sneak peek” at their upcoming CorrExpo panel discussion.

Tim Connell of AG Stacker: “You can schedule quarterly or semi-annual visits from your vendor for a combination of maintenance audits and assistance, operator training, and process training.”

WHERE TO START

When it comes to buying, maintaining, or increasing the efficiency of capital equipment, our panelists suggest a couple of opening strategies. “Look for machine modularity,” says Tim Connell of AG Stacker. “Then add new machine components to add new capabilities. You can schedule quarterly or semi-annual visits from your vendor for a combination of maintenance audits and assistance, operator training, and process training.”

Sun Automation’s Rob Casella agrees that quarterly or semi-annual checks are a must. “Spend a day watching or have a knowledgeable and experienced employee watch your operator run the machine full time. Ask a lot of questions during running and setups. You will find that there are issues with your machine and/or peripherals that are causing them to run slower or have slower setups. Or you may find that there is a training deficiency,” Casella says. Identifying and correcting these deficiencies can eliminate bottlenecks and have a ripple effect through the plant.

It can be tempting to let an intensive operations review be a one-off effort—but you’ll risk losing momentum on the improvements. A better plan is to set up a predictive maintenance schedule and follow it with no exception. There are tools that can keep a plant on track. “Look into quarterly preventive maintenance contracts, as well as at IIoT platforms for machine monitoring,” says Casella.

Once a plant has begun the effort to identify opportunities for improvement, tackle the low hanging fruit. Can you eliminate labor in your material handling? Can targeted training help operators meet higher production goals? Make sure the plant has sufficient metering installed in critical areas; remember, “You cannot correct what you cannot measure,” says Connell.

According to panelist Ted Kulwicki of BW Papersystems, there are ways to maximize capabilities of certain board grades or high-volume orders. “Raising speed a few hundred feet per minute in key areas with additional heat or process changes, coupled with proper training and proper maintenance techniques, can add production to any corrugator,” he advises. “Adding additional pre-heat drums or steam showers can allow heavyweight papers to be run faster. Adding knife motors can add capacity at smaller cut lengths as well as raising the knife speed curve. There may be pockets of short sheet business that can be run at speeds 10 percent faster. These relatively low-dollar investments can pay high dividends.”

Adding a new high speed or high productivity machine has an impact on the plant’s total flow, so take that into account to avoid downstream disruptions. Casella advises, “Be sure to calculate how you expect to feed it and take away the board fast enough to be sure your investment can reach its full potential. Make certain that your crew has the skill set to maintain the new machinery and management is willing to invest the money to maintain the upgrades that will be needed on these new machines in the future.”

Ted Kulwicki, BW Papersystems: “Improvements within the plant often present opportunities for audits and improvements in other machines.”

TWO STRATEGIES—OR ONE?

Casella’s advice makes it clear that improving ROI isn’t a “project”—it’s a “process.” Getting value from an investment is an ongoing effort. Two of the best tools available to support that process are machine audits and preventive maintenance. For the best results, box plants should not consider these to be two separate strategies; an integrated approach will yield better results.

BW Papersystems’ Ted Kulwicki explains. “Data from a sound Preventative Maintenance (PM) program and production and waste indicators can determine audit cadence. OEMs understand typical time to failure or replacement, areas of concern, and typical lead time and installation timelines. In addition to regular process and product audits, situational audits can take advantage of planned downtime to evaluate machines and make necessary repairs and upgrades required to ensure compatibility with new equipment,” he says. “Improvements within the plant often present opportunities for audits and improvements in other machines. For example, a new Flexo Folder Gluer can prompt an audit of the corrugator to ensure the plant produces enough product to maximize the FFG investment.”

Plant managers should be mindful of how external factors can disrupt ongoing efforts. “Due primarily to the large labor shortage that occurred shortly after COVID set in, I know a lot of converting partners have had more turnover in skilled positions like head operators of converting machines,” says Spencer Bird of JB Machinery. “With that said, PM practices and overall equipment training falls by the wayside. We set up a machine audit and operator retraining when this occurs, or if we haven’t been in to service a plant facility in 2-3 years since an installation occurred.”

Casella suggests tracking machine speeds specific to order. “If the same order is speed-trending down, then it is probably an indication of wear. Quarterly maintenance contracts will usually catch this before it happens; make them part of your contract when buying equipment,” he says.

Other triggers can prompt a machine audit as well, says John Rastetter, Pamarco—for instance, print quality and color match. “Downtime caused by these two issues can contribute to significant productivity loss. This is a key sign that it’s time to audit the process and the anilox roll.

“Start with an anilox audit to determine the roll condition, looking for wear; plugging will give a good indication of what needs improvement,” says Rastetter. “If the roll is clean and shows more than 15 percent volume loss, consider replacement. If the roll is plugged, return it to operational condition by cleaning with a variety of approved processes. A thorough review should address why it plugged. Look at your daily, weekly, and monthly cleaning regiments; just as important, look at how the crew is controlling pH and viscosity, which are often the root cause of most printing issues and roll plugging.”

Once an audit is completed, plant managers must turn the findings into actual process improvements. Analyze the data to determine areas that need attention, then determine the ROI on any expected gains. An experienced technician can prioritize repairs or updates.

Rastetter notes that an OEM can be a resource here. “Your anilox supplier will be pleased to assist you in auditing your process for best practices when they visit to do an anilox audit. This process can provide valuable insight into not only the anilox, but your maintenance practices and ink management. The findings will be reviewed with plant management, and an operator training program will be developed. By educating your production crew on every shift, we can help drive productivity improvements.”

It can be difficult to determine whether it’s time to invest in new equipment or whether a simpler upgrade will be enough to achieve your plant’s goals. Casella agrees that an unbiased supplier taking a consultive role can be a huge help. “Keep in mind that a new machine will most likely require a new foundation and possibly even new peripherals, along with new training to operate the new machinery. Your skilled labor availability must support the new equipment.”

Plant managers must take many factors under consideration, including condition of the existing equipment, realistic production goals, timeline, and budget. “It’s an interesting puzzle,” says Kulwicki.

“We have programs in place to rebuild equipment, and with the current upgrade offerings we can upgrade some equipment to ‘Better Than Original’ condition. Improvements in registration, print quality, fold quality, and ease of setup are all possible,” he says. “Lead time for upgrades is shorter than that of a new machine, which allows a machine to get back to full capacity quickly or help to bridge the gap while waiting for new machine delivery.

“Also, the plant must have realistic expectations for the performance capabilities of an existing machine upon completion of upgrades and rebuild. Careful consideration must be used to pair the right machine with the expected future production and quality goals,” he concludes.

Connell says every evaluation should include people, processes, and technologies, then prioritize the causes of bottlenecks, to determine what to do. He offers a few questions to guide the effort:

- What processes can be improved in terms of productivity, quality, or safety?

- How good do you want to be?

- How fast do you want to go?

- Are you looking for new capability, or additional capacity?

- Have you weighed cost vs return + reliability?

VIRTUALLY LOOKING AHEAD

A review of recent “Tech Talks” at CorrWeek and SuperCorrExpo reveal a host of impactful new machine technologies introduced over the past few years. This year’s CorrExpo (see sidebar) will also feature new technologies, both on the exhibit floor and in the What’s New/Tech Talks pavilion. We asked our panelists what they were most excited about for boxmakers looking to maximize overall efficiencies.

Connell thinks digital capabilities show promise: “Touchscreen machine interfaces, fewer buttons, mobile apps, and web-based remote support for information and training resources,” he says. “Some of the most exciting digital products include Digital Twins, smart machines (networked for support and machine learning), Artificial Intelligence, and the use of augmented reality for training and testing.”

It’s interesting to note that all these technologies are designed to take the pressure off already beleaguered operators. “I think the most impactful new machine technologies that have made a strong impact in the market have been the technologies that allow a machine line to run with less manpower and overall automate certain aspects of the production run,” says Spencer Bird. “In our specific case, we have introduced a new inking system that completely takes pH, viscosity, and temperature control of ink out of the operators’ hands to free them up to do other aspects of the job without needing to worry about human error. We also have a new brush cleaner that eliminates the need to manually wash print plates. Overall, this type of tech saves a lot of time press side so operators can perform other duties. Suppliers and OEMs have made this type of automation a large focus over the last 5-10 years, both to eliminate human error and to reduce the need for more manpower press side.”

According to Casella, new tech may have taken a back seat during the pandemic, but it will continue to evolve. “Exciting may not mean profitable,” he says. “I think the most impactful new tech has been with material handling equipment. Plants have seen great increases in speed of some of the flexo-folder-gluers especially, but total cost of ownership (TCO) has also risen and can sometimes make the ROI not so favorable. Look at every new technology’s TCO—and make sure you do your homework.”

Meet Our Experts

The corrugated industry service professionals providing feedback for this article are:

- Spencer Bird, regional sales manager, Northeast & Midwest, JB Machinery

- Rob Casella, technical director, Sun Automation

- Tim Connell, director of sales, AG Stacker

- Ted Kulwicki, aftermarket sales leader, BW Papersystems

- John Rastetter, VP sales & marketing, Flexo Division, Pamarco

All will be participating in a panel discussion titled “Maximizing the Efficiency and Quality of Existing Capital Equipment” at CorrExpo, which will take place August 28-30 at the Huntington Convention Center in Cleveland, OH. The event features a full technical program and exhibit floor over two days of networking and knowledge-sharing. The panel is scheduled for Wednesday, Aug. 30, at 9 a.m.; it will be moderated by Dave Burgess, JB Machinery, and Will Whiteside, Absolute, will be an additional speaker.

Experience two keynotes, top-notch sessions, and the latest technologies—all under one roof. Special multi-tiered pricing offers excellent group rates for box plants. Register online at www.correxpo.org.

Paper 360

Paper 360