Earlier this year, the American Forest & Paper Association (AF&PA) released its preliminary 2021 data from US paper and paperboard mills. According to this report, total containerboard production in 2021 increased 5.6 percent compared to 2020 — the ninth increase in the past 10 years. Containerboard has demonstrated the highest rate of growth for any major paper grade over the last six years, and paper producers are making large investments to keep up with growing demand.

WHAT’S DRIVING NEW GROWTH?

Containerboard, which is made up of corrugated medium and linerboard (the papers used in producing boxes), experienced a major spike in demand as a result of increased e-commerce rates at the onset of the coronavirus pandemic. Online shopping surged in the first quarter of 2021 and, while that shift was largely compelled by government mandates, we have now seen a structural change take shape as consumers have become more accustomed to, and now even prefer, online shopping.

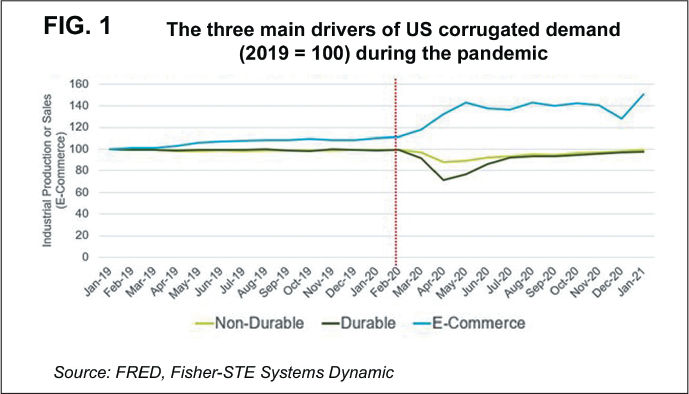

As a result, containerboard producers have responded to this market shift by ramping up capacity at an unprecedented rate, as these papers will subsequently be converted into corrugated board that will be used for shipping boxes. Of the three main drivers behind the demand of corrugated boxes in the US (non-durable goods, durable goods, and e-commerce), e-commerce was the primary driver of corrugated and containerboard demand in 2020.

As illustrated in Fig. 1, durable and non-durable goods (about 85 percent of demand) behaved as expected during the first economic shockwave in early 2020; however, e-commerce then accelerated and offset declines in other sectors.

Along with the increase in e-commerce rates, sustainability-related initiatives have gained momentum as importance is being placed on environmental, social, and corporate governance (ESG) issues at the corporate and global policy levels. Many companies are looking for ways they can reduce packaging waste throughout the supply chain to address the surge in e-commerce while still adhering to sustainability goals and initiatives.

“Paper products and materials like containerboard help to meet the needs of consumers seeking sustainable choices. These are some of the most recycled materials in the US — in fact, more paper by weight is recycled from municipal waste streams than plastic, glass, steel, and aluminum combined,” AF&PA President and CEO Heidi Brock stated. “Consumer demand is growing for sustainable paper products, and our industry is investing to meet evolving customer and consumer needs.”

According to AF&PA, paper recycling rates have consistently increased with each year: 2021, for example, exceeded 2009 rates by nearly 63 percent. As a result, and in alignment with the paper industry’s commitment to sustainability, the industry has completed or announced around US$5 billion in manufacturing infrastructure investments from 2019-2023 with the goal of maximizing recycled fiber usage in pulp and paper products. These investments will help increase the amount of recovered paper used by US paper and paperboard mills by approximately 8 million tons — a 25 percent increase over 2020 levels.

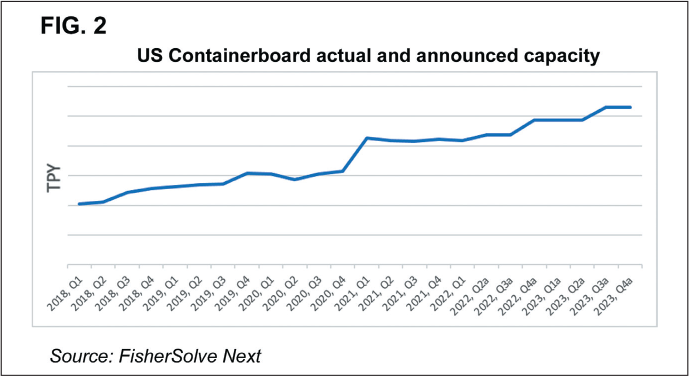

The evolving dynamic between the push for sustainability-related initiatives and the growth in demand for packaging and corrugated has created a huge opportunity for the containerboard sector. Figure 2 illustrates current and announced US containerboard capacity, which shows that capacity skyrocketed in early 2021 as producers tried to keep up with the surge in demand, adding more than 2,200,000 tpy of containerboard into the market.

For the remainder of 2021, capacity ebbed and flowed. However, US production is expected to reach even higher numbers in 2022 with more than 1,200,000 tpy of added capacity by the end of 2022 compared to the end of 2021 — reaching a total of nearly 43,000,000 tpy.

WHERE IS ALL OF THIS ADDITIONAL CAPACITY COMING FROM?

With production already at record levels, what will happen when all of this announced containerboard hits the market? Will there be an oversupply?

Since the pandemic created an immediate upswing in demand for more packaging, and as companies look to develop sustainable packaging solutions, we are beginning to see investments expand in the domestic corrugated sector as an attempt to keep up with containerboard production. So far, new box plant investments that have been announced include:

- WestRock in Longview, WA

- International Paper in Atglen, PA

- Kruger in Elizabethtown, KY

- Green Bay Packaging in Fort Worth, TX

- Georgia Pacific in Centralia, WA

- Pratt in Henderson, KY

These investments are just a few examples of the numerous companies responding to the booming demand the containerboard sector has experienced, and is expected to continue experiencing, for the foreseeable future.

WHAT ADDITIONAL IMPACTS HAS NEW DEMAND CREATED?

While the increase in demand for containerboard has created new opportunities for containerboard producers, it has also contributed to price increases. The industry has seen an increase in prices for raw material fiber, particularly recovered fiber sources. Figure 3 illustrates the different types of raw material fiber used to produce containerboard and the price change each has experienced since the fourth quarter of 2020.

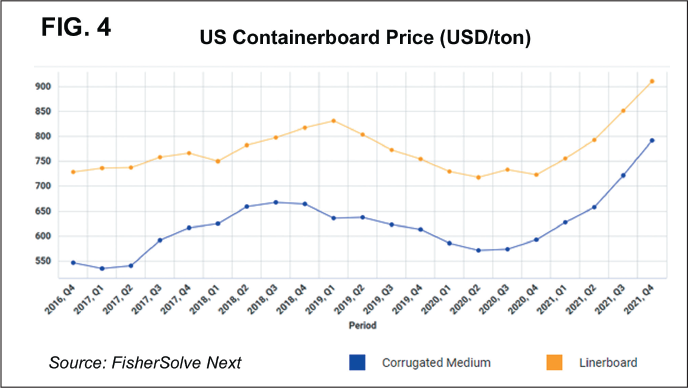

The increased price of raw material fiber, in combination with high containerboard demand, has driven containerboard prices even higher. In Fig. 4, we can see the trend of trade-derived domestic prices for corrugated medium and linerboard. Over the course of 2021, prices for both products rose steadily, reaching US$910/ton for linerboard and US$791/ton for corrugated medium — a 26 percent and 32 percent increase, respectively, compared to fourth quarter of 2020.

After analyzing these trends and thinking forward, participants in the containerboard and corrugated sector need to remain mindful of a few important questions:

- Is this a sector worth investing in right now?

- How will the price of OCC change going forward?

- Will the continued rise in recycled fiber cause producers to use more virgin fiber and what impact would that scenario have on all fiber prices?

- Will the price of containerboard continue to rise?

- What impact will the heightened awareness around sustainability have on recycling?

Paper 360

Paper 360