Tissue360º took the opportunity to interview Esko Uutela about the COVID-19 impacts on global tissue demand as well as ongoing challenges the industry is facing going forward.

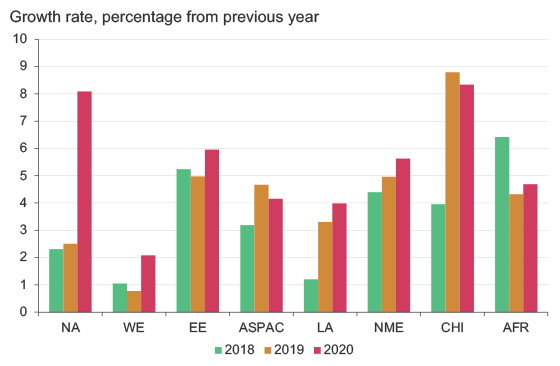

There was quite a dramatic increase in demand for tissue that obviously came as the pandemic struck. Uutela says that the sudden increase was due to pandemic panic buying, meaning there is a lot of overbought stock still hanging around resulting in demand going back down for 2021 numbers. “In North America we saw the demand shoot up to an unprecedented 8 percent, so we are expecting a drop down by 6 percent in the 2021 numbers as we come back to normal.

“However, we will still see a 2 percent gain as we come back to the same previous trend line.”

Uutela is optimistic that Europe and Asia will replicate the numbers in the US; however, in not so dramatic fashion. “Europe will show a minus by the end of the year, same as Japan, but then continue to grow, whilst China and the rest of Asia will carry on its growth trend. But it looks like demand growth as a whole will resume to its former strength,” he adds.

THE COVID EFFECT

According to Uutela, at the outset of the pandemic hoarding of tissue products happened in different regions, but North America, Europe and Australia were hit the hardest as capacities were already in high use. In China, overcapacity allowed production to increase, despite many mills being out of action for six to eight weeks or even longer.

- The COVID-19 pandemic in 2020 had the most striking impact on North American tissue market with growth accelerating up to 8%.

- Asia Pacific market has shown good growth recently despite the rather stable Japanese market.

- Most markets reacted to the pandemic positively, but India’s AfH-oriented business suffered badly.

Uutela says, “What this tells us is that tissue really is one of the daily necessities needed in a modern society, and during the coronavirus pandemic this has become very clear. It was a shock to see that even violence erupted, with customers fighting for the last pack of toilet paper, and there were tissue trucks being hijacked in Hong Kong and Germany.

“The second wave of infections in autumn 2020 increased hoarding again, but tissue mills were better prepared for deliveries and so only some top brands were temporarily in short supply.”

In 2020, the COVID-19 pandemic had the most striking impact on the North American market, and most markets reacted to the pandemic positively.

In terms of grades, Uutela says in the short term the impact is definitely positive for the consumer tissue business, but negative for the AfH business. US shipments for consumer tissue rose by 16.3 percent in 2020, while AfH shipments started to contract in April and ended with a decline of 8.5 percent for the year. The trend in Europe was similar, but weaker than in the US, particularly in the consumer tissue business. In China, the effect of the pandemic was rather short and the tissue business normalized after only a few months.

Uutela says of the AfH business: “2020 was a bad year due to many reasons. Travel and hotel stays were drastically reduced, more people were (and still are) working from home, and 10-20 percent of eating establishments may not reopen because of liquidity issues. Consumer tissue reached higher-than-average growth rates in most regions.”

According to Uutela, the numbers from 2021 are showing that some regions will see stagnation or weaker growth in tissue consumption than in the exceptional year of 2020. In the longer term, there are some positive factors helping tissue consumption.

“It is likely that people will continue to be concerned with hygiene issues, such as hand washing, which then requires drying,” says Uutela. “And many washrooms have reportedly turned off air hand dryers because they have been found to be virus slings. This is a positive for paper toweling, at least in North America, Europe and Japan, and probably also in other regions.

“AfH products such as folded hand towels are also being found in households for hand drying, reducing the use of cloth towels—a novelty. The general awareness of the importance of good hygiene for protecting health is expected to have positive effects for tissue, and the number of tissue users will likely grow in additional Asian and African countries with no tradition in tissue use.”

INDUSTRY FACING MANY CHALLENGES

After the massive increase in demand in 2020 comes the hangover in 2021, where demand was much less, and then back to normal growth. However, there are some serious problems the industry is dealing with currently. Uutela says, “Tissue producers have a number of challenges at the moment. There are logistics issues due to a lack of containers and increasing freight rates, fluctuating pulp prices that have been very high putting a dent in profitability—although they are on the way down now—and the increase in energy prices.

“In principle the tissue industry and markets are doing well; there will be less growth initially, but this year we will see the industry return to normal growth. However, the challenges coming from outside of the industry will remain.”

Paper 360

Paper 360