Solenis Growth Addresses Industry Trends

TED KELLY

It’s been five years since global specialty chemical company Solenis spun off from Ashland. Since then, the company has followed an aggressive growth strategy that relied heavily on merger and acquisition activity, completing nine deals to add geographic reach, new technology platforms, and additional product line offerings.

In January, 2019, the company successfully joined forces with BASF’s paper and water chemicals business. Today, Solenis continues to focus on growth by developing value-added chemicals, process solutions, and monitoring and control systems for water-intensive industries. The goal, according to Solenis President and CEO John Panichella, is to substantially change the landscape for customers in industries such as pulp and paper manufacturing, biorefining, chemical processing, mining, oil and gas, and power generation.

“We’ve used these acquisitions to achieve two important objectives,” Panichella says. “The first is to establish a geographic presence to supply the market directly. The second is to improve our technical portfolio in the key vertical markets we serve. If we can’t acquire the technology to help us grow, we rely on our specialized R&D teams to develop it.”

Although its acquisitions have been getting the most attention, Solenis has continued an equally aggressive campaign of plant expansions and new product development in key growth areas, including:

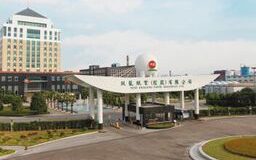

• Adding its ninth manufacturing plant in the Asia Pacific region (in Zhuhai City, Guandgdong Province, China) to make functional, water, and process chemistries.

• Opening a new technology center in Paulínia, São Paulo, Brazil, to better serve Latin America.

• Doubling polyacrylamide production capacity at its plant in Perm, Russia, and adding new production lines for sizing and defoamer products.

An important metric, Panichella notes, is that 25 percent of Solenis sales come from products that are less than five years old. “That keeps our R&D teams focused on identifying key trends and customer challenges emerging in industries around the world,” he says.

KEY GLOBAL TRENDS SHAPING

THE PAPER INDUSTRY

Sustainable alternatives: One area of global focus is in developing environmentally friendly packaging. “The paper industry has been elevating its focus on sustainability concerns for more than a decade,” says Andreas Tuerk, Solenis president, paper and water, Eurasia. “They look to suppliers like Solenis to help them reduce consumption of natural resources and energy and develop environmentally friendly packaging that is recyclable and repulpable.”

To address this need, Solenis offers TopScreen fully recyclable and compostable barrier coatings technology (see sidebar, Creating Environmentally Friendly Packaging). Derived from sustainably produced vegetable oils, TopScreen can replace paraffin and polyethylene coatings—substances that present challenges in recycling—used in candy twists, beverage cups, breakfast-food wraps, bread bags, and other packaging elements.

Increased demand for packaging materials: Similarly, as global e-commerce continues to flourish, the market for corrugated and paperboard boxes is growing rapidly, according to a study by the Fredonia Group1 reported at SuppyChain24/72. As a result, there is a universal desire to develop packaging strong enough to withstand the rigors of shipping, but as light as possible to save on shipping costs.

Achieving sheet strength efficiently and profitably has long been a quest of paper-based packaging producers. For many years, mills were able to meet strength requirements using tried-and-true tools like fiber selection, refining, sheet formation, and wet pressing. However, certain trends make this a difficult proposition, including increasing recycled content, a drop in old corrugated container (OCC) quality, increasing water system closure, and reducing packaging weights or volumes.

Single-component strength additives have been challenged to deliver the necessary performance to respond to these trends. Having joined forces with BASF, Solenis provides a robust portfolio of retention drainage fixations and strength solutions. For example, using a novel approach combining best-in-class chemistry with state-of-the-art process control analytics, Solenis has developed Fusion strength and performance technology, which gives paper and board manufacturers more flexibility in developing new grades to address market trends.

New innovations to provide competitive advantages: Solenis has always been known as an innovator, with breakthroughs that impact both papermaking processes and end products. Examples include:

• The imPress ID line of paper additives, which improves the runnability and performance of HP Indigo Digital Presses, generating print adhesion as much as eight times more effectively than common products on the market.

• Tapestry Yankee Coatings Solutions that help tissue makers meet increasing demands for softer, stronger, and more absorbent processes, thereby improving manufacturing performance and controlling operational costs.

• MicroSol advanced retention and drainage solutions that help graphic and specialty papers manufacturers improve colloidal retention, drainage, and dewatering, also optimizing starch use and formation.

In addition, following the BASF deal, Solenis now offers a full range of colorant products designed to provide a wide spectrum of colors, enhancing an extensive variety of paper, tissue, and board grades. Products include:

• Liquid and powder direct dyes that resist fading, bleeding, and chemicals

• Pigments specially manufactured for use in high light-fastness printing papers

• Basic dye range used for tinting newsprint and wood-containing papers

Finally, in the face of rapidly rising silicone prices, Solenis has developed high-efficiency silicone defoamers that deliver advanced knock-down and drainage characteristics to meet customer performance expectations while also controlling program costs.

KEY GLOBAL TRENDS SHAPING

THE INDUSTRIAL WATER MARKET

More demand for water reuse, water quality, and regulatory compliance: Water quality, water scarcity, and regulatory compliance are main concerns in nearly every market Solenis serves. “Reduction of water use is an important issue for heavy industries around the world, as companies work to meet their sustainability initiatives and address government regulation of this precious resource,” says Ed Connors, Solenis president, paper and water, Americas.

Connors believes those trends will continue as companies assess the overall impact of their water usage, from social and environmental perspectives to compliance and scarcity considerations. China, for instance, recently imposed more restrictions on air and water pollution, going so far as to close non-compliant plants.

“We have decades of experience helping customers with both water treatment and water conservation challenges,” Connors says. “We are uniquely equipped as a technology and service provider to help customers tackle these issues.”

Greater demand for PAM: The market for polyacrylamide (PAM) in water treatment has also tightened due to increased demand. With the complement of BASF’s paper and water chemicals business, Solenis is a strong No. 2 player in this market, well-positioned to secure the supply of PAM for its customers. In addition, Solenis offers a full complement of PAM products, including cationics used in paper, industrial and municipal wastewater applications, as well as anionic and nonionic polymers used in mining, oil and gas, and other applications.

Profitability and productivity: Because water is used as a heat transfer fluid in many industries, the presence of scaling and impurities in heating and cooling water is another important issue everywhere, from paper to chemical processing. Solenis’s state-of-the-art OnGuard i controller with Leak Alert not only helps control corrosion rates and minimize scale, it also provides early warning of potential equipment malfunction, enabling rapid response and corrective action.

KEY GLOBAL TRENDS SHAPING BOTH THE PAPER AND INDUSTRIAL WATER MARKETS

Loss of expertise from a retiring workforce: Across the industry, as experienced workers retire, more companies are relying on outside resources for support. With decades of experience, Solenis can help customers solve highly complex customer challenges quickly and precisely.

“We have thousands of passionate professionals who work together across 120 countries and five continents to deliver innovative and cost-effective solutions,” Panichella says. “The addition of BASF enhanced those capabilities, giving our customers access to an unmatched level of expertise and product selection.”

Increased demand for digital solutions: In a related issue, companies in all industries are also seeking digital solutions to help address productivity concerns, especially in monitoring their manufacturing systems.

“About 20 years ago, we recognized a need to support customers with application-specific monitoring and control technologies that allowed them to see how their water systems were performing on a daily or even hourly basis,” notes Panichella. “That’s why we developed the OnGuard technology.”

The OnGuard performance-based monitoring and controls system is recognized for its ability to enable real-time measurement of key performance indicators. About two years ago, the company added the ClearPoint biofilm detection and control program for industrial cooling and influent water. This system uses the OnGuard 3B analyzer, combined with advanced chemical treatment and Solenis’s applications expertise.

In addition, Solenis recently launched OPTIX applied intelligence that combines real-time predictive analytics and machine learning to create tailored models and process insights that help customers optimize their production processes. In one example, a North American paperboard producer used OPTIX to reduce its wet strength chemistry costs by approximately 20 percent.

“These new solutions have raised customer expectations,” Panichella says. “No one wants to wait until a scheduled operation or shutdown to measure what is occurring with their water systems.”

1 Fredonia Group 2 Supply Chain 24/7.

Ted Kelly is vice president, Asia Pacific, for Solenis; reach him at [email protected].

Creating Environmentally Friendly Packaging

As countries and municipalities take aim at the mountains of waste from discarded packaging materials, Solenis has created a family of barrier coatings that can be used to create environmentally friendly packaging.

In fact, the company was one of 12 winners in the NextGen Cup Challenge, a global innovation competition backed by giants of the food-service industry to redesign a widely recyclable and/or compostable-fiber hot and cold to-go cup. The challenge attracted nearly 500 entries from more than 50 countries.

Solenis received the award in the Innovative Cup Liners category for its TopScreen recyclable and compostable barrier coatings. Using this technology, paper/paperboard manufacturers and converters can produce paper and board that is repulpable, recyclable, and compostable.

The Solenis barrier coating solutions are water-based biopolymers and bio-waxes derived from renewable resources. That means papermakers can satisfy consumer demand and produce more environmentally friendly cups and food packaging.

The new formulations can be adapted to accommodate a number of additional requirements, including printability, flexibility or elasticity, and glueability. They can also be applied on paper machine coaters or off-machine coaters, or during converting on wax applicators or corrugators.

Solenis barrier coatings earned the company recognition in the NextGen Cup Challenge.