Are North American Kraft Pulp Mills at Risk?

CATHY GREENLEAF

The first recovery boiler for kraft application was invented by Tomlinson in the early 1930s. While the average life expectancy of a boiler is 40 years with a rebuild frequency of every 15 years, 57 percent of the recovery boilers currently operating on a global basis are operating beyond the anticipated life (Fig.1).

A recovery boiler is an integral component in the successful operation of kraft (and, to a lesser degree, sulfite) pulp mills. As the name implies, the chemicals for white liquor are recovered and reformed from black liquor, which contains lignin from previously processed wood. The black liquor is burned, generating heat that is usually used in the process or in making electricity, much as in a conventional steam power plant.

North America does have some of the oldest recovery boilers (52 percent of North American recovery boilers were built in or before 1978) when compared with other papermaking regions, and it also has the highest total steam capacity and rate in its recovery boilers (rate = kg or lbs/day of black liquor solids). One of the reasons for this is the aging of recovery boilers (Fig. 2).

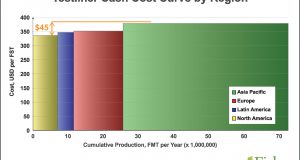

North America has gradually lost its stronghold versus other regions in kraft pulp production, declining by 6 million tons (9 percent) since 2007 (Fig. 3).

HEART OR HEEL?

As mentioned, the recovery boiler is the heart of the kraft pulp process, but it can also be the Achilles heel of the kraft pulp mill when it fails—resulting in unplanned downtime or catastrophic failure. Yet, in 2017 alone, three mills reported failure of their recovery boilers in North America.

While North America doesn’t have exclusivity in issues with recovery boilers, this region of the world does have some of the oldest recovery boilers when compared with other papermaking regions and has the highest total steam capacity and rate in its recovery boilers, as we’ve seen in Figure 2. So, what risks are these mills taking by not investing in the “heart” of their pulp mill?

If a recovery boiler fails, either catastrophically or with an unplanned down for repairs, the mill must curtail production. The duration this downtime can extend for up to 12 months if the boiler requires replacement, and the cost associated with replacement of the boiler on its existing footprint can be well upwards of US$50 million.

TWO EXAMPLES

Let’s look at two kraft mills in North America that have boilers well over 50 years old.

• Mill A produces a little over 100,000 ADST of pulp per year and the recovery boiler is 65+ years old.

• Mill B produces over 500,000 ADST of pulp per year and its average recovery boiler age is 56 years.

Both mills produce some printing & writing (P&W) grades, which have been in continual decline for demand, making it less likely for capital reinvestment. These mills are pulp self-sufficient, providing softwood kraft pulp at a cost (as of 2017 Q4) of US$470 and US$477, respectively, to their paper machines. As we saw with the Lincoln mill in 2013-2014, the mills could continue operation by purchasing pulp; but at what impact to their cost competitiveness and for how long?

Mills producing P&W grades that are at least partially pulp self-sufficient have a clear cost advantage over those that purchase all of their pulp, as shown in Figure 4.

Figure 5 reflects the cost impact to these mills in a scenario where they were forced to purchase softwood pulp to continue operation of their paper machines. In both cases, the increase in manufacturing cash cost per ton of paper on the machine moves the mills from 1st quartile cost to 3rd quartile positions.

Assuming the worst-case scenario—with each mill replacing the recovery boiler and purchasing softwood pulp for 12 months—Mill A’s incremental cost would be US$35.4 million and Mill B would spend an additional US$29.4 million. In addition to the incremental cost associated with purchasing pulp to feed the machine(s), there would be an increased cost of energy where a mill lost a recovery boiler.

Why would a mill spend approximately US$30 million in pulp purchases and lose the benefit of internal energy generation rather than make a proactive capital investment of US$50+ million? In some situations, such as a declining market, the mill may de-rate a boiler when major maintenance or rebuild is required. If the financials justify it, they will run the boiler at a lower pressure, hence delaying any capital expense. Even in a de-rated situation, mills will still need to maintain the boilers by repairing leaks and replacing tubes. Ultimately, the insurance company for the mill makes the final decision on whether de-rating a boiler is acceptable and, if so, for how long.

“Failure” in a recovery boiler can range from tube leaks to the most catastrophic: smelt explosion. While accidents do happen and great strides have been made to improve the safety of recovery boiler operation and maintenance, once a boiler is far beyond its predicted life the mill is operating on borrowed time and is doing so based on a well-informed decision.

FOOD FOR THOUGHT

• Where are the recovery boilers that would not be economic to repair or replace if they needed significant capital? What would their loss do to the mills they are in? What alternatives do those mills and their companies have?

• If (when?) the 10 oldest recovery boilers fail, North America would lose another 4 percent of its kraft pulp production. How much capacity in each grade of paper will be lost? How will that affect those paper markets?

• If recovery boilers are the scarce resource in the paper industry, where are there viable boilers serving paper machines that will eventually need to close from lack of demand? What other grades could those boilers be made to serve?

We look forward to thinking with you about issues like these.

Cathy Greenleaf is director of business intelligence at Fisher International, Inc., which provides insights, intelligence, benchmarking, and modeling across myriad scenarios. By arming companies with the knowledge that will help them gain a better understanding of their strengths and help identify weaknesses, Fisher is helping businesses stave off challenges and better position themselves for long-term growth. Greenleaf can be reached at cgreenleaf@fisheri.com.