MARK RUSHTON

Decades ago, graphic paper was a powerhouse, with global demand growth consistently outpacing growth in GDP. Clearly, things have changed. Paper360° Senior Editor Mark Rushton spoke with RISI’s John Maine, an industry-recognized expert for global printing and writing paper markets, to learn about what the future may hold for graphic paper.

RUSHTON: Can you give us a brief history of what has happened to supply and demand in the graphic paper industry over the last 10-15 years?

MAINE: Seventeen years ago marked the advent of the first secular decline in any graphic paper product. The product was newsprint in the North American market, and it broke away from its traditional drivers of GDP—retail spending and ad spending—and started marching to a new tune of market share losses to electronic media. One year later, the secular decline spread to the North American uncoated freesheet market as the long-predicted impact of electronics in the office finally took its toll. It would take another eight years before other markets, such as coated paper and uncoated mechanical, finally succumbed to print media collapse.

MAINE: Seventeen years ago marked the advent of the first secular decline in any graphic paper product. The product was newsprint in the North American market, and it broke away from its traditional drivers of GDP—retail spending and ad spending—and started marching to a new tune of market share losses to electronic media. One year later, the secular decline spread to the North American uncoated freesheet market as the long-predicted impact of electronics in the office finally took its toll. It would take another eight years before other markets, such as coated paper and uncoated mechanical, finally succumbed to print media collapse.

The industry initially refused to believe that the market was in secular decline. It had been through several recessions in the past, and the market had always bounced back. Thus, instead of permanently shuttering capacity to balance the market, many mills took downtime and awaited the recovery. But it never came.

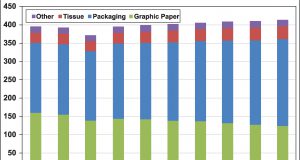

The recession of 2001 ended up being the spark that ignited the secular decline in newsprint and uncoated freesheet papers. The recession of 2008-09 in turn marked the turning point for the rest of the industry (Fig. 1). The lack of permanent shuts led to chronic oversupply, and it wasn’t until 2003-05 that several large producers started taking major permanent closures and even started a practice of pre-emptive shuts to balance a market in permanent decline before operating rates and prices collapsed.

What is the outlook for printing and writing grades on a regional basis?

The malaise has spread like a plague to the rest of the world. Western Europe followed the trends in North America about five years later and the developing Asian market reached what we believe was the start of a long-term secular decline in 2014. The explosive growth of China ended, and although its GDP continue to jump 6 percent per year, its newsprint demand peaked in 2009 and printing and writing demand peaked in 2013.

There are now few places around the globe where graphic paper demand is growing (Middle East, Africa) and they are far outweighed by secular decline in the rest of the world. Global graphic paper demand is now in permanent decline and has been for the past several years.

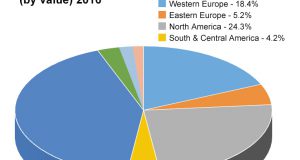

Going forward we can expect graphic paper demand to decline in almost all regions of the globe (Fig. 2). Rates of decline will be abating in the developed regions of North America and Western Europe, as these markets have  already seen the big hit from initial adoption of new technologies. Other developing regions will not see the big declines that initially hit North America and Western Europe because they never really saw print media develop to the extent that it did in the western world. At some point, we believe that a sustainable level of demand will be reached and the secular decline will end, but at this point, it is probably 10 years or more into the future.

already seen the big hit from initial adoption of new technologies. Other developing regions will not see the big declines that initially hit North America and Western Europe because they never really saw print media develop to the extent that it did in the western world. At some point, we believe that a sustainable level of demand will be reached and the secular decline will end, but at this point, it is probably 10 years or more into the future.

What have been the major factors instrumental in the decline—is it just electronic media, or are there other factors at work?

Electronic media is the biggie, but we can also blame electronic transactions, storage, and e-mail for a host of market declines. Cultural and demographic trends also bear some culpability.

Have high quality coated woodfree papers suffered the same fate?

All grades of graphic paper have suffered. Think about all those high gloss annual reports, for example, that are now a tiny fraction of what they used to be. Also, the media industries (magazines, catalogs, etc.) have been struggling financially and have in some cases switched to cheaper grades of paper to save money. This reversed a long-standing trend toward higher gloss, higher brightness papers. There have been some offsetting factors such as the better performance of high-end catalogs and magazines, as well as the growth of digital small volume printing. But in the end, high quality coated papers have suffered long-term secular decline as well.

When it comes to high quality graphic papers, some producers are noticing a bottoming out of decline and some are even noticing a small increase in demand. Can you comment on this? Will there always be a home for high quality papers?

High quality printing papers are declining and will continue to do so, though maybe at slower rates than the rest of the market. Specialties are growing, but these are mostly packaging specialties. This is why we are seeing so many conversions and interest in specialty papers and packaging.

What do you think the industry needs to do going forward to manage the supply and demand balance when it comes to graphic paper production?

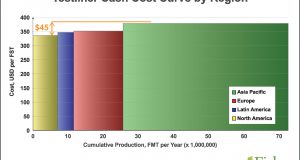

We have already shut most of the old, high cost, outdated mills. We are now seeing more emphasis on conversions to other products such as pulp, packaging, and even tissue.

The industry will also continue to battle imports as a means of balancing the market, but these battles will have marginal success at best as long as the real culprit driving up the imports, the strong dollar, remains unchecked.

Can you sum up your experiences with the graphics paper industry in your time as forecasting expert over the past decades? What do you feel the long-term future holds?

When I first started as an economist in the paper industry 40 years ago, graphic paper demand growth was consistently outpacing the growth in GDP, as it was a developing and rapidly expanding industry. We started looking into things like electronic media and plastics and made some predictions that these developments would slow the growth in graphic papers and the ubiquitous paper grocery bag. The criticism came that newspapers never collapsed as predicted due to the growth of television, and would live through any further electronic developments. Similarly, some believed that plastic bags were useless because they couldn’t stand up by themselves and slid down over the groceries when you tried to carry them in your arms.

There is some hope, since paper bags are making a bit of a comeback in some places. Maybe graphic papers will reach that point over the next 10 or 15 years, but this analyst will be long retired by the time that happens!

Meet

Meet

John Maine

John Maine is a co-founder and vice president of graphic paper at RISI. With more than 38 years in the graphic paper industry, Maine has developed RISI’s approach to graphic paper analysis and forecasting and is an industry-recognized expert for global printing and writing paper markets, prices, analysis, and forecasts. His published reports include the monthly Paper Trader, World Coated Paper Supply: A risk assessment of capacity closures; World Graphic Paper Forecast; World Graphic Paper Capacity; and North American Graphic Paper Forecast. Fig. 1

Fig. 2

Paper 360

Paper 360