Disruptions in the Pulp and Paper Industry—and Their Impacts

RESOURCEWISE

The pulp and paper industry has long faced disruptions, and 2024 has been no exception.

So far, the industry has been notably shaped by a series of events. When it comes to navigating these events, staying informed is key for professionals in the pulp and paper sector. By staying abreast of these disruptions, companies can effectively plan for the future. Here, we outline some of the significant disruptions that have shaped the pulp and paper industry in 2024 so far.

SHIPPING DELAYS IN THE SUEZ CANAL

At the very beginning of the year, companies faced chaotic supply chains due to the attacks on ships in the Red Sea. By the end of December 2023, major freight companies like MSC, the largest container shipping line globally, had made a critical decision to avoid the Suez Canal due to the increasing attacks on commercial vessels in the Red Sea by Houthi militants in Yemen.

These assaults, occurring on a crucial East-West trade route, have prompted a significant change in shipping routes. Instead of taking the shorter route through the Suez Canal, more than 100 container ships were rerouted around southern Africa. This diversion added approximately 6,000 nautical miles to the typical journey from Asia to Europe, resulting in potential delivery delays of three to four weeks.

Due to the occurrences in the Suez Canal causing ships to take longer routes to reach Asia, exporters experienced notable consequences. Take, for example, the transportation of pulp from Rotterdam to Asia. This extended journey will result in an estimated additional 10-11 days of travel time. Not only that, but the rising cost of containers led to a significant 30 percent increase in expenses.

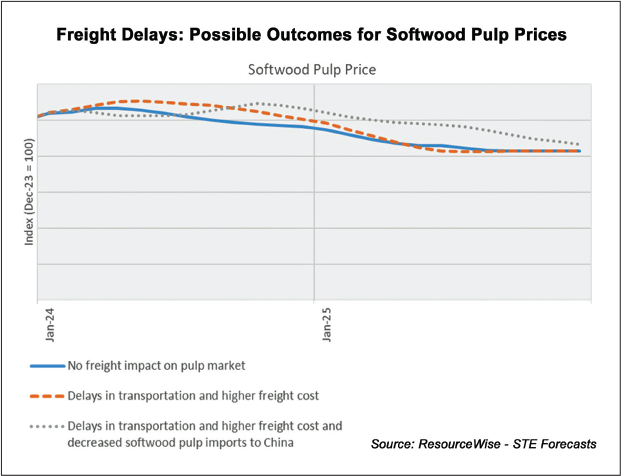

Using ResourceWise’s databases to test what would happen in the softwood pulp market, we can draw a few conclusions (Fig. 1). We can see that if transportation times for pulp shipments increase, this will postpone the next turning point of softwood prices in China, which will lead to higher pulp prices. Increases will first occur in China, with Europe following shortly after. Increased freight costs will, however, erode at least some of the price gain.

In addition to increased costs, softwood import volume from Europe to China will decrease due to the increased freight rate. This increases not only pulp floor prices in China, but also tightens the softwood supply and demand balance if no compensating imports are found.

LABOR STRIKES IN FINLAND

The pulp and paper industry experienced further disruptions when labor unions in Finland initiated a two-week strike on March 11 that posed significant impacts on the nation’s export and import sectors. This specifically impacted the freight and rail transportation sector. With a considerable portion of industries relying on rail transport for their raw materials, intermediary products, and final goods, the effects of this strike were felt swiftly.

However, this wasn’t the first strike Finland’s industry experienced this year. The Finnish paper workers’ union (Paperiliitto) and the industrial union (Teollisuusliitto) joined the political strike initiated by the umbrella organization of Finnish trade unions, Suomen Ammattiliittojen Keskusjärjestö (SAK). The strikes against the government’s planned labor market reforms in Finland began on February 1 and ended on February 3. These strikes affected numerous companies in the paper and forest products sector.

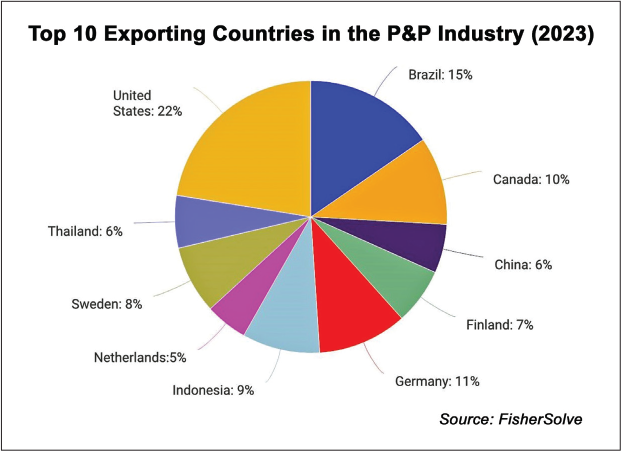

As we can see in Fig. 2, Finland is one of the top 10 exporting countries in the pulp and paper industry. This means the sector is vulnerable to disruptions caused by strikes. These earlier strikes and any potential future strike actions pose a significant challenge for businesses and the overall stability of Finland’s economy.

For example, UPM and Metsa Group were forced to close some of their mills due to the strike. UPM shut down operations at four of its mills: Kouvola, Rauma, Jämsänkoski, and the Kaukas pulp mill in Lappeenranta. Metsä Fibre announced temporary shutdowns affecting its Kaskinen and Joutseno pulp mills.

When strikes occur, questions for professionals in the pulp, paper, and forest products industries to ask include:

- What grades will be most impacted?

- What extent of production capacity loss will be experienced?

- What implications will this have on trading partners?

- What strategies can be implemented to mitigate additional losses?

METSÄ GROUP’S KEMI BIOPRODUCT MILL EXPLOSION

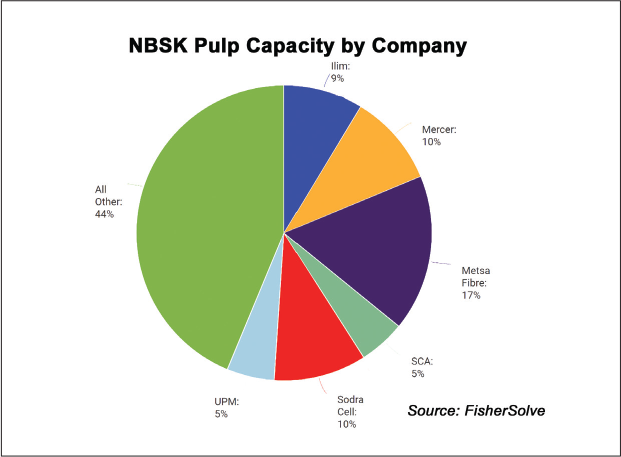

Weeks after the labor strikes hit Finland, a gas explosion at Metsä Group’s Kemi bioproduct mill halted production on March 21. The significance of Metsä’s Kemi bioproduct mill goes beyond just being a facility. It holds a substantial share (Fig. 3) in the Northern bleached softwood kraft (NBSK) market pulp sector, producing an estimated 1.5 million tpy of softwood and hardwood pulp.

With the unexpected shutdown of this pivotal mill, the industry was set up for a critical blow at a time already strained by previous disruptions.

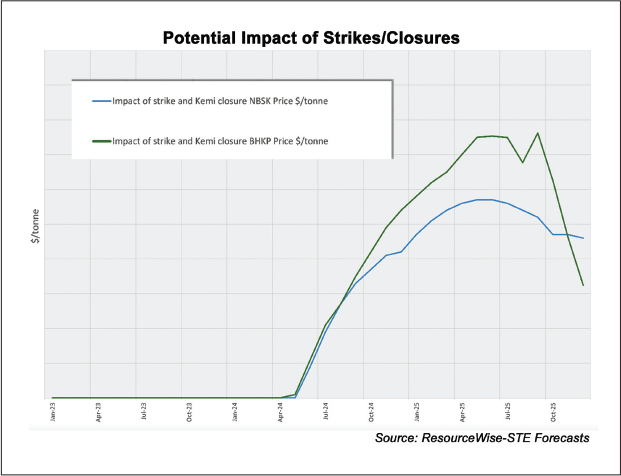

Using ResourceWise-STE Forecasts, a scenario was created to assess and estimate the impact of both the strike in Finland and the Kemi closure on NBSK and bleached hardwood kraft pulp (BHKP) prices in Western Europe. Market experts used the following assumptions to generate Fig. 4:

- Due to the strike, 1.1 million tpy of NBSK capacity and 310 thousand tpy of BHKP capacity were down, closing from March 20-25 and restarting on April 8.

- Due to the mill explosion, 1 million tpy of NBSK capacity and 320 thousand tpy of BHKP capacity were down starting March 21 and lasting for 11 weeks.

- Due to the strike, 17 percent of NBSK and 4 per cent of BHKP shipments were delayed on average by two weeks.

This graph illustrates the difference in price ($/ton) between the market in which these scenarios do occur and one in which they don’t. It’s important to note that prices don’t start to deviate until May and June because the supply/demand balance in the pulp market in spring is/was tight enough to drive up prices even without the strike and closure.

As Danish physicist and Nobel prize winner Niels Bohr once said, “Prediction is very difficult, especially if it’s about the future.”

We currently live in an incredibly unpredictable and volatile time, and it has become increasingly challenging for businesses to accurately plan for the future and navigate the unexpected twists and turns that lie ahead. That’s why it’s important to pay attention to disturbances that occur in the industry so companies can work on a strategic plan as soon as possible.