From individual consumers to executive meetings at major companies, energy consumption, the crisis that follows it, and the uncertainty of the future have been the recent “matters of the moment” in Europe. The latest developments regarding the sabotage of the Nord Stream pipelines make it very unlikely, if not impossible, that the natural gas crisis will be over in the short term. In August 2022, prices hit the worst spike Europe has seen in years as they reached €340/MWh (equal to about US$351/MWh)—creating costly consequences for both households and businesses.

Energy companies have been told over the last several months to fill their gas storage “no matter what cost” to survive the winter—which means gas prices have been through the roof. However, now that storage is full, prices have started to drop back to the €100/MWh range, as of the time of writing.

In the meantime, EU governments have done their best to keep their economies stable and running despite the ongoing issues. For example, Berlin announced in late September a massive, and somewhat controversial, €200 billion (US$206.57 billion) support program fueled by new debt, with its primary goal to support energy intensive industries such as pulp and paper. The exact amount of energy to be subsidized remains to be settled, but is looking to be as much as 80 percent of last year’s consumption.

This has sparked unrest in other EU countries that are afraid it might upset competitiveness within the EU community. European Commission President Ursula Van der Leyden proposed to EU country leaders that the European Union should consider imposing a temporary limit on gas prices and look at a specific cap on the cost of gas used to generate power.

“We should consider a price limitation in relation to the TTF in a way that continues to secure the supply of gas to Europe and to all Member States that would demonstrate that the EU is not ready to pay whatever price for gas,” von Der Leyen said, referring to the Dutch Title Transfer Facility (TTF) gas price.

While this intervention seems to be a strategy to control prices in a unified manner for the EU, one must remember that price caps may cause imbalances in supply since global energy is such a competitive market.

HOW HAS EUROPE’S GAS CRISIS IMPACTED PULP AND PAPER?

The pulp and paper industry is one of the largest energy consumers in Europe, as it is heavily dependent on fossil fuels and purchased electricity to maintain operations. It’s now more important than ever to “brace for impact,” though it will be a tough situation to navigate. However, it’s important to keep in mind that these changes will not affect all players in the same way.

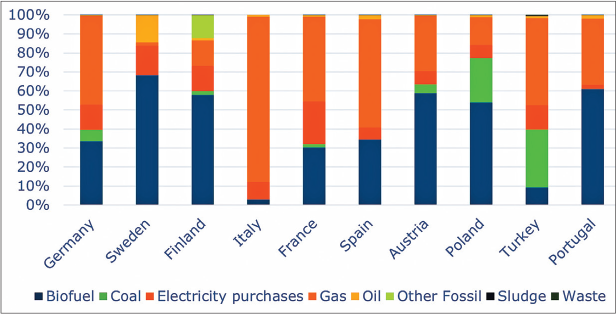

As illustrated in Figure 1, players in the paper industry in different countries across the EU have varying shares of energy sources that make up their total energy portfolios, which will have disparate results on the viability for those operating in these regions. Other factors that will impact viability also include the technical age of assets, as well as geography and energy source exposure.

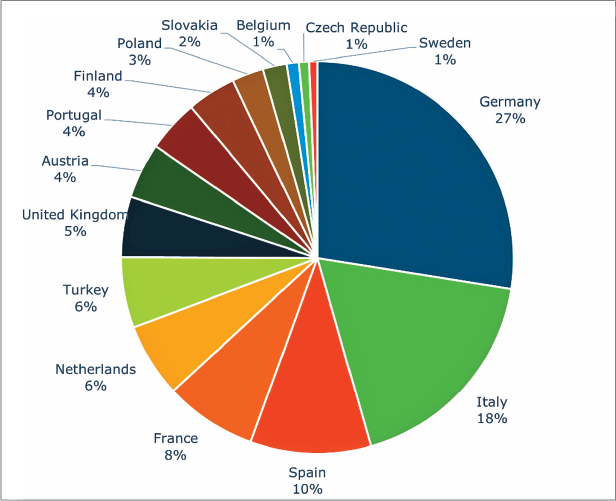

Figure 2 illustrates the gas consumed by P&P mills of the top 15 paper producing countries in Europe, according to FisherSolve. Paper industry powerhouses Germany and Italy are among the heaviest gas users in Europe. While it’s important for all companies around the world to consider action related to the energy crisis, it’s imperative for companies located in these 10 regions to develop a plan sooner rather than later.

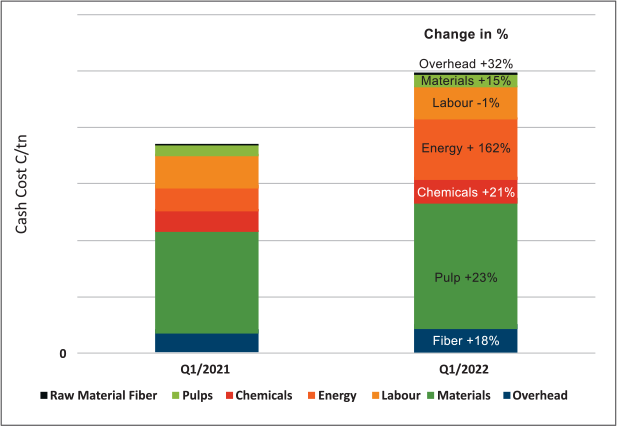

Even though many companies are hedging their electricity and gas purchases, the effect of increased energy costs is creeping into production costs—not only from pure energy and fuel purchases, but also from increased costs of chemicals, consumables, transport, and pulp, as seen in Figure 3.

Because the energy crisis has left many parts of the P&P industry in a fragile state, we have seen a number of mill shutdowns and curtailments occur as a result. This means that companies need to consider these two key challenges as we enter the new year:

- What might happen in the future?

- How many more companies could be on the verge of closing?

GLIMPSING THE FUTURE

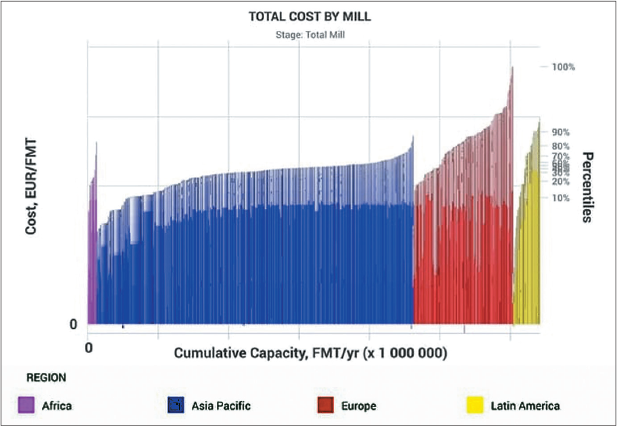

When focusing on tissue, a grade that is dependent on natural gas for paper drying, there are, at the time of writing, 2.4 metric tons of tissue paper mills sitting in the 4th quartile of the cost curve for being at risk due to high costs. Making a conservative assumption that 30 percent of the mills located in the last percentile will not survive the strong impact of these gas costs and will be forced to shut down machines (both temporarily and permanently), this means that roughly 720 kilotons of capacity could be removed. Countries with highest cost pressures are mainly the UK, Germany, Italy, and France.

Figure 3: Average Operating Cash Cost of European Specialty and Kraft Paper Mills 2021 vs 2022. (Source: FisherSolve)

Figure 3: Average Operating Cash Cost of European Specialty and Kraft Paper Mills 2021 vs 2022. (Source: FisherSolve)This tonnage will need to find a supplier soon or we might see a repeat of the COVID era in the supermarkets with empty shelves—although this time it won’t be from panic buying, but because some mills won’t have enough available gas for production, or the costs of production will be too high due to energy cost increases becoming unsustainable.

This tissue scarcity would then force producers to pass on the increase to the consumer, but one must understand the extent to which this is sustainable before the European market starts to see non-EU producers with much lower costs making profit from this situation. Right now, some producers from remote locations with much lower energy costs can already be competitive, even taking into account the cost of US$200/t for transportation.

The overall price of tissue will eventually depend upon the outcome of prices for gas, electricity, chemicals, and other raw materials, along with the price imposed by new entrants into the European market. They say tissue doesn’t travel well, but unless the EU imposes import duties to protect their markets, North African, Latin American, Asian and US players will be watching for opportunities to increase their margins with European sales.

With costs of the mills producing on the 4th percentile of the cost curve for tissue at over €1,500 per ton (about US$1,548/ton), these mills will be an easy target for more competitive players outside of Europe, even with the logistic costs factored in (see Fig. 4). However, because prices for shipping containers are finally dropping back to normal pre-pandemic levels, this means that the European industry can handle competition from remote locations able to pay lower logistics costs.

All in all, the next few months are likely to bring more uncertainty and turbulence, meaning it’s imperative that every pulp and paper company:

- Find a network of potential new partners.

- Evaluate its position in terms of energy and other costs regarding its competitors. Which companies are under pressure? Which ones are not?

- Understand the trade dynamics (integrated vs non-integrated, virgin vs recycled) and which markets are the most attractive for non-European newcomers.

- Understand the future scarcity by region and/or create what-if models with different local government subsidies.

- Run price models forecast scenarios for certain grades as mill capacity is taken out.

For more data and insight into the present and future state of the pulp and paper industry, contact Fisher International at fisheri.com.

Paper 360

Paper 360