GRAEME RODDEN

Following the lead of other global events and forced to go virtual, Fastmarkets RISI’s 35th annual North American forest products outlook conference still gave delegates the chance to listen to some key players in the sector as they gave their insights into the market today and what can be expected in the future.

In opening the conference, CEO Dan Klein highlighted the key factors shaping the landscape: heightened awareness of the importance of personal protection and hygiene; the increase in remote work, schooling, and other activities; the expansion of e-commerce; the campaign for sustainability; geo-political influences on global trade, e.g., trade disputes that still exist with COVID-19; and government intervention.

It becomes a question of “shape or be shaped,” Klein added. In the next six to 24 months, do you want to shape or be shaped by market disruptions?

A true visionary in the industry, Anthony Pratt, Pratt Industries (and Visy Industries in Australia), was honored as the North American CEO of the Year (see our interview in the Nov/Dec 2020 Paper360°.) Under his guidance, Pratt Industries has grown to be the fifth largest boxmaker in the US and has pioneered the use of recycled paper for more than 30 years.

In his acceptance talk, Pratt noted that the company is prepared to invest US$10 billion in its facilities. The company’s quest continues to be making boxes that meet all quality specs from a 100-percent recycled furnish.

Pratt’s circular economy manufacturing culture is driven by its “milligators”—the principle of having corrugators installed in the paper mill. Waste from the mill is used to produce energy while waste from customers goes back to the mills. Pratt said the technology installed allows the company to work with the worst quality paper: “If you can tear it, we can use it.”

He told delegates that sustainability and commerce are complementary and that there is no need to make a choice between the two. The industry is lucky, Pratt said, to be smack dab in the middle of the two biggest revolutions: sustainability and the internet. The industry is well placed to take advantage of both.

In response to questions, Pratt said that in the future 80 percent of the food we buy will be delivered to our houses. “Our challenge as an industry is to become the package of choice versus plastic or other alternatives.”

Corrugated is well-positioned to be the leader in the packaging sector of the future. But, it must be able to adapt to the digital revolution, e.g., customized printing.

COVID-19 CONVERSATIONS DOMINATE

As could be expected, then pandemic played a large role in many of the discussions.

In one of the first panels, moderator George Staphos, Bank of America, discussed the effects of COVID-19 on operations and demand with three CEOs, including Anthony Pratt. Pratt noted that the pandemic led to an explosion of online retail, which forced Pratt Industries to work on taking care of its customers’ changing needs. “Keeping up with customers and making sure we served them was our priority. There was a huge shift to digital (in the corrugated box market). We needed to understand the channels to do the right products for them, and we have done a lot of work related to that,” Pratt said. “We need to stay in tune with the digital world.”

Mike Doss, CEO, Graphic Packaging International (GPI), said business “skyrocketed” in the food and beverage sector, but other sectors fell off—“So we needed to shift some production.”

Howard Coker, CEO, Sonoco, noted that availability of skilled labor became an issue as absenteeism increased. The coronavirus reinforced the shift to more automation in mills.

In terms of demand and the way the pandemic has kept people at home, Pratt said he hoped the shift would go from safety reasons to convenience so that the at-home audience continues to grow. Then, he added, the consumer won’t be content with a plain brown box, but increased customization will be the next step.

Doss said that, given the supply chain shocks suffered during the pandemic, GPI was still able to re-engage with customers and forge new relationships. He also believes the industry will see more “at home” customers.

Lasse Sinikallas, director of macroeconomics, Fastmarkets RISI, said in the face of the COVID pandemic, central banks are boosting the global economy to help it recover, stay alive, and grow.

In the US, the Federal Reserve has cut interest rates to zero. In Europe, the ECB continues to supply the market with money. An EU recovery package has been agreed upon. In China, government-led stimulus has been low, but the nation has been investing heavily in infrastructure.

The greenback is still strong, Sinikallas said, but wondered how it will perform when we recover from the recession. In all regions, he noted that a recovery is in progress, but it will take time to reach previous levels. The US job market is still in turmoil. Although it has recovered well, it is still down 10.3 million jobs. The jobs lost were heavily focused in the service sector. Consumption growth will drive the US economy.

In Europe, confidence remains low. Drops in various GDPs in the first quarter were huge. All KPIs are low but they have recovered from the depths. Still, consumer confidence is low compared with industrial confidence. European industrial production has shrunk and although recovering, it is still below previous years’ levels.

In China, the industrial sector has recovered nicely although investments are still relatively low. Production is close to what it was prior to the crisis. Chinese retail trade growth is still behind the previous year’s level.

Sinikallas said all regions have their advantages and challenges. In the US, on the plus side: interest rates are low; the demographics are favorable; household leverage is low, while household net worth is high; and oil is cheap.

However, there is a risk of inflation. Also, there is political uncertainty (Sinikallas spoke prior to the US Presidential election.) There has been serious damage to the service sector. Trade wars remain an issue.

In Europe, on the plus side, low rates will help the economy recover; EU recovery funding will open opportunities; and the industry is transforming. Negatively, there is a risk of deflation; growth was low even before the pandemic; there is a north/south divide; unemployment is high; and the fate of the Euro, in context with other issues such as Brexit, is still unknown.

In China, there is a conversion to a consumer-led economy from an export-led one. Infrastructure has received an investment boost. There is global synchronized growth. Looking at the challenges China faces, Sinikallas mentioned demographics as well as debt and inflation. Any trade war will not favor the country. Emerging markets that China services are facing problems.

Overall, Sinikallas said he sees a global recovery coming in 2021. GDP growth in the US in 2021 could reach 4.9 percent with 5.2 percent growth in Europe and 8.2 percent in China.

Risks to a global economy include COVID fall-out such as a collapse of supply chains and debt, trade policies, the US election, political leadership changes (e.g., Germany, Japan) and a rise in geopolitical tensions.

He ended on a positive note saying that most executives have an optimistic outlook and the situation now is even better that it was a few months ago.

PELLET IMPORTS

TO PARTS OF ASIA WILL LEAP

Looking at specific products, John North, Fastmarkets RISI senior economist, international timber, focused on pellets. In Asia, it is still a huge market (import). Meanwhile, Japan is growing exponentially as it turns away from nuclear-generated energy. One estimate shows imports reaching 10 million metric tons in five years.

Vietnam is still increasing its exports, an estimated three million metric tons in 2020. There is a lot of pellet making capacity coming online there.

Although European pellet import rates have been trending down since 2018, they still continue to grow. The EU is setting conditions to go heavy into renewables, including woody biomass, and the region will rely on imports. These will be heavily subsidized. North said there is a good opportunity for producers on the East Coast of North America and South America.

PULP SITUATION STILL UNSETTLED

Fastmarkets RISI Vice President, fiber, David Fortin said pulp consumption growth has softened as the frenzied pace in tissue eases and graphic papers hit a low point in the cycle.

Various factors are creating an unsettled situation. Supply side disruptions caused by the pandemic offset a portion of the demand declines. Inventories remain elevated. The China/US trade war exacerbated the unsettled situation caused by the coronavirus.

Industrial markets are improving, but from low levels, Fortin added. The market was coming out of a recessionary environment in 2019 caused by the trade war. This year was looking better until the pandemic hit.

We are now at a point where industrial markets are expanding globally, but from exceptionally low levels. The Chinese economy is recovering, but slowly. Developed nations’ economies suffered a collapse, but the near-term outlook is not as dire as predicted.

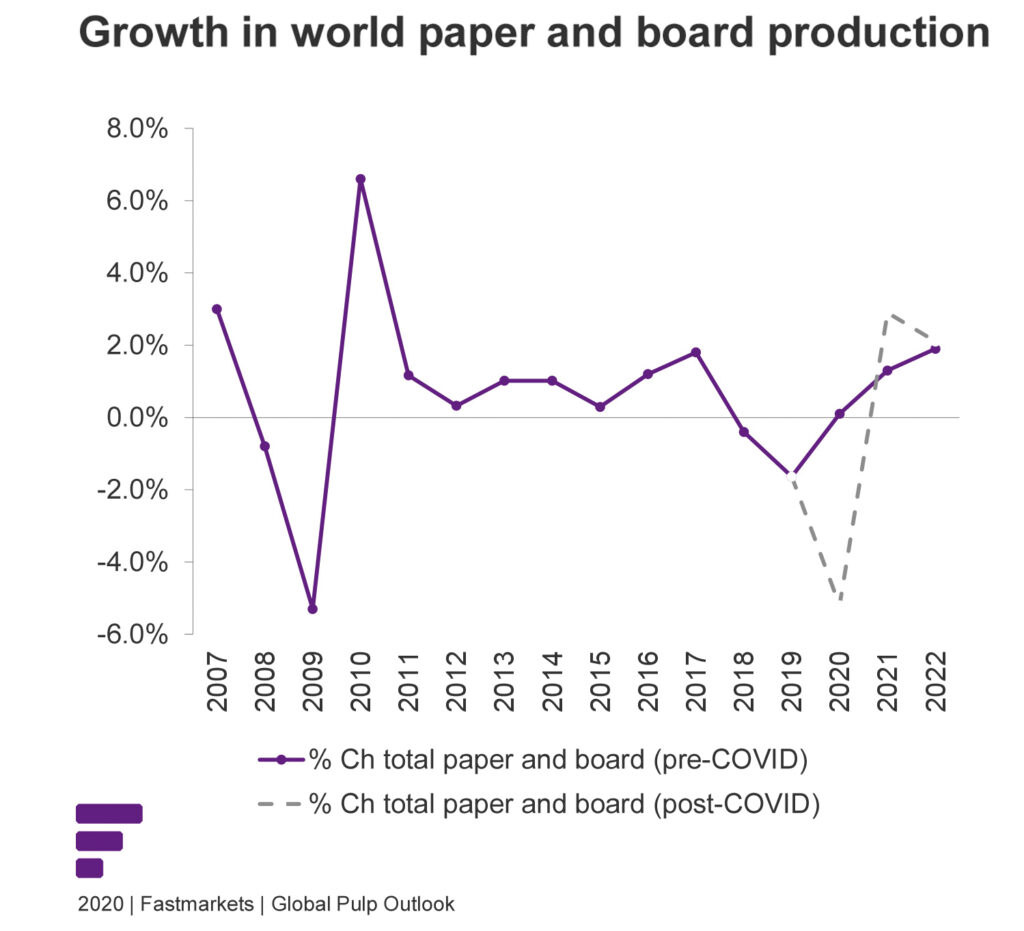

In 2020, there is likely to be a “jaw-dropping” collapse in world pulp and paper production of more than 5 percent or greater than 20 million metric tons (see Fig. 1). Fortin said he expected the situation to stabilize in late 2020 and accelerate into 2021-22.

Graphic papers still account for about 30 percent of market pulp demand, so the plummeting demand for P&W grades dropped pulp demand substantially lower. Fortin expects a decline in market pulp demand of around 2.5 million metric tons in 2020. Demand will rebound in 2021 before getting back to pre-pandemic levels in 2022.

Unexpected downtime continues near historic highs. Before the pandemic, the industry suffered from events such as drought, fires, strikes, and wood supply issues; then the coronavirus hit in 2020. Will the massive increase of downtime extend into the future? Probably, Fortin said.

Although bleached hardwood kraft producer inventories have been brought back to normal, bleached softwood kraft pulp inventories remain bloated. Why? In part, because fluff pulp demand has weakened and producers built inventory to account for delayed downtime that is currently underway (editor’s note: Fortin’s statements were made in October, 2020.)

China accounts for 36 percent of global market pulp demand and imports about two million metric tons monthly. Imports continue to grow despite the pandemic and supply side disruptions. Major Chinese ports are still carrying excess inventory, which will continue to weigh on ordering decisions. The complete ban on recovered paper in China as well as further restrictions around single use plastics will provide a tailwind for virgin pulp demand.

The northern bleached softwood kraft (NBSK) premium over bleached eucalyptus kraft remains high (about US$150). A weak market and lower availability of NBSK may result in the spread remaining larger for longer. All easy conversions to higher bleached hardwood kraft use have likely been made.

BROCK: PROUD OF INDUSTRY’S EFFORTS

Day 2 began with an interview between Fastmarkets RISI’s Renata Mercante and AF&PA President and CEO Heidi Brock. When asked about the impact that COVID-19 has had on the industry, Brock said it was significant, but that she was proud of the progress the industry made adapting to the pandemic.

The industry has been recognized as essential, but Brock pointed out that it needed to work hard across the supply chain to get that designation. With the US presidential election still coming up (at the time of her comments), Brock said no matter who wins, the pandemic will play a big role in determining the future. She said the industry wants the best science and technology information used to create the best policies.

CORONAVIRUS HAMMERS AFH PACKAGING;

OTHER SPENDING BUFFERS THE BLOW

The conference continued with more outlooks for the various grades. Ken Waghorne, vice president, global packaging, Fastmarkets RISI, addressed the paper packaging side. He noted that the key factors driving global developments over the next 2-3 years will be:

• Economic headwinds and uncertainty (which existed pre-pandemic);

• Changing recovered paper policies;

• E-Commerce; and

• Environmental concerns, i.e. paper vs. plastic.

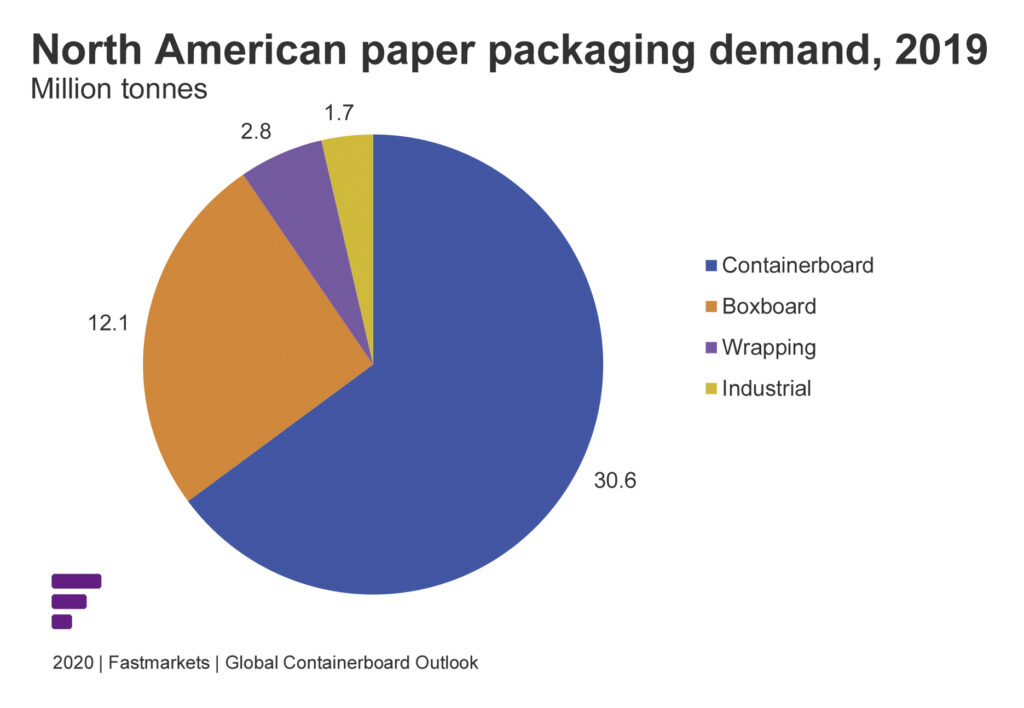

In the last couple of years, a global downturn in manufacturing followed by COVID has hurt paper packaging demand. China and Europe have suffered big drops in 2020. In 2019, total global demand for packaging was 265 million metric tons with Asia accounting for about 50 percent of demand.

In North America, two-thirds of demand is containerboard, which is closely tied to the manufacture of consumer goods (see Fig. 2). Boxboard is about 25 percent of the market.

Waghorne said the service sector is where he sees weakness. For example, spending in July was down 9 percent from year ago levels. Food service remains down 17 percent from a year ago, offset somewhat by increased spending in grocery stores.

There has been a 36 percent drop in away-from-home (AfH) activities such as movies and sporting events, but there has been a shift in spending to recreational products used at home. Consumer spending on goods is running ahead of pre-COVID levels for now. Spending in July was up 7 percent compared with a year ago.

Industrial production in North America was in good shape at the beginning of 2020, but the bottom fell out when the pandemic hit. However, Waghorne has seen a recovery since the economy restarted in May.

Some of the largest segments of the packaging market were able to shake off the effects of the coronavirus—except for cup stock, because of the sudden loss in demand from the entertainment sector.

He sees a manufacturing recovery over time, but expects some losses as a second wave of the pandemic hits. North American packaging demand should grow 3.4 and 3.2 percent in 2021 and 2022 respectively, but some of 2021’s growth could be pulled into 2020.

One issue North American containerboard faces is a surplus of capacity. It is expected to grow significantly over the next five years. Between 2019 and 2023, 2.3 million tons of new capacity is coming online. Therefore, capacity shortages are unlikely for some time.

Looking at the global situation: in Latin America, Brazil and Mexico dominate demand, each with about a third. However, each country has different dynamics. Brazil is self-sufficient while Mexico is closely tied to the US. Waghorne does not expect any demand growth in Mexico through 2022. In Brazil, exports will grow as significant new capacity enters the markets thanks to Klabin and WestRock.

In Europe, demand growth is slowing and oversupply is developing with one million metric tons of new capacity added in 2020. Capacity increases in eastern Europe will push more western European exports outside the region.

In Asia, Chinese RCP policies are changing the way companies are operating around the globe. Chinese containerboard production fell by 4 million metric tons in 2020. However, net imports will increase for the year. In the rest of Asia, demand has declined, but should rebound in 2021-22. A lot of non-traditional producers are increasing exports, up to more than 6 million metric tons by 2022.

What to watch for in the near term:

• Shifts in retail that are giving a boost to corrugated demand;

• The progression of the pandemic and how various economies rebound;

• Whether the pandemic has disrupted the push for sustainability;

• Robust capacity expansion in every region; and

• One final shock to the global RCP system in 2021.

Overall, Waghorne said there will be an average annual demand increase of 1.5 percent through 2022.

CHINA CONFIRMS ITS BAN

ON US RCP IMPORTS

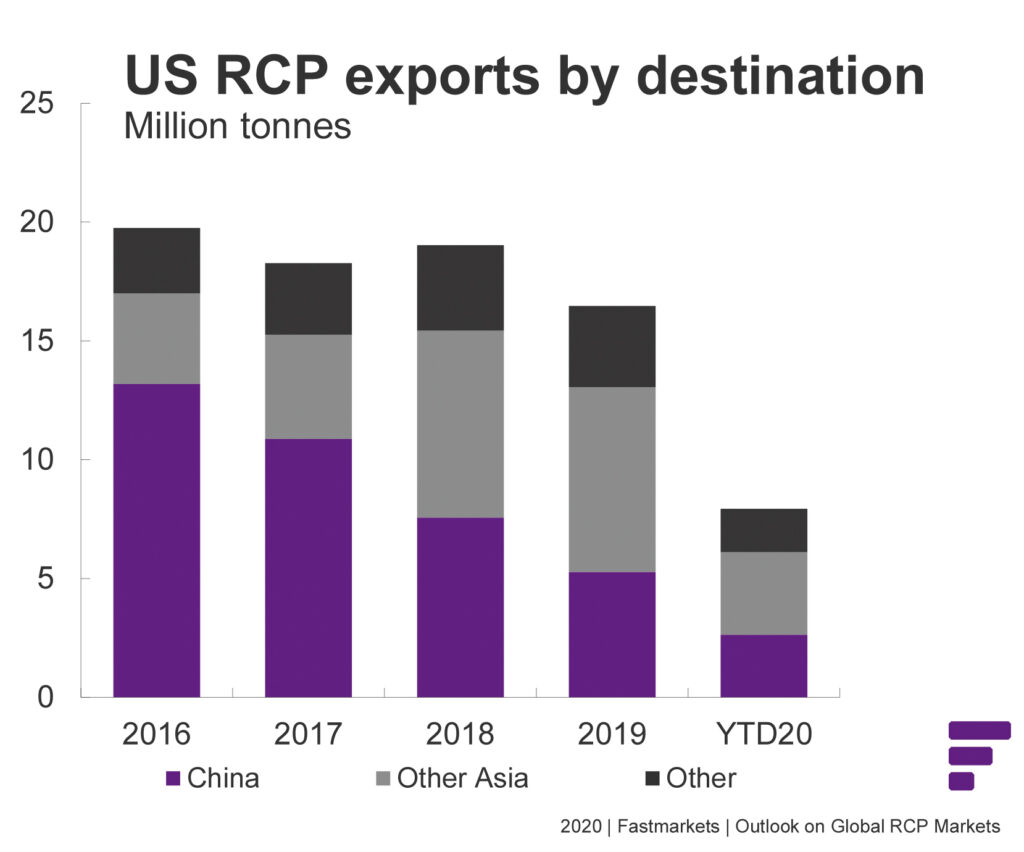

Regarding recovered paper, Hannah Zhao, senior economist, global RCP for Fastmarkets RISI, said North American demand dropped in May and June as the economy slipped in the summer. Exports of RCP to China rose in late summer and early fall as buyers took their last chance to buy US RCP before China implemented a total ban.

On the supply side, there were temporary disruptions in the spring. In the long-term, what will be the effect of growing e-commerce on the recycling system? E-commerce has increased during the pandemic and is likely a permanent effect, so there will be an increase in demand for boxes and, therefore, OCC.

For high-grade RCP, there was a severe supply shortage in the spring. As the work-from-home phenomenon took effect as well as school closures, this had a negative impact on demand for graphic paper and, therefore, the supply of high-grade RCP.

For mixed paper, there has been a sharp price decrease between 2017-19 because of China’s ban as well as other Asian countries’ restrictions. Prices have stabilized recently and trended up after the pandemic. There has been strong demand from other Asian countries. In the US, domestic demand for mixed paper has grown 5.5 percent year-over-year. Overall, US RCP exports show continuous decline to China and slowing demand from other Asian countries (see Fig. 3).

A direct effect of the RCP ban has been the rise in recycled pulp exports from the US with significant opportunities to keep growing. China has confirmed the ban on all RCP imports by the end of 2020, but it waived tariffs on US recycled pulp imports at the beginning of 2020. These continue to grow, up by about 160 percent year-over-year in the first eight months of 2020. This has led to a number of RCP pulp projects, mostly in the US and Southeast Asia.

Zhao believes that it is likely that not all will come to fruition; still, China’s recycled fiber shortage will continue. Virgin pulp can help— “but by how much?” she asked. There are issues of price and availability.

Is recycled pulp a short- or long-term solution? Will China continue to import recycled pulp to make containerboard or will it import containerboard? China’s domestic recycling rate has risen, but at 80 percent, how much higher can it get? Plus, there are quality concerns about its domestic RCP supply.

Other Asian countries have seen their RCP imports increase sharply because of limited domestic recovery rates and strong demand growth. They are increasing their containerboard exports to China.

In summary, there is still a lot of uncertainty in the Asian market as well as concerns about the coronavirus. Will other Asian countries put restrictions on RCP imports? Will there be restrictions on recycled pulp imports? Can North America improve its quality of RCP?

EVERYTHING CHANGED FOR TISSUE

Fastmarkets RISI’s principal, tissue, Esko Uutela, spoke about how the pandemic totally changed the dynamics of the tissue market. “COVID has changed everything for tissue,” he stated.

Consumer tissue sales boomed while AfH sales suffered. Panic buying emptied tissue shelves across the world. North America, Europe, and Australia were hit hard because there was not a lot of extra capacity available to fill demand.

In China, overcapacity helped to increase production even if some mills were closed six to eight weeks. Tissue mills turned out to be strategic assets. Uutela spoke of tissue trucks being hijacked in Hong Kong and Germany.

In Germany, after five weeks of panic, tissue levels normalized. A second wave has led to more buying. Overall, the year 2020 will be above average for the country.

In the short-term, in the US the impact will definitely be positive for the at-home sector. AfH sales plummeted from April through July. Overall, 2020 will be bad for the AfH sector because of decreased travel, restaurants closing, and the shift to people working from home.

In the long-term, the outlook for AfH is still positive. Hygiene issues are at the fore and will remain so. The coronavirus has actually helped improve hygiene standards. Electric hand dryers have been turned off because they were found to be “virus slings.”

In the consumer sector, households will probably keep higher stocks than in the past—for example, two weeks instead of one. The number of tissue users will likely grow in countries with no previous tradition of tissue use.

In 2019, Uutela said global tissue consumption was 40.6 million metric tons. The market is dynamic and emerging markets are growing in importance. China has surpassed western Europe in market size. Asia is accounting for an increasing share of demand—39 percent—compared with 34 percent in 2014.

In North America, the market has been strong recently, led by AfH. The pandemic reversed that with the at-home sector driving growth. The overall result is significant growth for the year.

Canada is still the main source of US tissue imports although China is now almost at the same level. Due to the pandemic, imports increased by 15 percent in the first half of 2020. Tariffs on Chinese tissue were removed, so imports increased significantly.

Pre-coronavirus, AfH product shipments showed a growth rate double that of at-home products. In March 2020, panic buying boosted the at-home sector. Since April, AfH has been in a deep recession. Significant amounts of AfH bath and facial tissue landed in households. In the second half of 2020, at-home demand growth in the US was expected to slow, but still be above average. The AfH sector was still expected to struggle. Total volume should show good growth: at least 5 percent, maybe 6-7 percent.

Uutela expects continued growth in North American consumption until 2022. But what will happen to AfH in 2021? He expects a “normal” year in 2022.

Although the coronavirus is horrific, it did have a positive effect on the tissue market. Uutela said the outlook remains good despite the number of new investments in North America. A lot could depend on how net imports develop.

Latin America shows varying growth with a change to a more positive trend expected. Almost 470,000 metric tons of new capacity is expected through 2023. The utilization rate will remain low, at maybe 80 percent.

In western Europe, Uutela is looking at growth of 1.8 percent in 2020, which he expects will go back down to 0.5 percent in 2021. He said the region has taken a long time to recover from the 2008 recession. Political tensions have cut growth in eastern Europe.

In Asia, the Chinese economy was badly affected by the pandemic, so growth in tissue consumption will only be 5 to 6 percent in 2020 compared with 9 percent in 2019. Exports from China grew by 6.3 percent in 2019 despite US tariffs, so with these removed, exports to the US should increase.

Chinese tissue investments are “exploding,” but Uutela said closures and delays can be expected. The expected net capacity increase is much higher than organic market growth. An ongoing structural change in the Chinese tissue industry has been radical and is expected to continue. It is looking at a 70 percent utilization rate in the near future.

Many other Asian countries such as Indonesia, India, and South Korea have good opportunities for growth, but the region is still plagued by a low utilization rate. Long-term, the outlook is positive. In 2020, global tissue consumption should rise by more than a million metric tons or 4.7-4.8 percent, which is very good.

Look for more normal growth rates in the future unless the pandemic continues. AfH will continue to suffer and will need a long recovery period. Many regions have too much investment. In those cases, the positive effects of the coronavirus will not change the outlook.

FLUFF PULP: A GROWTH MARKET,

BUT WITH HEADWINDS

Another sector of the pulp market in growth mode is fluff. Patrick Cavanagh, pulp economist, Fastmarkets RISI, said demand for fluff pulp is a function of disposable income and demographics: babies 0-2.5 years; women 12-51 years; and, adults 65+ years. Fluff accounts for about one-quarter of global bleached softwood kraft market pulp shipments with 85 percent of capacity in the US.

The large population base of emerging markets coupled with increasing disposable income will make them the driving force behind future demand growth. In 2019, total demand was 6.3 million metric tons, up one percent from 2018.

In recent developments, coronavirus-led panic buying for essential hygiene products has diminished as confidence in the supply chain has been restored. However, there should be a lasting boost from demand for wipes.

Although fluff is still a growth market, Cavanagh said global demographic trends are showing cracks. There have been lower than expected birth rates across economies. The recession will set back income growth in emerging markets. Pessimism about the pandemic could further de-escalate birth rates. However, the world’s aging population remains a positive for this market.

China will be the largest market for future demand growth as the middle class continues to expand. Globally, baby populations will peak in 2020 and will then decline, albeit slightly, Cavanagh noted.

Global fluff pulp capacity is 7.5 million metric tons, up about 6 percent over 2019. Poor conditions in the P&W and dissolving pulp markets pushed producers to fluff.

While Domtar is planning to add more fluff pulp capacity, Ence has delayed a project to add 120,000 tpy of eucalyptus-based fluff pulp, although Cavanagh said it may return to the proposal later. Daio Paper will add 90,000 tpy when it converts a paper machine to fluff pulp in 2022. He added that there is still a lot of swing pulp capacity in the US that could go to fluff (up to one million metric tons).

The pandemic recession in emerging markets will have direct negative implications for fluff pulp demand growth. Overcapacity and declining birth rates will be headwinds to face in the future.

PRINTING & WRITING:

THE HITS PILE UP

Derek Mahlburg, director, North American graphic paper, was the bearer of more bad news for this hard-hit sector. He said the sector would suffer its worst decline ever in 2020, with operating rates tumbling to as low as 50 percent during the worst of the crisis.

By autumn 2020, the sector was beginning to recover a bit as a return to “normalcy” off the lockdown nadir occurred. But, demand decline of 15 million metric tons exceeded even that of the recession of 2008-09.

Global demand is now 102 million metric tons and an increase of 1.8 million metric tons is expected in 2021 before the decline continues.

In North America, demand was expected to drop 22.6 percent in 2020. Mahlburg said there would be no safe haven for any grade: coated or uncoated freesheet, or mechanical. However, there will be a slight recovery in 2021 as activity continues to resume and a presumed resolution to the pandemic emerges.

North America was already reeling from a poor year in 2019. Will the structural changes caused by the pandemic stick? If they do, P&W grades will suffer even more. Spending from consumers is still subdued and the sector will need a boost from the service industries.

There is an accelerating decline in magazine advertising. This has led to a drop in the number of issues published annually. The shift to digital will limit any recovery.

Catalogues in the US are also doing poorly, but Mahlburg is more optimistic about their future.

The print book sector is the one area not struggling, with a 2.8 percent rise in demand in the first half of 2020. The E-book share of the market has stalled at 20 percent.

Mahlburg noted that, in June and July, the uncoated freesheet sector had recovered more than 40 percent of its pandemic losses with the possibility of upping that level to 67 percent. However, a second coronavirus wave could cause that rebound to falter. He also said the pandemic will exacerbate the long-term decline of uncoated freesheet demand. Although the North American industry has cut capacity and shows good operating rates, there is still excess capacity of uncoated freesheet globally, up to 3.1 million tons by 2022. The pressure will be on producers to increase exports.

For the total graphic paper sector, since 2015, nine million tons of capacity have closed, of which half was converted into other grades. Massive demand drops will lead to major capacity adjustments. Trade will be a major risk after these adjustments to North American producers as offshore producers will try to increase their exports to the US.

Paper 360

Paper 360