Uncertainty Dominates Tissue Markets

The current tissue market can be summed up with one word: UNCERTAINTY. Consumer spending is cautious, and brand loyalty continues to erode. Political and legislative unpredictability, shifting tariffs with the US, inflation concerns, and volatile energy costs all contribute to a complex landscape where stability is elusive and both businesses and consumers tread carefully amid ongoing disruption.

The results of a recent survey conducted by AFRY claimed that North American tissue companies are predominantly focussing on top line growth while their European counterparts emphasise their profitability. While I see evidence that this is correct, additional aspects are having a significant impact on the tissue industry:

- Enormous build-up of defense budgets

- An unprecedented turmoil in energy mix and costs levels

- A certain general unpredictability—including supply chains—that impacts forecasting, budgeting, and financing.

All these matters shape the environment that is relevant for our beloved tissue, which is, whether we like it or not, a commodity product of limited loyalty by the end-consumer. Let’s elaborate a bit on the single aspects.

THE TARIFF SITUATION TO AND FROM THE US

There has been a lot of backwards and forwards on the setting of tariffs, and it continues to be a moving situation.

Current tariffs for BEHK have been set at 15 percent from Brazil to the US, which will drive cost inflation that will almost certainly be passed on to the consumer. Other pulp and paper products from Brazil are subject to 50 percent tariffs, but for tissue this is less relevant and may just put a stop to producers seeing the US as an export market.

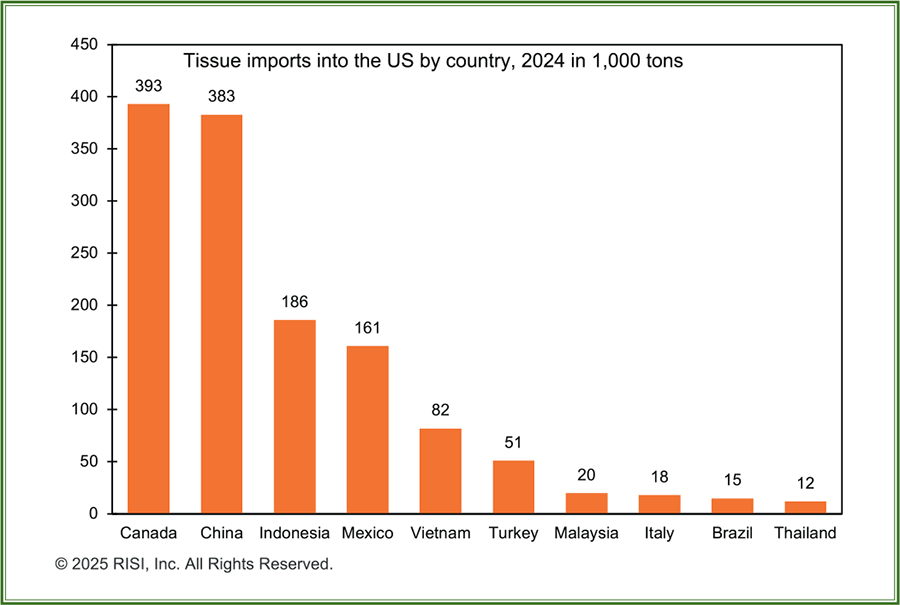

Tariffs from Asia to the US remain high, however they are not finally settled as yet. Interestingly, Asian countries account for close to 700,000 tons of imports into the US—which is more than the capacity of 10 large tissue machines. The result is Asian producers will have to look elsewhere for export opportunities.

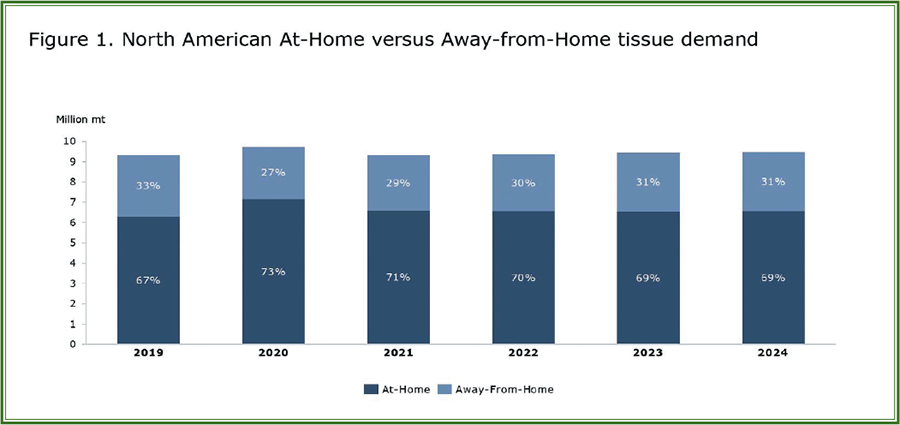

Rising production costs are expected to drive up shelf prices, as producers pass these increases on to consumers. In 2024, the Bureau of Labor Statistics reported a 26 percent rise in grocery prices, with consumers now spending the highest share of their income on food in 30 years. For less brand-loyal categories, shoppers are increasingly turning to retailers’ own brands or private labels, a trend already evident in recent years. Although the overall market appears mature in terms of total volume (see Figure 1), much of the recent capacity growth has come from private label producers responding to shifting consumer behavior.

While investment costs of capacity have dramatically increased for both greenfield and brownfield investments in recent years, we have also entered a period of M&A, not only, but strongly driven by the Sofidel Group’s acquisitions of Clearwater, ST Paper Duluth, and Royal Paper, in addition to new capacities. This has enabled the company’s fast top-line growth, especially for retailer labels.

© 2025 RISI, INC. ALL RIGHTS RESERVED

© 2025 RISI, INC. ALL RIGHTS RESERVED

Retail sales are growing at the expense of the branded producers and may soon approach 40 percent of the volume (compared with 30 percent in 2016). This may look moderate; however, it means the market is shifting toward private label in the magnitude of up to two tissue machine capacities per year.

So, how are the major branded producers responding? Georgia-Pacific at its Palatka, FL, mill and Kimberly-Clark (KC) at its Beech Island, SC, mill and Ohio facilities are making significant investments to enhance warehousing through automation, robotics, and AI. These upgrades are timely, as new mills like those from Sofidel are setting higher productivity standards. Particularly noteworthy are KC’s planned warehousing improvements, which include the introduction of “direct shipments”—a move that could reshape its logistics strategy. These efforts signal a shift toward more efficient, tech-driven operations aimed at maintaining competitiveness in a rapidly evolving manufacturing and distribution landscape.

Will this be the future way to reduce operating costs and gain valuable consumer insights to secure and optimize future sales in branded products?

Meanwhile, KC has teamed up with Suzano for its international tissue business in a 49/51 percent joint venture. The proceeds of the deal are expected to be invested in KC’s branded businesses for the US FMCG markets.

It will be interesting to observe how the relationship with Suzano develops, including potential fiber optimizations for TAD and global supply agreements, as well as the handling of less profitable international units. KC may fully exit the JV in the coming years. Competitors’ responses will also be worth watching.

EUROPE – FOCUSED ON PROFITABILITY AND COST

Meanwhile in Europe, tissue companies are focusing less on top line growth, but targeting cost and profitability optimization, especially in the more mature Western European countries.

While several projects are still in the pipeline prior to final decisions in Europe, a major hotspot of new investments remains in the UK, where Fourstones is expected to start up, ICT and Modern Tissue (Eren Group) and Wepa are in the project phase, and more projects prior to decision. Essity in Prudhoe has built a new recycled paper facility following the trend of enabling the recycling of lower grades than SOP (sorted office papers), the scarce traditional main source for RCF based tissue.

European companies are facing a very high-cost level for energy when compared with the US, with little or no room for passing on costs to customers. An interesting—and sustainable—approach to address the energy turmoil in Europe is the Fortissue mill of Grupo Ghost in Portugal with the Toscotec rebuild that enables a push-button change between conventional and “green” energies used to run the tissue operation. With the highly volatile electricity pricing (expected to last or to get even worse in future years), this is definitely seen as a strong asset.

Energy storage systems—now more cost-effective and efficient—offer greater flexibility by storing green energy during low-demand periods, when electricity prices are sometimes zero or negative. These smart solutions, enabling on-demand renewable power, are more likely to gain traction in Europe than Micro Power Plants, which may suit larger paper facilities better.

The dry forming of tissue, developed jointly by Voith and Essity under the “Sahara” project, is an innovative technology that promises CO2-neutral tissue production with up to 95 percent less freshwater use and 40 percent lower energy consumption. Despite its potential, commercialization is unlikely within this year. The process will likely remain proprietary to Essity for some time, limiting broader market adoption. However, it is reasonable to expect that other machine manufacturers—particularly those with nonwovens equipment in their portfolios—are exploring similar technologies in response to the innovation, potentially accelerating competition and future alternatives in sustainable tissue production.

European tissue machine manufacturers remain global technology leaders, but they must avoid repeating the European car industry’s missteps against rising Asian competition. Toscotec is leading electrification efforts in tissue production, with pioneering projects in Portugal and France and the development of an induction-heated Steel Yankee Dryer (SYD). Valmet focuses on optimizing total energy use, offering Best Available Technologies (BAT), including heat pumps. Meanwhile, Andritz, following its acquisition of A.Celli Tissue, is advancing new technologies and has recently shown strong market momentum, achieving notable sales success across multiple regions and signaling a bold competitive stance in the global landscape.

One of Andritz’s new technologies, Hy TAD, has recently been sold to Longjing Paper in China, and claims to consume up to 50 percent less energy when compared to TAD. It will be interesting to follow market performance of this technology versus competing TAD projects, even though this process is entirely based on bamboo pulp. Does this technology, or another new development, ATAD, have the capability to tackle the ultra-premium segment in the North American retail space where other intermediate technologies have largely failed?

China and the Far East Asia region are expected to drive around half of global growth in tissue demand and deserve close attention. These regions are increasingly building up local fiber supply and improving the quality and capabilities of their regional machine suppliers. Additionally, Russia’s reliance on them supports low-cost production through access to gas and oil.

Given these dynamics, it may be an opportune moment for the Western world to invest in disruptive technologies and innovative alternative fiber raw materials to remain competitive and sustainable in the face of shifting global production and supply advantages.

TAMA2U/SHUTTERSTOCK.COM