North American/European Containerboard Capacity Declines

Has growth in this sector finally reached its peak?

Containerboard demand took the pulp and paper industry by storm in 2020 and 2021. Various factors, from increased sustainability initiatives to a booming e-commerce sector thanks to pandemic lockdowns, fueled the need for mills to continuously up containerboard capacity. In fact, there was a roughly 10 percent increase (about 20 million tons) in global containerboard capacity from 2019 to 2021.

Yet the question producers and suppliers all around the world kept asking was: how long can we expect this sector to continue growing?

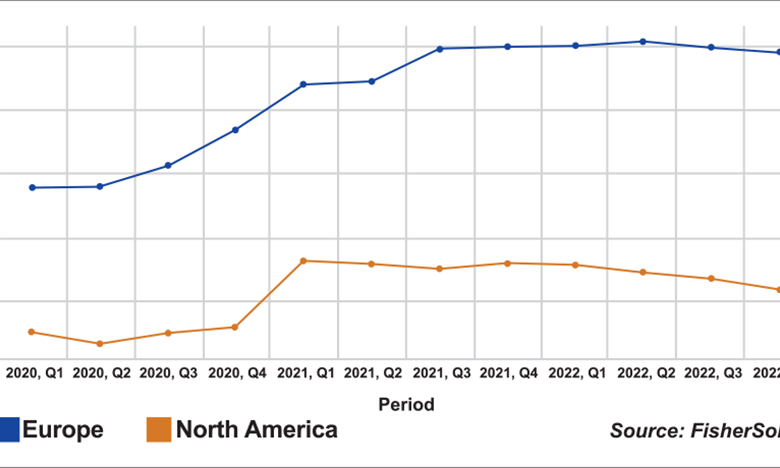

Looking back on 2022, we began to see a bit of a slowdown in containerboard demand, and consequently capacity, in the second half of the year in North America and Europe. As illustrated in Fig. 1 from FisherSolve, the decrease in capacity in 2022 compared to 2021 was minimal—down 2 percent year-over-year in North America and down 0.40 percent year-over-year in Europe.

While the dip in capacity in 2022 wasn’t anything extreme, it still comes as quite a surprise considering both regions reached record production in 2021 after experiencing a significant jump in demand over the prior two years. Compared to 2019, North America experienced a 6 percent increase in 2021 and Europe saw an 11 percent increase in 2021.

So what happened?

DECLINE IN CONSUMER SPENDING

As consumers lived in a largely virtual world during the height of the global pandemic, ecommerce became a booming segment. It was essentially the only way consumers could shop—or felt safe shopping.

Fig. 1 Containerboard Capacity in North America and Europe

However, now that stimulus checks are a thing of previous years and factors such as inflation and rapidly rising interest rates have entered the picture, consumer spending has decreased. Fitch Ratings cut down its US growth forecasts for this year to 0.5 percent growth, a decrease from the 1.5 percent that was predicted in the June forecast.

Amazon experienced this reluctancy to spend during its Prime Day event in October, 2022, which didn’t have as much success as the original Prime Day sale in July. According to Numerator, the average spend per order on October’s sale was US$46.48, down from US$60.29 during July’s sale. Klover also reported that transaction frequency was 30 percent lower during the October sale, as opposed to the original sale in the summer.

Transportation costs were also a factor in the dip of ecommerce and ultimately the demand for containerboard. To offset inflation and increase revenue quality in a slowing market, shipping costs were placed onto consumers as freight prices began to rise. Effective January 2, 2023, FedEx levied a general rate increase averaging 6.9 percent for its Express, Ground, and Home Delivery services.

As the ecommerce sector began to experience some decrease, we saw impacts occurring in the pulp and paper industry. For example, in North America, we saw removals/reductions in several locations. However, this was offset some by the anticipated restart of Domtar’s Kingsport, TN, mill and Biron’s added capacity in Q4.

The falling demand, together with new supply, drove US containerboard operating rates to levels not seen since 2008—and we expect them to stay low until 2024.

THE ENERGY CRISIS PLAYED A PART

Decreasing demand in the e-commerce sector wasn’t the only factor to contribute to the 2022 decline. The energy crisis played a part as well. In August, prices reached the worst spike Europe has seen in years—EUR340/MWH (about US$374/MWH). This created costly consequences for both households and businesses.

It just so happens that, of the major grades in the pulp and paper industry, containerboard is the biggest gas user in Europe by total consumption. The effect of increased energy costs creeping into production costs resulted in both permanent and temporary shutdowns.

Fig. 2 China OCC and Linerboard Price Trends

Fig. 2 China OCC and Linerboard Price TrendsCONTAINERBOARD PRICES IN CHINA

Overall, containerboard capacity has yet to decline in China or Asia Pacific as a whole. Containerboard prices in China, along with OCC prices, fell to the lowest level the country had seen in two years during the second half of 2022. A large contributor to this was China’s zero-COVID policy as it ultimately led to a decrease in containerboard demand.

If we take a look back at the history of China’s containerboard industry, the segment started to boom in 2016 when the national supply-side reform began. This kickstarted a sharp rise in profitability, which drove a new round of capacity expansion.

However, after the announcement of the nation’s recycled paper ban in 2017—in combination with various challenges such as the China-US trade conflict, the global Covid-19 pandemic, “Dual-Control” energy consumption regulations, geopolitical tensions, and softening demand—overproduction and surplus worries became a serious concern. Companies faced huge operating pressures as a result.

Since May 2022, the price of both OCC and finished paper have significantly decreased (see Fig. 2). Big players even announced a huge profit decrease in their “first half” annual report. Lee & Man, for example, announced that its gross profit had decreased 50.4 percent and net profit by 56.9 percent.

While new, future containerboard investments have been mostly in China, these investments are reliant on China’s growing middle class to continue purchasing consumer goods, which will consequently boost demand for containerboard. This will become more important as North American companies start moving the production of their products locally or to other countries besides China.

FORCES THAT WILL SHAPE THE UPCOMING YEARS

Nonetheless, when looking at global capacity in the pulp and paper industry, containerboard was still far above all other major grades at the end of 2022. Production capacity was 140 percent greater than market pulp, the second leading major grade.

The immediate future of containerboard is dependent on increased popularity of the sustainability movement as well as the e-commerce sector. If the importance of these factors maintains focus, the applications for containerboard will continue to grow.

For example, in 2018, Georgia Pacific introduced its EarthKraft Mailer series—a new line of curbside recyclable paper padded mailers manufactured specifically with protection and sustainability in mind. As a paper-based alternative to plastic or bubble-padded envelopes, the lightweight mailer provides superior performance while remaining cost-competitive for the e-commerce industry and curbside recyclable for consumers.

Due to the extremely favorable response to the new mailer’s functionality and recyclability from key customers like Amazon and from consumers, Georgia-Pacific opened two new locations in Jonestown, PA, and McDonough, GA, in 2022.

There is no doubt that we are seeing increased support for a “green transition.” As a result, we are expecting to see an uptick in virgin fiber containerboard production thanks to its alignment with sustainability targets. We also expect to see the share of microflute continue to grow, since it gives containerboard both fiber efficiency and shelf appeal. Those who can efficiently produce using this will be the frontrunners in the years to come.

Another factor that will shape the future of containerboard is the trajectory of the global economy. As we just discussed, the economic uncertainty looming over our heads has led to a noticeable decrease in consumer spending, thus decreasing containerboard demand. The main question that comes with this is: how long will this last?

The demand and need for containerboard aren’t going anywhere. Still, the crazed boom we saw in the sector in 2020 and 2021 is something we are not likely to experience in the short-term.

Some questions to consider include:

- Will fiber availability create a near-term slowdown in Asia’s containerboard sector?

- Will we see a decline in containerboard capacity in other regions?

- Would investments in containerboard machines in North America and Europe be high-risk?