NANCY HASSON

Consumer awareness about excessive plastic pollution and its hazardous effects on the environment has intensified in recent years. As many governments respond by implementing new taxes and bans on plastic, brand owners are substituting renewable materials for many types of plastic packaging. So, how will these trends affect the pulp and paper industry, and will available capacity and fiber supply keep up with demand for fiber-based packaging?

MARKET DRIVERS

The first driver is legislation. Government regulation has increased in many countries to help drive change and reduce the impact of plastics. Certain single-use plastics have been identified as leading contributors to plastic pollution and are the target of most legislation.

While bans on polyethylene shopping bags have been in place in many parts of the world, the EU and UK are leading the way in implementing wider bans on single-use plastics:

• The European Union has implemented a EUR .80/kg tax on non-recycled plastic packaging waste.

• 23 states in the US have some form of plastic bag legislation enacted, and several cities have banned plastic drinking straws1.

• China banned certain single-use plastic products in 2020 with a phased implementation.

Consumer awareness is another driver. Public awareness of plastic waste in the environment has risen to an all-time high. Interest in plastic waste and pollution has consistently increased over the years as more consumers educate themselves on the negative impact plastic waste has on the environment.

A few findings from the 2020 Paper & Packaging Board report confirm this:

• 77 percent of consumers think more highly of companies that package their products in paper-based packaging.

• 84 percent of consumers express concerns about the environment.

• 33 percent of consumers avoid plastic product packaging if they can.

Brand owners and retailers also drive this market. Packaging trend-watchers say the sustainable packaging trend is here to stay, and brands are making serious commitments to act upon the anti-plastics outcry. Several well-known consumer goods companies have committed to reducing plastic content in their packaging:

• Nestlé released its plan to make 100 percent of its packaging recyclable or reusable by 2025.2

• Apple has replaced the traditional transparent protective plastic film with a paper alternative for its new iPhone 12. The company has also reduced plastic in its packaging by 65 percent since 20153.

• Samsung announced plans to replace plastic packaging with paper and other renewable materials, even if the alternate materials are higher cost4.

Another indicator of the importance of replacing plastic is the number of innovations in renewable, eco-friendly packaging, which are being announced at a fast clip. For example:

• Anheuser-Busch InBev, a Belgium-based beverage company, has launched a new sustainable packaging design for its Corona beer brand that uses leftover barley straw from farmers’ harvest to create a paper board for packaging.

• Absolut recently rolled out its paper bottle prototype, which is made of a mix of paper and recycled plastic.

• Beverage companies are adopting paperboard multi-packs for cans to replace shrink wrap and plastic rings, such as Molson Coors and WestRock’s CanCollar®.

SINGLE-USE PLASTICS

As we consider the impact of the anti-plastics trend on the pulp and paper industry, there are many single-use plastics that have fiber-based substitutes. Let’s review a few of the high-volume packaging items that could be replaced with paper or molded fiber:

• Drinking straws: Numerous bans have been proposed or implemented on plastic straws, which are rarely recycled. Nestlé and Tetra Pak announced they will eliminate plastic straws; Seattle became the largest US city to ban them; and Starbucks almost completely phased out plastic straws5. Paper straws are reported to be 10 times the cost of plastic straws6, but are still a very inexpensive item at US$.02 – .05 each. In the US, straws are estimated to consume about 50,000 tons of plastic per year.

• Plastic shopping bags have been a prime target of bans around the world (banned in 60 countries and counting), because billions are used annually for only a few minutes, and used bags clog waterways and drains and choke marine life. However, faced with pay-for-use bags (paper, plastic, or re-usable), consumers trend toward the re-usable bag, boosting growth in paper grocery bags only short-term while consumers build their personal re-usable bag inventories.

• Plastic bottles: About 200 billion plastic water bottles are produced globally, and the majority end up in landfills. Paper cartons could replace a portion of plastic bottles as consumers seek to avoid plastics.

IMPLICATIONS FOR PULP AND PAPER

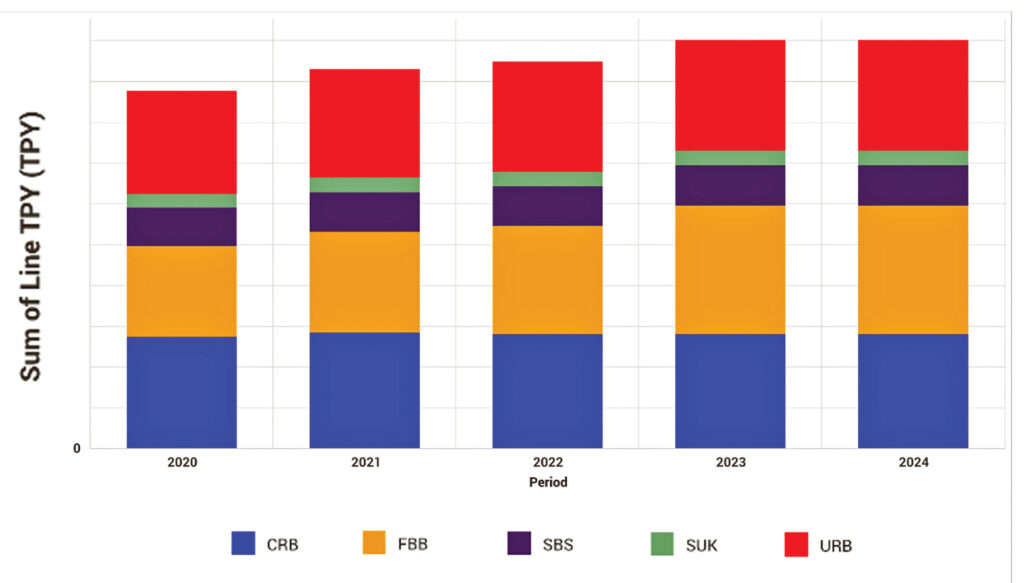

Pulp and paper industry participants need to know where to expect investment as plastic substitution continues over the next few years. We project that virgin and recycled paperboard will see a significant increase in demand, as paper food-grade containers and paper cups replace plastic over the next five years. Considering plastic beverage cups, replacing 10 percent of plastic cups globally with paper would require an estimated 588,000 tons of cup stock, an increase of 20 percent over 2021 global capacity of 2.9 million tons.

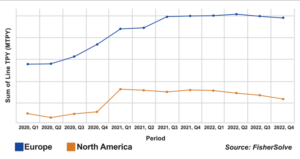

If we calculate potential replacement of plastic packaging in the US and Europe as public concern over plastic waste continues, Fisher estimates that a 5 percent replacement of plastic with paper would consume 1.5 million tons of paper, both virgin and recycled. Figure 1 shows the actual and announced global paperboard capacity increase of 12 million tons over the next four years—only 1.4 million tons of this additional capacity is in Europe and North America.

Beyond paperboard, molded fiber packaging has seen steady growth over the past couple years, as reported by the International Molded Fiber Association. Foodservice items and a number of consumer and household product packages are now made with biodegradable molded fiber instead of plastic. As advancement in manufacturing technology continues for molded fiber, cost reductions and performance improvements will allow more packages to convert to molded fiber, using both virgin and recycled pulp7.

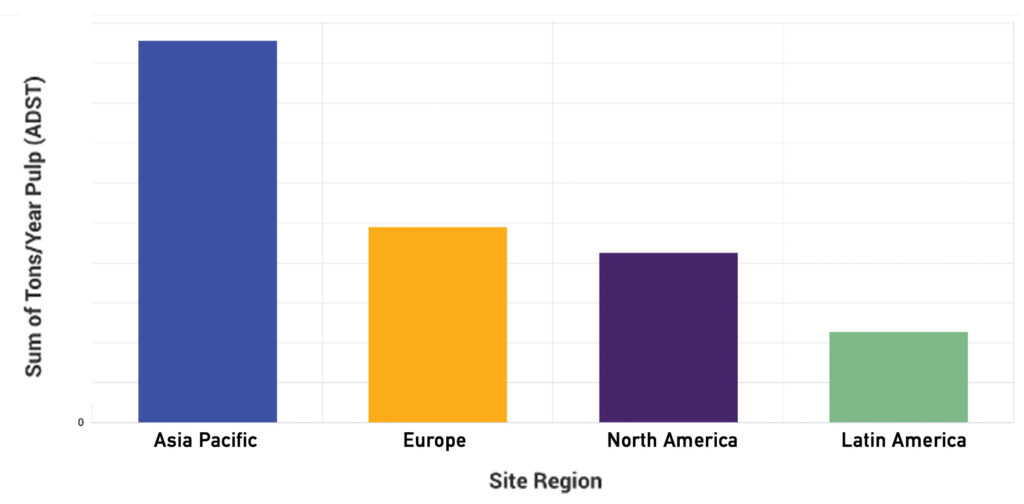

To satisfy increased demand for paper and pulp instead of plastic, capital investment in new capacity may be required in areas with good fiber resources (Fig. 2).

The anti-plastic movement and range of traditional and new packaging materials available to replace plastic brings up important questions and opportunities for the pulp and paper industry. A few issues to consider are:

• If more pulp is required to meet demand for paperboard and molded fiber packaging, will pulp prices increase so much that fiber-based alternatives to plastic become cost-prohibitive?

• How quickly will consumer sentiment cause a shift in demand for renewable packaging materials? What will be the pace of investment and substitution of plastic in Europe, North America, South America, and Asia Pacific?

• Will fiber from sustainably-managed forests be enough to support growth in pulp and paperboard?

• How quickly will renewable fibers like bamboo, bagasse, and straw contribute significantly to fiber supply?

The momentum behind this trend doesn’t seem to be slowing—if anything, it’s only going to continue to gain speed. Understanding new demand for fiber-based packaging will be crucial for producers and investors in the pulp and paper industry moving forward. With more and more companies releasing new sustainability plans, commitments, and initiatives, the possibilities are endless.

References:

1 State Plastic Bag Legislation (2021).

2 Nestlé (2020). The Rules of Sustainable Packaging.

3 Apple, Inc. (October, 2021). Apple’s Environmental Progress Report.

4 Samsung Press Release (January 28, 2019). Samsung Electronics to Replace Plastic Packaging with Sustainable Materials.

5 Gibbens, Sarah. National Geographic (January 2, 2019). A brief history of how plastic straws took over the world.

6 Ell, Kellie. (July 9, 2018). Paper straws cost ‘maybe 10 times’ more than plastic straws.

7 International Molded Fiber Association (June 18, 2018). The new “old” packaging material.

Nancy Hasson is senior consultant, business intelligence, Fisher International. For more data and insight into the present and future state of the pulp and paper industry, contact Fisher International at fisheri.com.

Paper 360

Paper 360