BRADLEY ROBB

It is a challenging time to work in the corrugated business. The containerboard sector reached record production in 2021, according to the American Forest & Paper Association (AF&PA). Total containerboard production increased 5.6 percent compared to 2020. Yet at the same time, the Association of European Coreboard producers (ECBA) issued a warning: Despite the positive market development, the revenue situation of many ECBA members has reached proportions that could threaten the industry’s existence.

Germany’s Verband der Wellpappen-Industrie e. V. (the Association of the Corrugated Board Industry, or VDW) paints a similar picture. Even during the months before the outbreak of the Ukraine war, the market situation had been tense and the cost pressure had been higher than ever. The corrugated board industry, as well as the supplying manufacturers of corrugated base paper, are significantly dependent on natural gas as an energy source. Already, some paper mills are closing temporarily due to gas prices getting out of hand. Electricity prices are exploding as well. The price for a megawatt hour on the Dutch TTF exchange on March 7, 2022, temporarily moved toward EUR350 (US$381). In March, 2021, the end-of-day value had remained below EUR20 per megawatt hour.

Skyrocketing raw material prices are also putting massive pressure on the corrugated board industry. The overall price level for corrugated base paper rose by 66.1 percent from September 2020 to December 2021, according to the VDW. Consulting company Fisher International reports that over the course of 2021 raw material prices to produce corrugated packaging rose steadily, reaching US$910 per ton for linerboard and US$791 per ton for corrugated medium. This amounts to a 26 percent and 32 percent increase, respectively, compared to the fourth quarter of 2020.

The current COVID-19 omicron wave poses additional challenges for the corrugated board industry: the logistics sector is facing a significant shortage of truck drivers. Freight space is becoming scarcer. Corrugated board manufacturers themselves are also affected by a decimated workforce due to quarantine and sick leave. Additionally, they are expected to produce in a more sustainable manner to meet customers’ expectations.

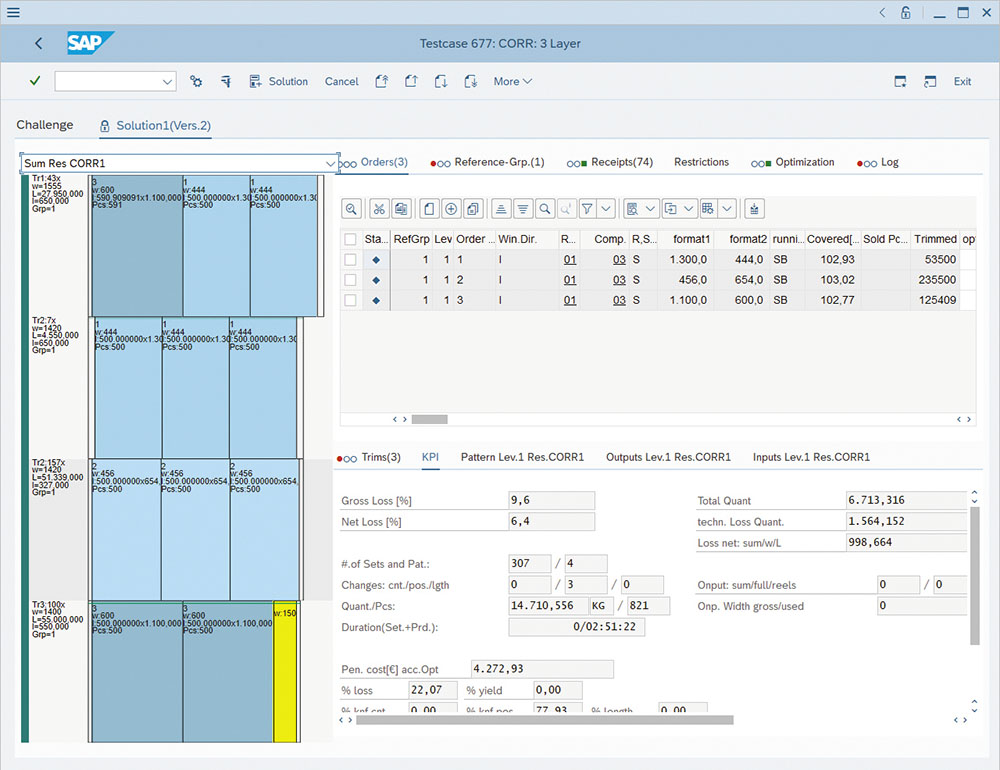

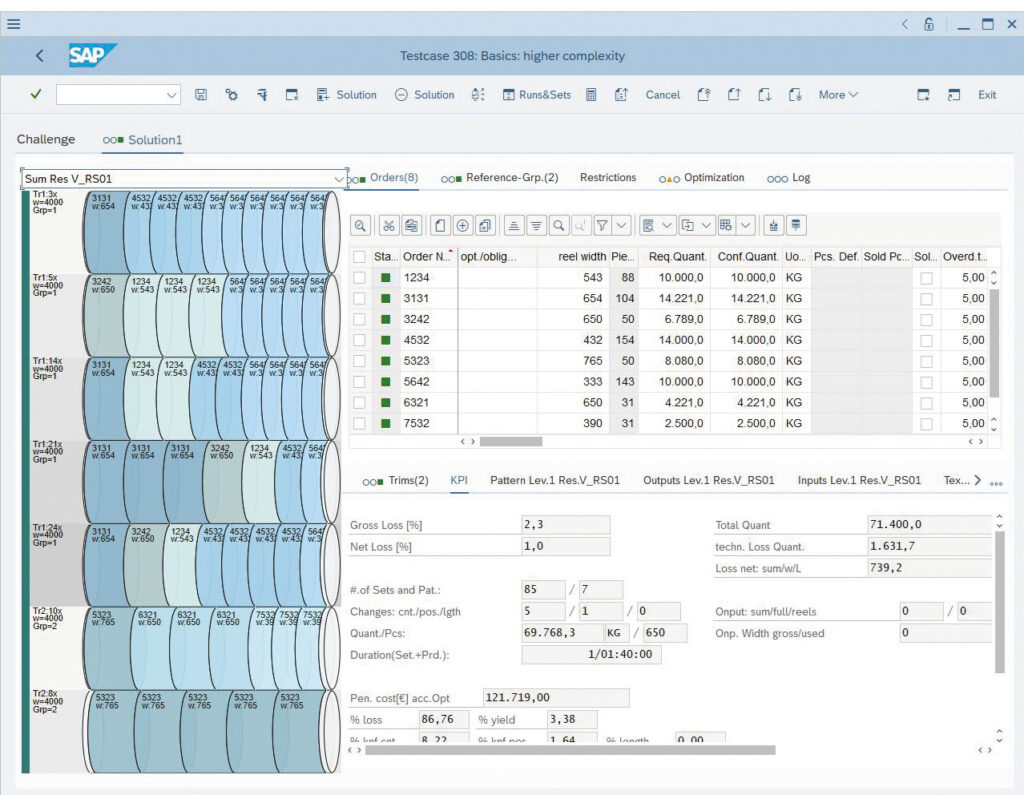

User screen of a digital trim optimization tool (Trim Suite) being used for corrugated production planning.

The question currently keeping manufacturers of corrugated board awake at night is not whether orders will continue to come in; it’s whether they can continue to deliver — and whether production is financially sustainable. Many enterprises are discovering that their organization is no longer equipped to achieve their targeted results while becoming more sustainable at the same time.

Most producers of corrugated goods have started to increase their prices accordingly. But customers’ willingness — and ability — to pay more is limited. So how can companies cope?

DOUBLING DOWN ON DIGITAL

Alfred Becker, global lead, product management for forest products, paper, and packaging industries at SAP SE, suggests an increase of digitalization activities to tackle today’s volatile market situations. “Increasing transparency with suitable data-driven technology enables organizations to become more agile, more flexible, and more resilient,” Becker says.

User screen of a digital trim optimization tool (Trim Suite) being used for corrugated production planning.

One promising approach to building resilience in corrugated industry enterprises is to develop fully integrated IT systems. Areas where data is hidden in manual processes or isolated digital solutions are particularly vulnerable to volatility and crises, since much of the knowledge associated with those processes is not documented for general access. This often includes unstructured files stored on an individual machine, or even only in the heads of a few specialists.

Examples might include the addresses of suppliers with a poor response rate, special conditions known only by one procurer, recipes for certain products, or the number of essential materials in stock. Any organization that only has isolated IT solutions, or even purely paper-based processes, will find it impossible to enact efficient, secure information assembly and exchange; to effectively monitor workflows; or to address cost, quality or sustainability issues in a timely fashion.

It’s not enough merely to digitize some parts of the enterprise like the administration and billing/payment departments. Production also needs to become transparent. A key building block is a Manufacturing Execution System (MES), which can provide information about the status of production orders. The MES is the data hub linking platform data from the shop floor with data from the enterprise resource planning (ERP) system, ideally fully integrated into the other components of the company’s IT. This enables a centralized view of all data relating to the manufacturing process and detailed analyses of the data. Now it becomes clear which production step consumes a lot of energy and which processes or procedures are “greener” than others. Companies then can optimize their processes accordingly.

Another use of a modern MES is the recording data associated with maintenance tasks. This is helpful in times like these as well. A spare parts inventory can be maintained in parallel with consumption posting for maintenance orders. Doing so yields high potential for cost savings and reduces working capital. It also provides an ability to quantify and evaluate the risk that production will halt due to a lack of basic wear parts. It is then possible to counter the risk appropriately by proactively purchasing additional stocks of important parts to keep on hand locally, as a safeguard against changing circumstances (during which rapid delivery cannot be guaranteed).

Plants can reap more benefits by the digitalization of the processes in the areas of quality assurance and quality control. This is especially true since the corrugated industry is moving toward more sustainable production, and cardboard is set to replace other raw materials in packaging production.

According to Industrial Physics, a global testing and inspection company for packaging, products, and materials, nearly three-quarters of the 225 packaging companies surveyed (71 percent) reported that they experience the quality control processes for environmentally sustainable packaging materials as “significantly more difficult” or “somewhat more difficult.” Nearly half of these companies (49 percent) state that “meeting testing standards” is one of the biggest challenges they face in the wider adoption of environmentally sustainable packaging materials.

By integrating digital tools like an MES into production processes, quality inspections can be triggered on an event basis and production data can be linked to quality data. Deviations in quality can be analyzed and traced back to changed production parameters. This ensures the traceability of every batch produced — and it decreases the amount of goods that must be reproduced because of quality issues. This increases the efficiency and sustainability of a companies’ production.

PRODUCTION PLANNING

Digital integration can also help address issues such as efficiency and sustainability on another level: production planning. How can data optimize scheduling or trim processes?

Planning and optimization tools calculate in advance which boards are to be produced where and when and specify how the board will be trimmed to generate the required end products. A trim optimization tool, such as Trim Suite (from T.CON GmbH & Co. KG) even considers the stocks of the respective layers of corrugated board during planning. The software also helps to reduce machine set-up times, and the need to reconfigure machines — nowadays, mostly in paper and film production. Trim Suite’s functionality has been enhanced to even tackle the production of cardboard — especially challenging, considering that corrugated material will typically contain three layers of paper, each of different grade, thickness, length, and grammage.

Integrating software components like Trim Suite into an integrated IT landscape is vital, because the number of business-critical tools and applications is growing. A patchwork of applications can make it impossible to leverage process improvements. A lack of integration boosts maintenance costs and reduces the budget available for digital innovations that drive value creation. If a company plans to grow fast — as many corrugated companies and other packaging companies must do — the “patchwork” legacy IT systems often slow things down since they are hard to roll out to new plants or business units.

Producers are not the only ones that need to evolve and increase their level of digitalization. Software and consulting companies must adapt to new demands as well if they want to support corrugated companies efficiently. Their business demands highly specialized solutions for their business functions, but all parts of the IT landscape must form a fully integrated, seamless puzzle, not a patchwork. This is, on a technical level, not an easy task. That’s why some IT players pool their expertise so they can offer wholistic solutions that support specialized business processes.

For example, T.CON, which has a focus on integrated end-to-end processes in manufacturing companies, and aicomp Group, a leading provider of ERP solutions in the packaging industry, are now advancing their successful collaboration through a sales and implementation partnership. Their goal is to offer a solution that is already integrated in the SAP product configuration. This will offer customers a fast turnaround time for quotation requests, improved efficiencies, and optimized production for waste reduction. It sounds like a perfect match for the digitalization of the corrugated and the packaging business in challenging times.

Bradley Robb is international business manager, T.CON GmbH & Co. KG, an owner-operated business and SAP Gold Partner. Visit www.tcon-international.com to learn more.

Paper 360

Paper 360