NICK INCE AND TOM HAYDEN

If you’re at all familiar with the graphic papers market, then you’ve been hearing for years that it’s in a decline—and that’s true. On average, the global market has been dropping by roughly 3.2 percent CAGR (compounded annual growth rate) for the last five years. However, the good news is that there are “hot spots” where potential growth opportunities exist in this declining market.

VIABLE ASSETS AND GROWTH

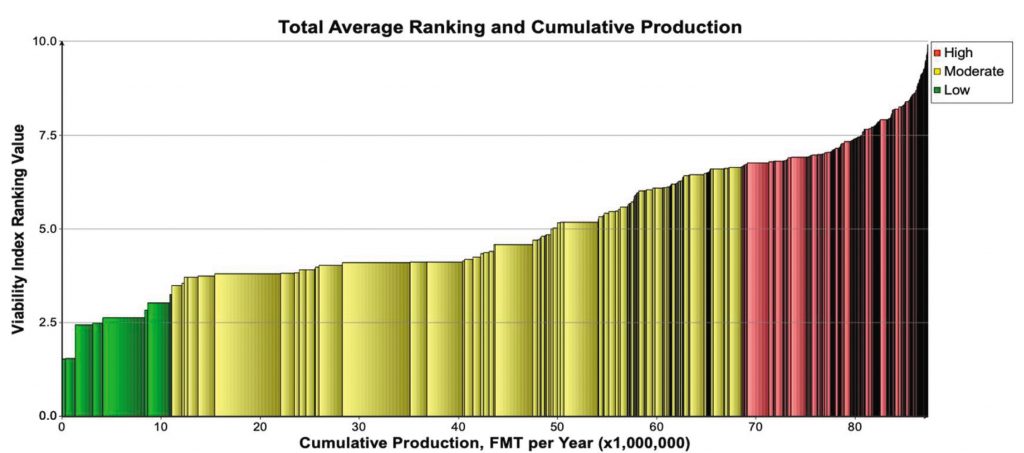

First, it’s important to consider the top, most viable paper machines. These are the assets that will operate long-term, providing good, stable business. The Fisher Viability Index Ranking Value chart (Fig. 1) shows all the graphic paper producers in the world, with the higher value also being the greater risk. The machines in red are at high risk of being shut down or converted to more financially stable paper grades.

The most viable machines will typically be the modern, large machines that are the lowest cost and most efficient to operate. However, smaller machines producing higher value specialty grades are also viable.

Second, it’s important to understand that not all segments of this market are equal. While the market as a whole is declining, there are growing subsegments. For example:

• Newsprint: -7.5 percent CAGR

• Graphic Papers: -1.5 percent CAGR

• Specialties: +1.3 percent CAGR

• Digital Print: +16.4 percent CAGR

The digital print market, especially, should be a target segment. This includes the new, highspeed, roll-fed, inkjet printers and HP Indigo printing. The number of pages printed on these have been growing at more than 20 percent annually. The advent of new printing techniques requires changes in paper properties, and both high-speed inkjet and HP Indigo printing require paper with specific surface treatments to ensure the highest print quality.

To address this need, Solenis has developed a new line of imPress™ paper additives, with imPress IJ technologies for high-speed inkjet printing and imPress ID technologies for HP Indigo printing. These additives help paper producers achieve the necessary print quality and printer runnability for their end customers. This is just one case where Solenis aligns research and development resources to focus on the future growth of subsegments.

ALIGNING WITH MARKET NEEDS

It’s also important to understand and align with market needs, especially in the areas of cost reduction, development of new grades, and machine conversions. Let’s look more closely at each of these:

Cost-reduction projects:

The lowest-cost producers will always be more viable, so it’s important to work on cost-reduction projects while continuing to maintain paper quality. Also, remember that being a low-cost producer does not mean using low-cost additives; bigger savings can be realized in higher-spend areas, such as energy reduction, fiber optimization, and improving machine efficiency.

Solenis is helping producers lower operating costs with the development of new technologies, such as:

• MicroSolSM advanced retention and drainage solutions for reduced energy consumption and fiber loss

• Spectrum™ XD1878 microbiocide to help improve machine efficiency

New grade development:

Even within a declining market, there are opportunities to launch new products or differentiate offerings to grow market share. Specialty chemical companies that are experienced in paper production, such as Solenis, can support paper producers in developing these new grades.

For example, we helped a specialty paper mill seeking to expand into the fast-growing HP Indigo printer paper market. This specific paper requires special additives to improve Indigo printer performance, and the paper used on these printers needs to be certified by HP. The testing includes ink adhesion to the paper, printer runnability, and print blanket compatibility. We recommended adding Solenis imPress ID-115 to the mill’s standard size press solution. The results exceeded expectations with near-perfect results in all categories. Following this trial, the mill received 3-star certification—the highest rating possible.

Machine conversions:

Ultimately, if a machine is no longer viable to produce printing and writing paper, there could be opportunities to convert the equipment to produce alternative grades. While this can be a significant investment, a company like Solenis can help by collaborating on a market analysis to ensure the right grades are selected for production before deciding to convert a machine. Once a decision has been made, Solenis can also help design a wet-end chemistry program to accelerate the project’s start-up curve.

THE FUTURE

For paper producers seeking to increase growth, it’s important to work with suppliers and technology providers that can offer a broad array of capabilities for specific applications. As a leading global chemical supplier for the printing and writing market, Solenis is equipped with a long history of delivering both the technology and experience to help keep machines viable, even in a declining market.

With more than 30 years of specialty chemical experience in the paper industry, Nick Ince is responsible for driving Solenis growth in the regional market segments for graphic & specialty and tissue & towel in Asia Pacific. Tom Hayden is a pulp and paper engineer graduate from University of Wisconsin – Stevens Point with more than 25 years of specialty chemical experience in the pulp and paper industry. Solenis is a leading global producer of specialty chemicals for water-intensive industries, including pulp and paper. Learn more at solenis.com.

Paper 360

Paper 360