BRUCE JANDA

The coronavirus pandemic has touched all parts of the global forest supply chain and has brought new visibility into the pulp and paper industry (P&P) in particular. In North America and Europe, the P&P sector has been front-page news since the widespread run on toilet paper that took place from March through June.

To meet the surge in demand for household tissue and towel products, many mills added shifts and converted machines, and consumers seem to have put a newfound premium on personal hygiene that will likely impact trends going forward. The initial hoarding activity seems to be over (although, at press time, there is speculation that another nationwide lockdown may prompt a similar response), and we’re now able to analyze how recent consumer habits have impacted the tissue and towel industry and look ahead at potential developments that might take shape in the coming months.

RECENT HISTORY

As frantic consumers well remember, toilet paper became one of the world’s hottest commodities just a few short months ago. With a few exceptions, we have largely seen the supply chain stabilize in most regions.

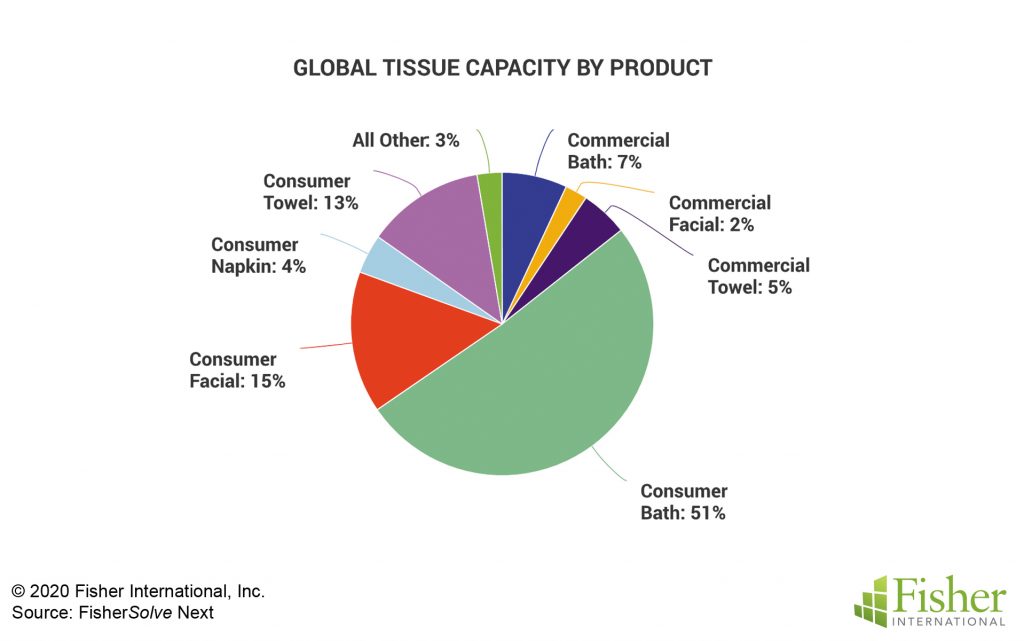

Figure 1 shows the global tissue product mix for consumer, commercial, and industrial tissue products. Global consumer bath accounts for 51 percent of the total capacity. Commercial bath provides an additional 7 percent of capacity to total 58 percent. This is the total bath tissue volume that the supply chain was set to deliver in 2020.

While some commercial bath tissue is produced in familiar consumer formats for away-from-home use, a significant portion of the commercial tissue production is converted in formats that cannot be readily adapted for at-home use. This resulted in a temporary gap in supply for consumers at home, and the issue is mostly behind us at this point so long as the supply/demand equilibrium remains steady.

It is worth noting, however, that the recent spike in global COVID-19 cases has prompted spot runs on consumer toilet paper in various parts of the globe. This time around, they appear to be much more locally focused, short term glitches in the supply chain, and most retailers have prepared for the issue.

TRENDS TO WATCH

The initial strong demand for toilet paper drove tissue mills to work at full capacity, which has resulted in delayed scheduled maintenance over the last few months. Now that the supply chain is equalizing, producers are able to take care of these issues and pay closer attention to a few developments taking shape in the market:

1. Commercial tissue demand in highly affected areas will continue to see more outages. The tissue machine production numbers will remain steady or increasing as tissue base sheet paper can be diverted, but the converting machinery devoted to only commercial product formats can be expected to see layoffs. This trend could be moderated partially by increased hand towel consumption in food prep and health care, but it is unlikely to make up for closed schools, offices, and travel facilities.

2. North American consumers continue to demand mostly ultra-premium products at home. Roughly 55 percent of at-home tissue use in North America is ultra-premium, which is astronomically higher than it was 15 years ago. In looking at previous recessions, people usually step down to value or economy brands. But during the Great Recession starting in 2008, consumers continued to buy the highest performance tissue available despite the tough economic times. This trend is likely to continue for high-end brands or private labels from club stores.

These habits will continue to drive strong demand for at-home, ultra-premium tissue products, which will also continue to negatively impact demand for certain formats such as dispenser napkins and hand towels as restaurants, bars, and retail establishments remain closed or operate at limited capacity. That said, a newfound emphasis on hygiene in public spaces is poised to drive significant demand for tissue and towel products as we approach flu and cold season.

POST-CORONAVIRUS FOCUS: HYGIENE

COVID-19 has brought a new focus on cleanliness and preventing the spread of disease through personal contact and contaminated surfaces—especially in public spaces. Fisher clients in both Europe and North America are asking if we’re going to see some pull back from air dryers, which have a reputation for being less hygienic than hand towels.

Tissue makers focused on the commercial or the away-from-home market have long understood that hand washing and drying with a paper towel is an underserved market need. If people followed professional guidelines, there would be a significant increase in paper hand towel demand.

While we don’t know what life in the post-pandemic world will look like, it is reasonable to expect there will be structural changes to our routines and behaviors that will become permanent, and an increased focus on cleanliness will be one of them. Manufacturers in the tissue and towel sector now must ask some important questions:

• What if this pandemic results in a sea change in handwashing compliance and frequency?

• What if patrons in restaurants, hotels, retail establishments, truck stops, etc. all demand better hygiene facilities?

• What if people begin washing their hands after touching public handrails, buttons, doorknobs and pulls, etc.?

With hygiene and hand washing now at the forefront of our daily lives, we understand air dryers create conditions for cross-contamination and defeat the purpose of hand washing. This opens up new opportunities for tissue and towel market penetration.

HOW WILL POST-PANDEMIC TOWEL PRODUCTION RESPOND?

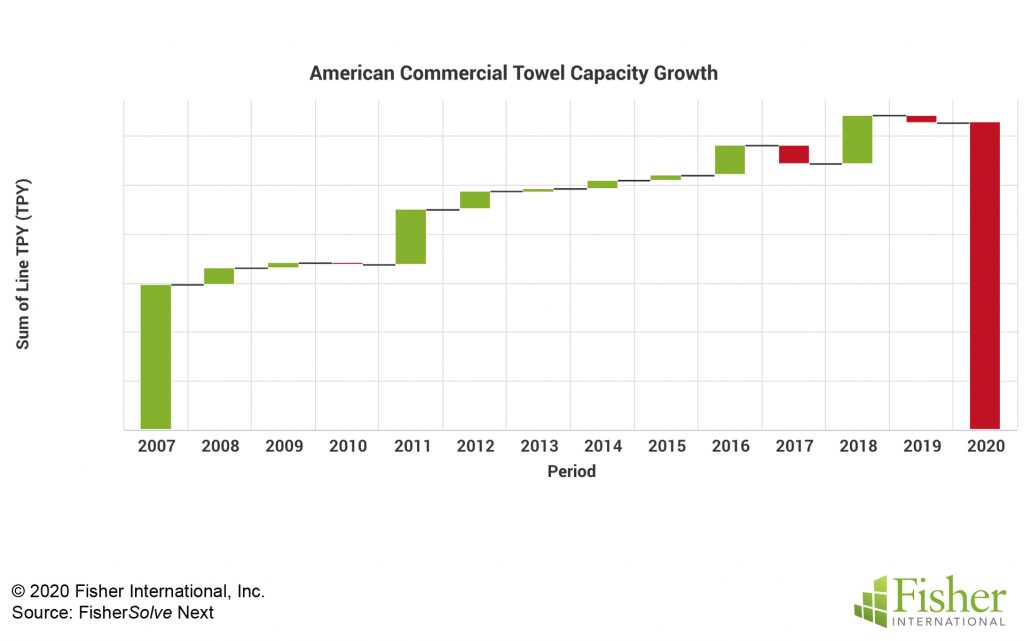

Going into 1Q 2020, the United States produced 57 percent of all commercial hand towels. This provides the opportunity to use the US as a test case for modeling potential demand changes after the pandemic passes. American hand towel capacity grew at a CAGR (compound annual growth rate) of 6.5 percent from 2007-2019. The capacity additions shown in Figure 2 include grade changes, rebuilds, and new machines over that period.

A small consumer behavior change in response to the pandemic could be a step-change in demand of 10 percent, requiring two new large tissue machines. If consumers make significant changes in the way they use facilities and toweling in the future, a 30 percent increase in demand (requiring nearly six new tissue machines) is realistic.

This kind of impact on the tissue business would be considerable, but American tissue producers have largely remained quiet on the issue in the past, unlike European producers. Based on the sea change in consumer behavior we are facing as a result of the pandemic, maybe this time will be different. Tissue makers should be proud of the role they play in maintaining public health, and they should pay close attention to new opportunities on the horizon as we inch closer to a post-pandemic, if still uncertain, future.

Bruce Janda is a TAPPI Fellow with more than 40 years of experience in the paper and non-woven industry, specializing in tissue and towel products and processes, from concept through manufacturing and commercialization. Reach him at [email protected]. For more data and insight into the present and future state of the pulp and paper industry, contact Fisher International at fisheri.com.

Paper 360

Paper 360